In just five years, with relentless effort and perseverance, I miraculously increased the initial principal of 300,000 to 78,100,000. The secret to all this comes from the essence of practical experience that I summarized after careful consideration, and I have committed these essences to memory!

As retail investors, we must deeply understand the truth that risk and opportunity coexist. In this financial journey, only we can be the masters of our destiny. Relying on others for hope is akin to handing victory to someone else; such retail investors will ultimately walk toward the abyss of failure.

Learning is the solid foundation for success. In the turbulent world of cryptocurrency, only by continuously learning, refining skills, and understanding the essence of publicly available information can one stand firm in this ever-changing field.

What is called technique is not just superficial skills; rather, it is a deep understanding and skilled application of one or two core technical indicators. Through these indicators, we can glimpse the inner pulse of the crypto market and capture fleeting opportunities.

When these techniques are closely integrated with our operational strategies, they become our sharp weapons in the crypto market, helping us navigate the battlefield of finance.

What is the most troublesome thing about trading? It is not about finding entry points, but about lacking a systematic approach from beginning to end—either blindly entering and falling into traps, or randomly setting stop losses and take profits, or losing all capital due to uncontrolled position sizes. Today, I will share the six major trading steps I have summarized from years of actual trading, covering the entire trading process from trend judgment to risk control. Following these steps can significantly improve trade quality, and even beginners can directly apply them!

Step 1

First, judge the trend/sideways movement; do not act like a "headless fly."

Every time I open the chart, the first question I ask myself is: Is the current price following the trend (upward/downward) or in a sideways fluctuation? This step directly determines the win rate of subsequent trades—we must find trends that match our strategies to avoid unnecessary detours.

I am a trend trader who only trades when there is a clear trend. This is also the key reason why many people fall into traps: regardless of how the market moves, they rashly enter upon seeing a signal without clear rules for judgment, resulting in naturally poor trade quality.

The method for judging trends is simple. Using trend structure, moving averages, or trend lines will suffice; just choose what you are comfortable with.

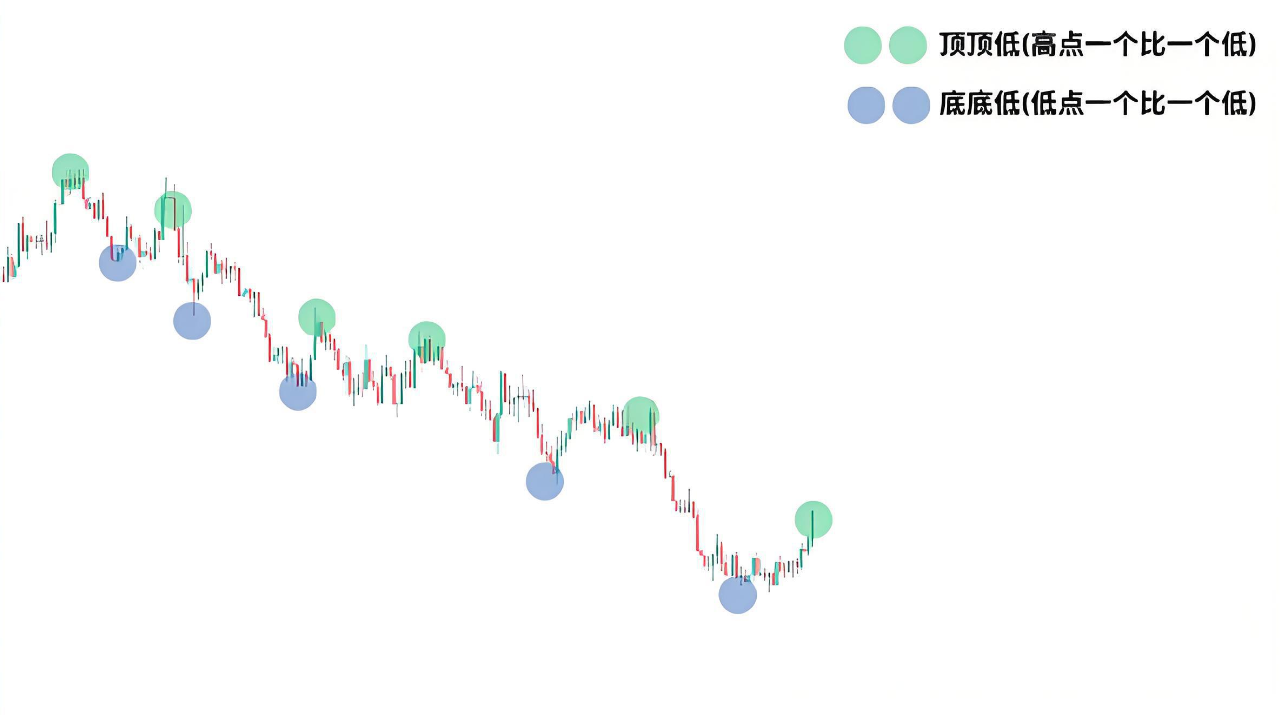

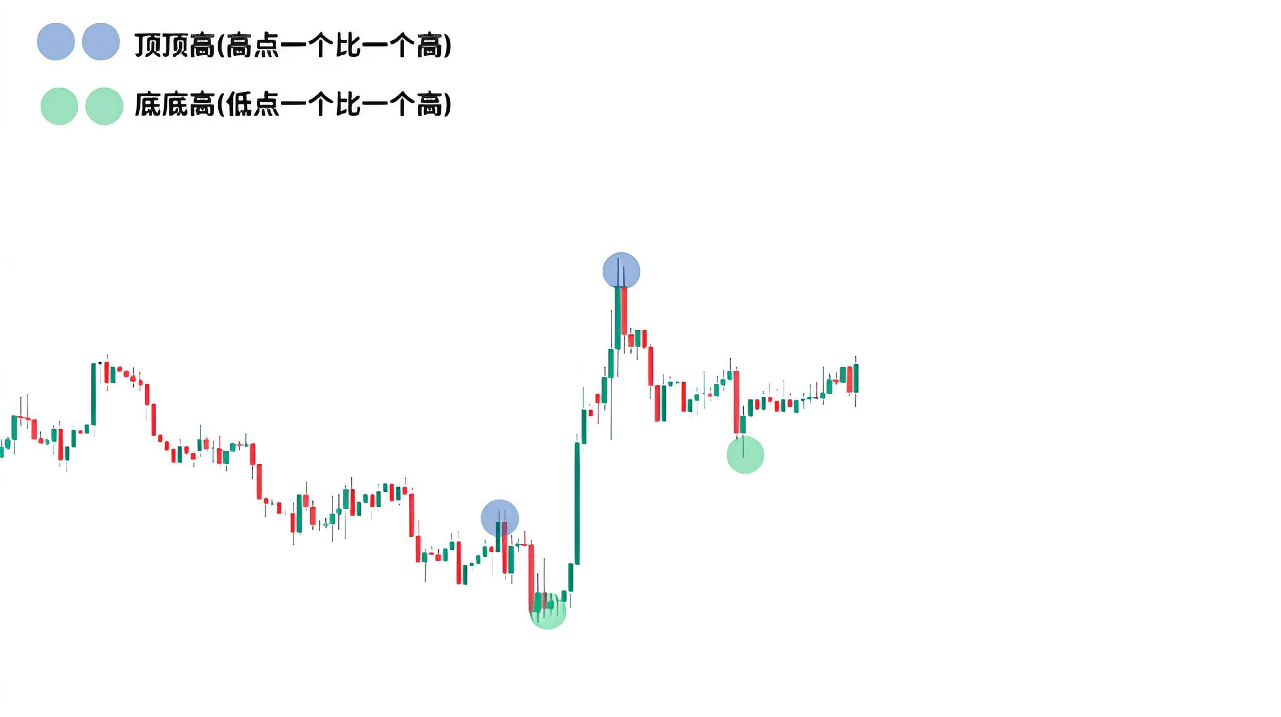

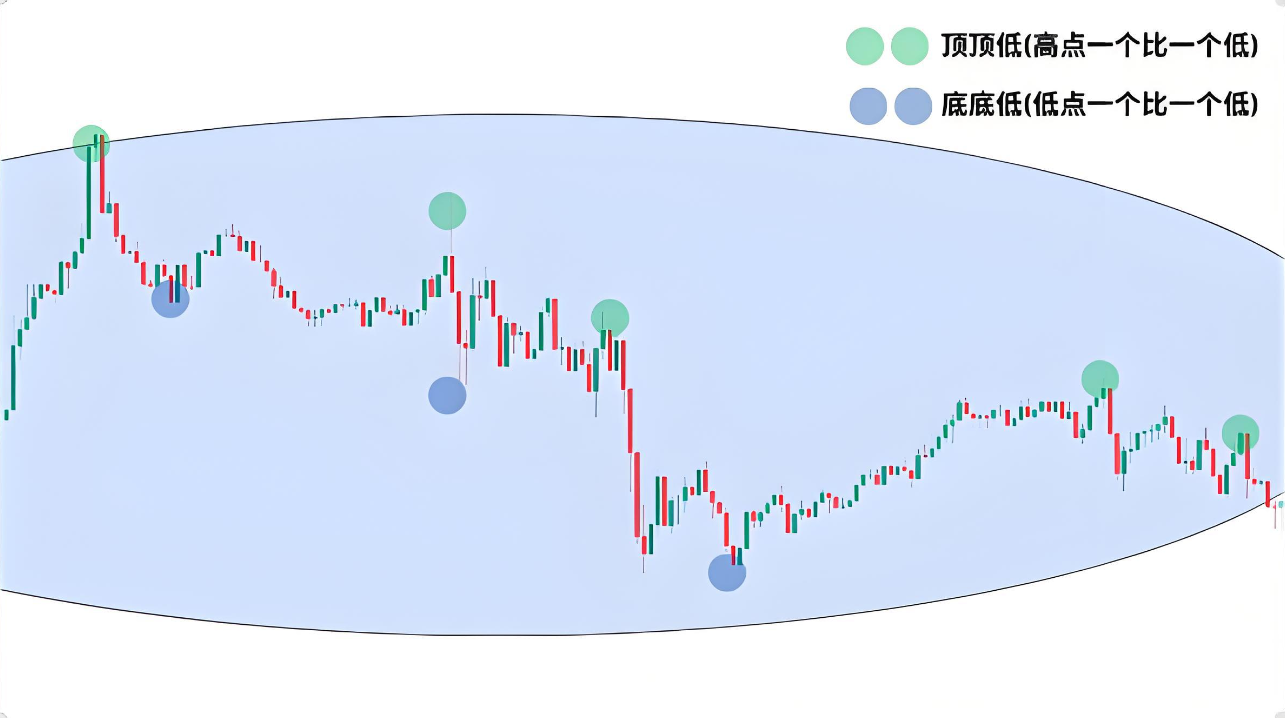

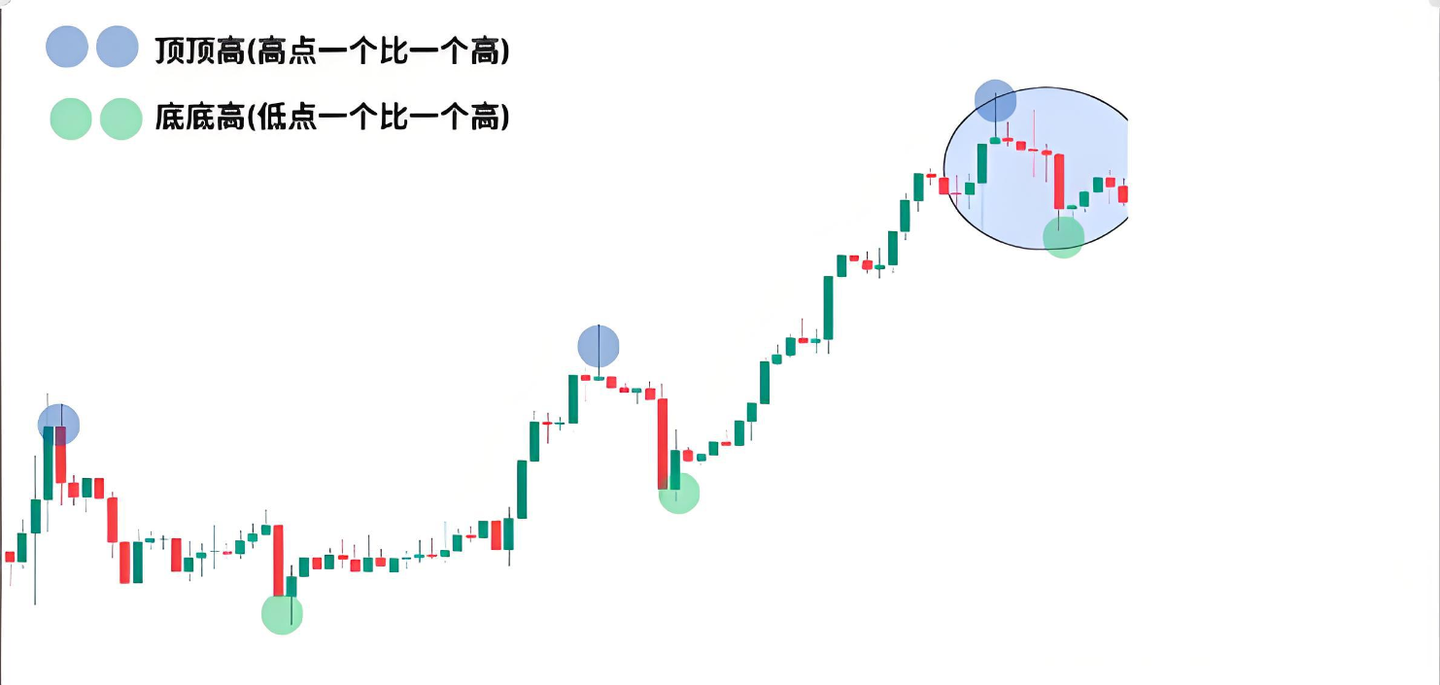

Downward trend: When the price forms a "higher high, lower low" structure, look only for short opportunities until the trend reverses.

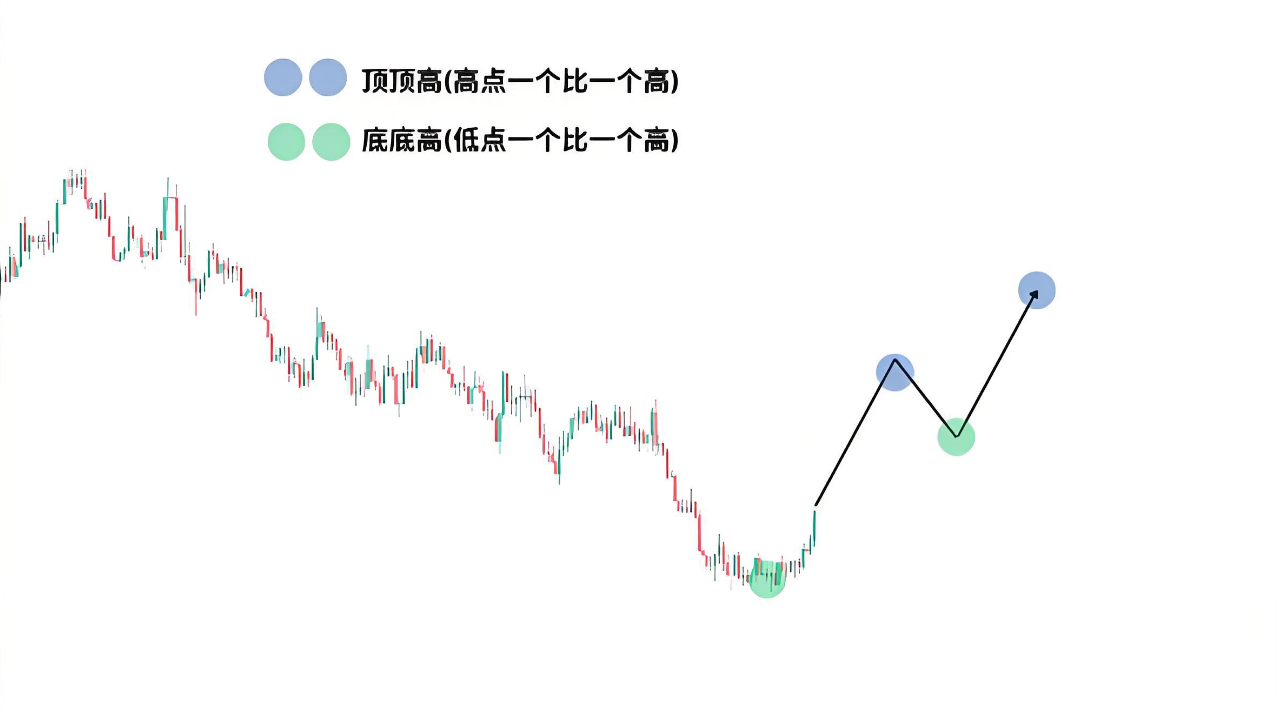

Upward trend: If the price no longer creates new lows and instead forms a "higher high, higher low" structure, switch direction and go long.

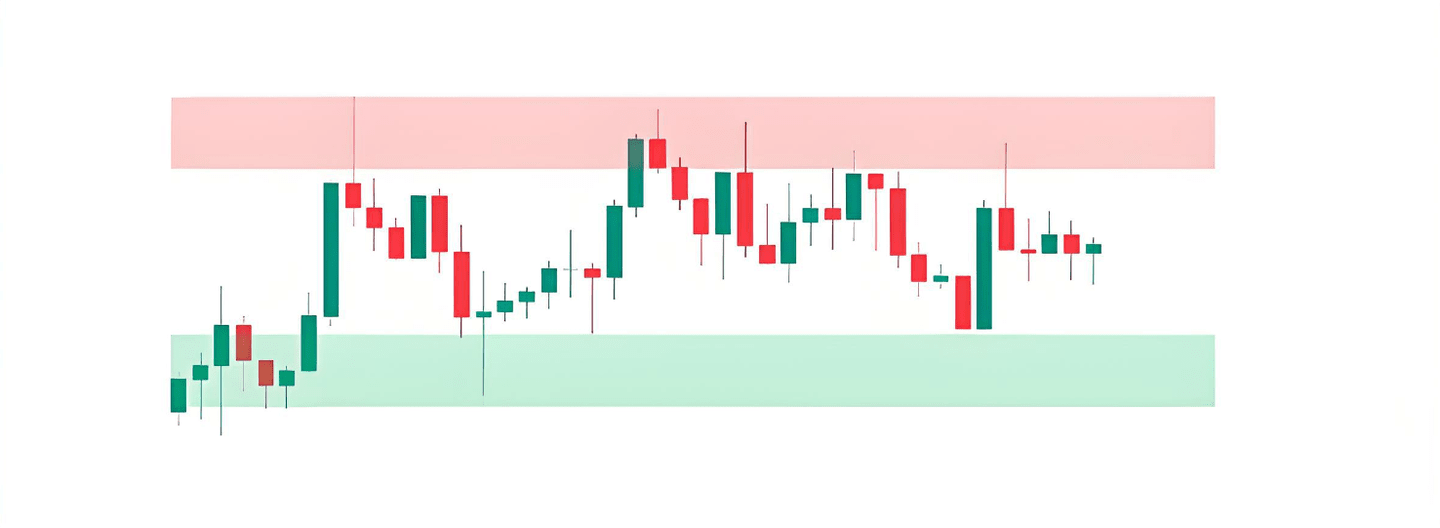

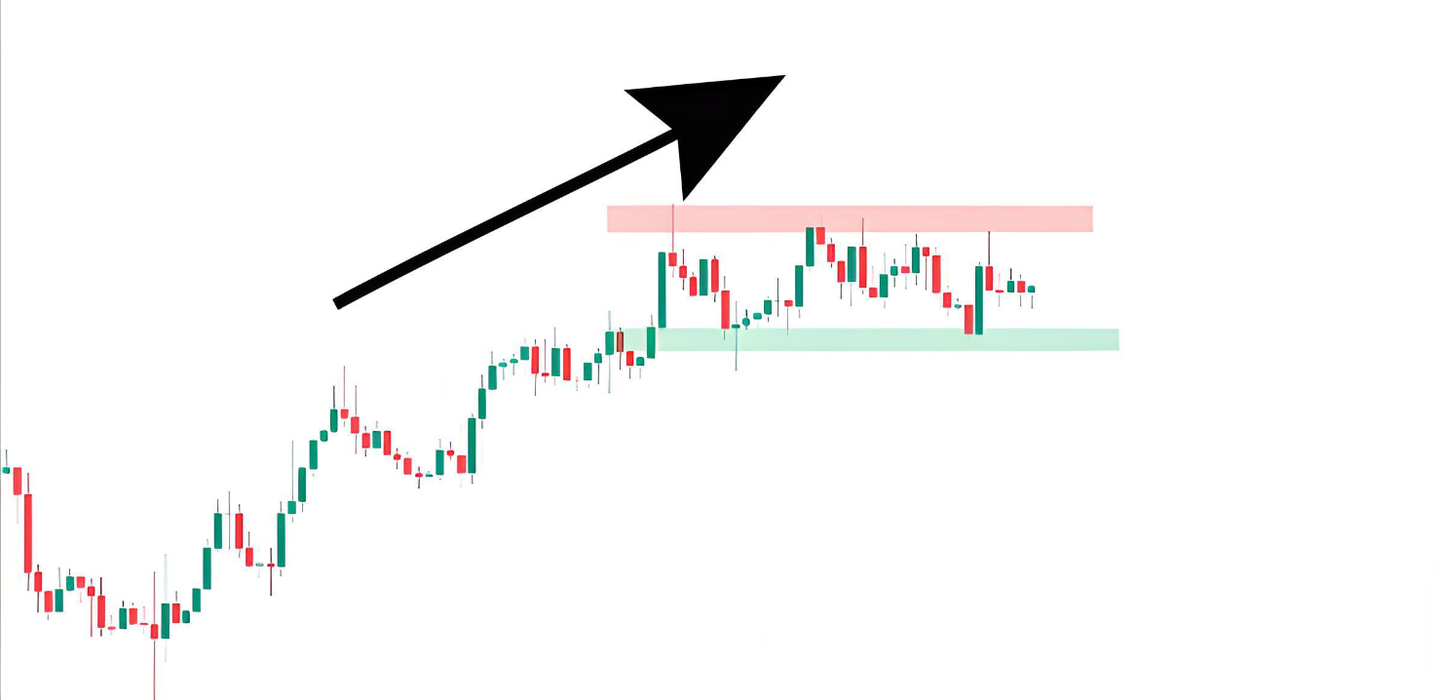

Sideways fluctuations: The price oscillates between support and resistance levels without clear highs or lows. I generally avoid this—it's uncertain when or where it will break, and the risk is too high.

But if you really want to trade sideways, here’s a little trick: zoom out the chart to see the larger trend.

For example, while it looks like a sideways market on small time frames, when zoomed out, it reveals an overall upward trend; the current sideways movement is just a pullback, so you can only go long at the bottom of the sideways movement (support level) to align with the larger trend, which significantly increases the win rate.

Step 2

Clearly define the trend stage + entry method; do not act as a bag holder.

Understanding the trend is not enough; you need to know which stage the current trend is in and how to enter—different stages and different entry methods have completely different risks and rewards.

1. First, look at the trend stage:

Early stage: For example, when a downward trend just reverses and forms a new upward structure.

Or, when the price just breaks above the 50 moving average, it's safest to enter at this point, with the largest profit potential.

Mid-stage: The trend has been ongoing for a period, and the pullback may be larger, but the overall direction remains unchanged. At this point, you can wait for a pullback to enter.

Late stage: The price has risen significantly (or fallen significantly) and is encountering key resistance (or support) levels. At this point, do not impulsively enter; it is highly likely to be a trap, and the trend could reverse at any moment.

2. Then choose an entry method (both have pros and cons; choose what suits you):

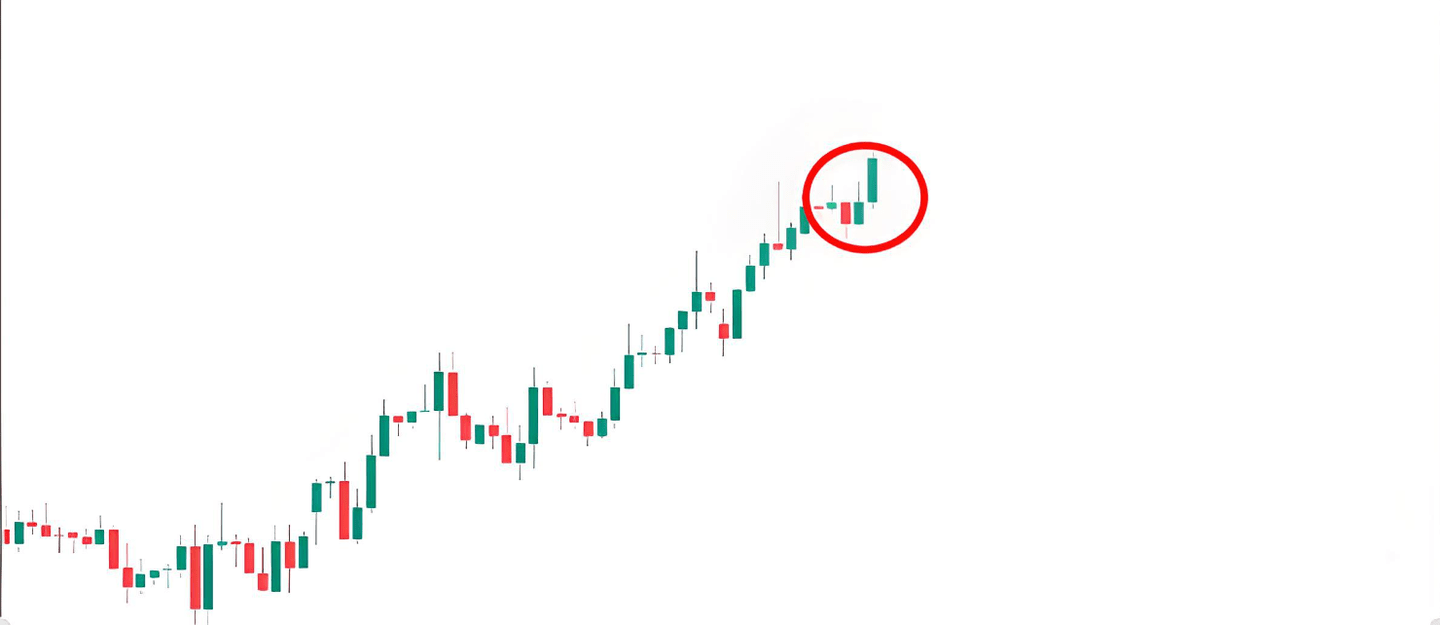

Breakout entry: Enter when the price breaks through key levels, able to catch the trend immediately and make quick profits, but the probability of false breakouts is high, making it easy to be stopped out.

Pullback entry: Enter when the price pulls back to key levels, with a higher win rate and lower risk, but you may miss out if the price rises directly without pulling back.

Step 3

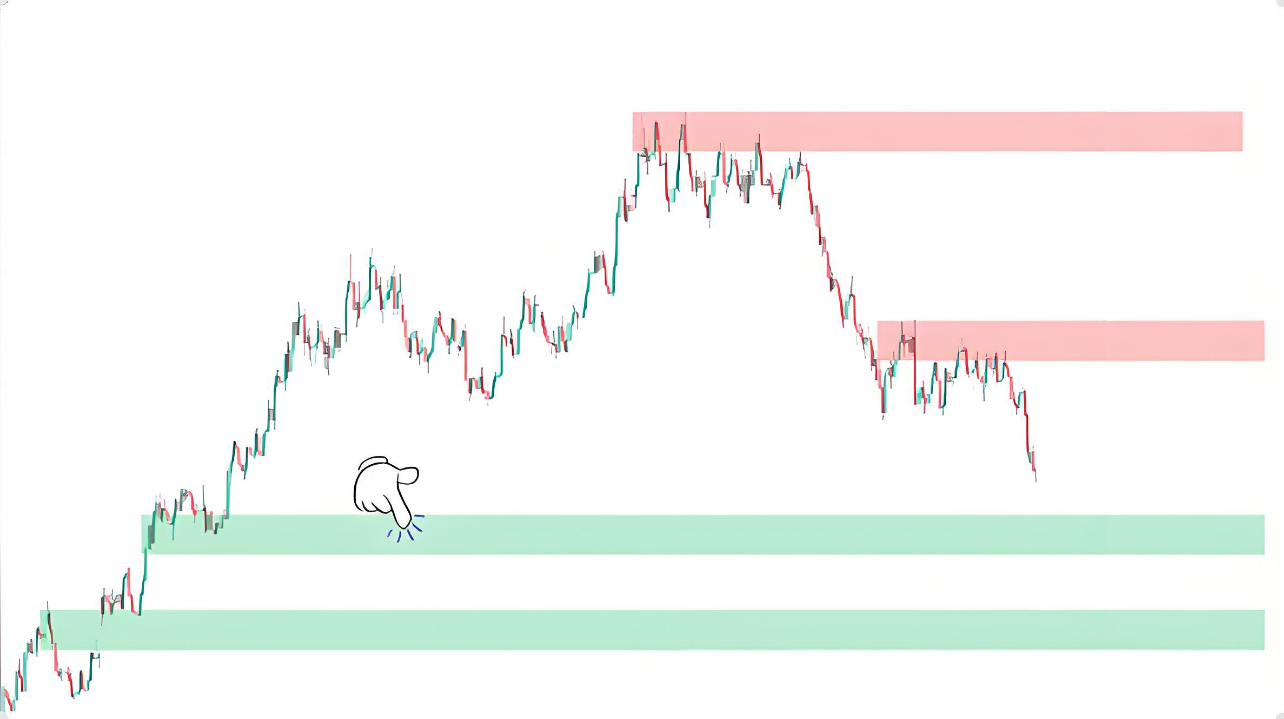

Draw key levels; don't draw "all over the place."

Many traders make the mistake of drawing a bunch of support and resistance levels on the chart, thinking each one is a valid signal, resulting in increasing confusion and ultimately making wrong decisions.

My approach is to draw only the "core key levels," usually drawing two above and two below is enough—more than that is useless and instead interferes with judgment.

For example, in a downward trend, draw two resistance levels above and two support levels below. Only short when a bearish signal appears at the resistance level, and set the take profit at the next support level to avoid price rebounds and secure profits in advance.

For example, an upward trend.

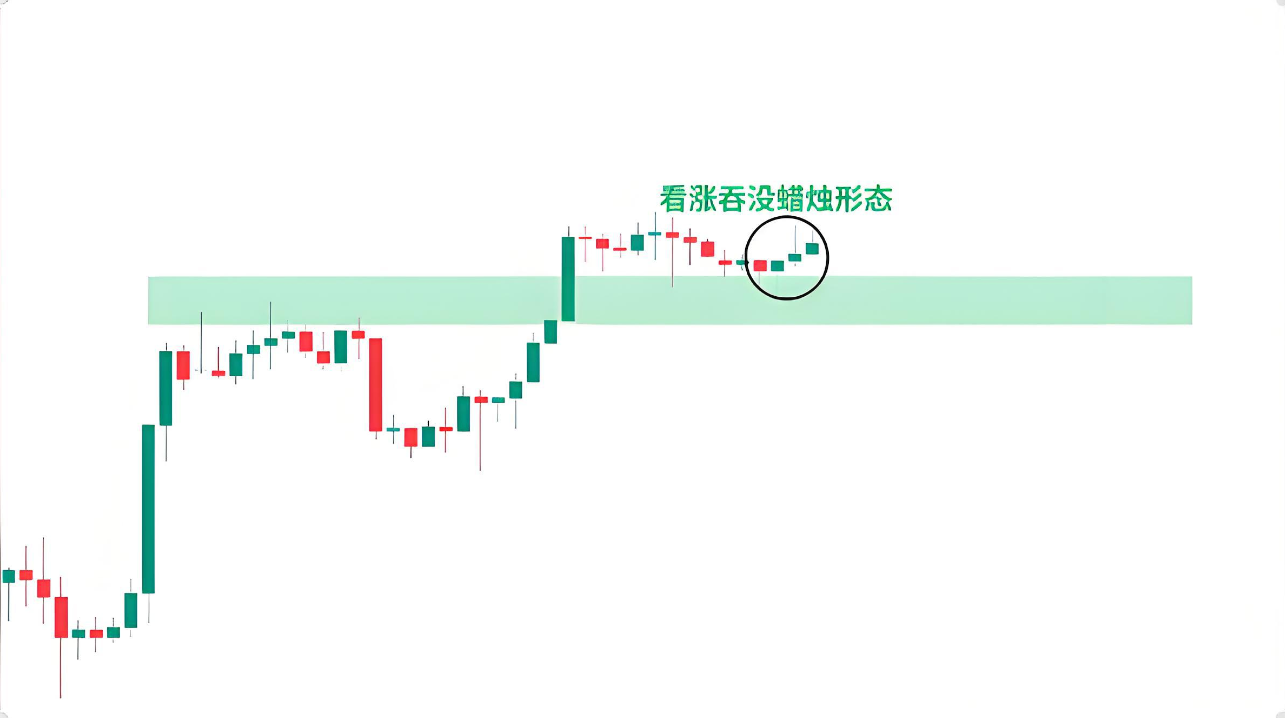

Draw two support levels below and two resistance levels above: when the price pulls back to the first support level (which also coincides with the 50 moving average) and shows a bullish candlestick pattern, go long at this point.

If it breaks the first support level, wait for the signal at the second support level. If it breaks again, it indicates that the trend may reverse, and you should give up.

Step 4

Use larger time frames to filter out risks and avoid "picking up sesame seeds and losing watermelons."

Many people trade only by looking at small time frames, getting confused by short-term fluctuations and ignoring the larger trend—no matter how much small time frames rise, if the larger trend is downward, it's just a rebound and is likely to fall back.

The two core functions of larger time frame charts:

Confirm the trend direction: for example, the small time frame shows a downward trend.

But when you open a larger time frame chart and find that the overall trend is upward, this decline is merely a pullback; you cannot short at this point, but should seek long opportunities instead.

Avoiding risks: For example, while the small time frame shows a buy signal, the larger time frame indicates that this price level is a strong resistance. At this time, do not enter; it is highly likely you will be stopped out.

Summary: Find entry points in small time frames, establish direction and determine key levels in larger time frames. The combination of both can improve the win rate.

Step 5

Formulate an exit plan in advance; don't let emotions dictate your actions.

The most frightening thing in trading is not the loss, but the lack of an exit plan—watching the price fluctuate after entering, either being greedy and not taking profits or panicking and randomly stopping losses, ending up with wasted effort.

The correct approach is to establish an exit plan before entering, including stop loss, take profit points, and risk-reward ratio. Once entered, strictly execute it without mixing in any emotions.

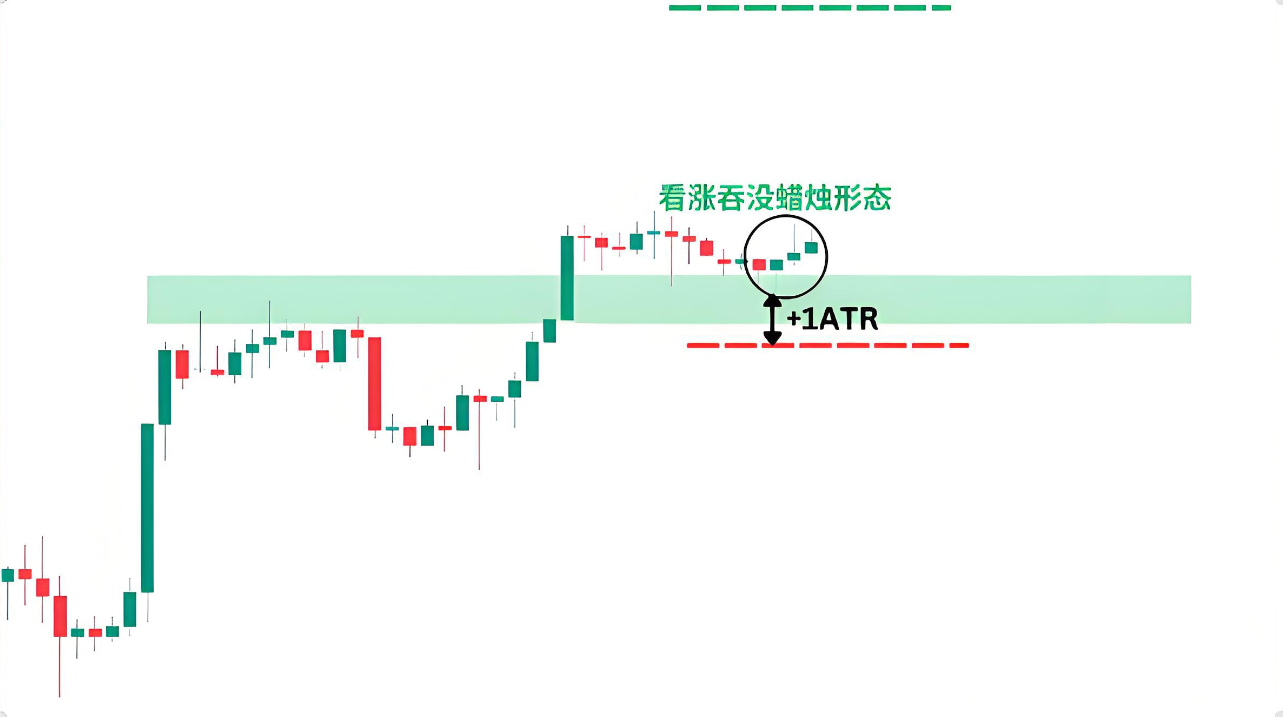

Stop loss point: Set at "key level + ATR value," for example, when going long, set the stop loss below the support level + 1 ATR to avoid being stopped out by false breakouts. If the price breaks below the key level and triggers the stop loss, it indicates a wrong analysis, and you should exit decisively.

Take profit point: You can set it based on a fixed risk-reward ratio (for example, 2:1) or based on key levels. The core idea is that "profits should exceed losses," ideally at 2:1 or more.

Exit methods: Either set fixed take profits or passive take profits (for example, taking profit after the price breaks below the moving average), determine this in advance, and do not change it after entering.

Step 6

Strict risk control; staying alive is essential for long-term profits.

This final step is the "lifeline" of trading—no matter how great your strategy is or how high your win rate is, without risk control, you will eventually lose all your capital.

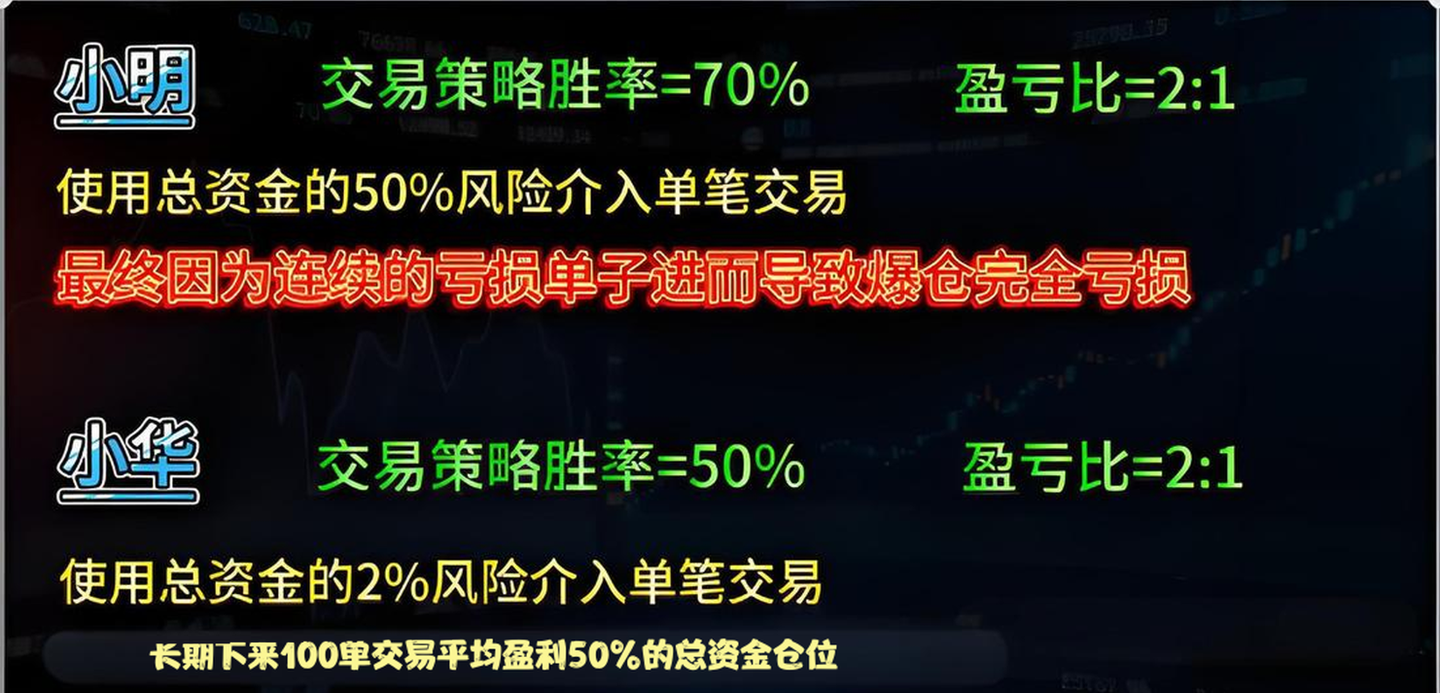

Let me give you a real case:

Xiaoming: The strategy win rate is 70%, with a risk-reward ratio of 2:1, but he trades with 50% of his capital each time. He made a lot of money on the first few trades but then lost two in a row, wiping out all his capital and exiting the market completely.

Xiaohua: The strategy win rate is only 50%, with a risk-reward ratio of 2:1, but he only uses 2% of his capital per trade. Even if he faces consecutive losses, the impact on total capital is minimal, allowing him to stay in the market. Over the long term, he can average a profit on 50 out of 100 trades.

This is the importance of risk control! Remember: the loss on a single trade should not exceed 2% of the total capital (at most 3%). Even if you face consecutive losses, you can preserve your capital and have a chance to earn it back. The core of trading is not "how much to earn in a single trade" but "staying alive in the long term."

Final Summary

High-quality trading is not based on luck but on a replicable process: first judge the trend and direction, then look at the stage to select entry methods, draw core key levels to find opportunities, use larger time frame charts to filter risks, formulate exit plans in advance, and finally use risk management to protect capital.

These 6 steps are interrelated. As long as you strictly follow them, you can avoid most pitfalls and turn your trading from "blindly following the trend" into "rational decision-making." There are no shortcuts in trading, but if you find the right method, you can avoid many detours and gradually achieve stable profits!

This is the trading experience that Yan An shared with everyone today. Many times, you lose a lot of opportunities to make money because of your doubts. If you are afraid to boldly try, engage, and understand, how can you know the pros and cons? You only know what to do next after taking the first step. A cup of warm tea, a word of advice, I am both a teacher and a friend you can talk to.

Meeting is fate; knowing each other is destiny. I firmly believe that those who are destined will meet despite a thousand miles apart, and those who miss it are merely fate. The journey of investment is long, and temporary gains and losses are just the tip of the iceberg. Remember that even the wisest can make mistakes, and the most foolish can sometimes gain; regardless of emotions, time will not stop for you. Pick up your frustrations and stand up to move forward again.

The secret techniques have been shared with you; whether you can become famous in the world depends on your own efforts.

Be sure to keep these methods in mind; review them often. If you find them useful, feel free to share them with more people involved in crypto trading. Follow me for more valuable insights into the crypto world. Having been through the rain, I am willing to hold an umbrella for the retail traders! Follow me, and together we will navigate the path in the crypto world!