A big player in the cryptocurrency world who earned 80 million in ten years will tell you what to pay attention to in the cryptocurrency world!

In fact, once you grasp the essence of trading cryptocurrencies, life is like achieving enlightenment!

10 years ago, I just stepped into the cryptocurrency world. Like most retail investors, my losses and profits seemed to rely entirely on luck, with no patterns to grasp.

However, after staying in the cryptocurrency world for a few years, through continuous learning and absorption, along with the constant sharing and guidance from mentors and senior brothers, I finally began to understand and formed my own investment system!

Today, I will share my trading strategies and insights with friends in the cryptocurrency community.

If you have ever stared at the market for five or six hours a day, you definitely understand that feeling: in the first hour, you are still full of energy, but by the midpoint, you start to zone out, and the last two hours are almost sustained by willpower.

Worse yet, the time you tough out may not bring more profits, but rather often leads to impulsive trades, fatigue entries, revenge scaling... ultimately swallowing all the effort of the day.

Especially for traders participating in funded account or self-directed trading challenges, success comes from focusing solely on the best opportunities, even if it means you need to "do a little less." #比特币VS代币化黄金

This is not a question of ability but rather a result of the brain's structure.

Smart traders avoid the "ascetic-style watching" approach and instead turn to a more efficient, more human way: the 90-Minute Rule.

This article will take you deep into the "90-Minute Rule"—a strategy that is becoming popular and is particularly suitable for self-directed traders or day traders. It helps you keep your mind sharp and capture optimal opportunities when the market is most active.

What is the 90-Minute Rule? Why do self-directed traders need it?

The 90-Minute Rule is a strategy that allows you to concentrate all high-intensity judgment operations into a single 90-minute time block. But be aware, concentrating trading time does not diminish your performance; on the contrary, it can enhance it. You can think of it as a methodology: focus your energy on the periods that yield the most profit and withdraw before mistakes become likely. #以太坊市值超越Netflix

In terms of trading with a funded account, accounts typically have strict daily loss limits and drawdown rules, meaning every decision you make is crucial.

For example: Think about "overtrading." If you have time, take a look at our article on "overtrading," which breaks down how it disrupts your decision-making and how to avoid it. Simply put, overtrading is one of the fastest ways to blow up your funded account. The reason is that the longer you sit in front of the screen, the more likely you are to make impulsive trades that do not align with your plan.

Moreover, "decision fatigue" is also a very real risk—judgment declines over time. Studies show that even a brief mental break can significantly improve your performance in sustained tasks.

Following the 90-Minute Rule can also help traders avoid many common mistakes, such as entering trades out of boredom, chasing low-quality opportunities, revenge trading, or the impulse of "one more trade before I stop." In other words, it forces you to prioritize filtering trading opportunities and focusing on high-probability trades.

Ultimately, the 90-Minute Rule allows traders to trade smarter, not longer. This keeps the mind alert and provides more energy for important post-trade tasks, such as journaling, fundamental analysis, and strategy backtesting. For those who must adhere to strict daily loss limits and trailing stop rules, maintaining precision and discipline in execution is their most critical advantage.

The psychological principle behind the "90-Minute Rule"

The market has a rhythm, and so does your brain. The "90-Minute time block" falls right into a "sweet spot": the active range of market fluctuations coincides perfectly with the optimal attention span of humans. Additionally, the human brain performs better with clear time boundaries, which is why deadlines boost efficiency and time-limited promotions stimulate purchases.

This principle also applies to trading. Compressing your trading day into a strict 90 minutes creates an artificial sense of "scarcity." Your mindset shifts from "I can trade later" to "I must find the best trade right now." This transformation prompts you to pursue quality over quantity, trading with intention instead of randomly taking opportunities.

This can also alleviate the common pressure on traders that they "must do something" every day, as if they need to prove themselves. However, the longer you sit, the more low-quality trades you tend to make. Conversely, when you set strict time constraints, discipline becomes a habitual practice rather than relying on willpower every day.

Science supports this as well, referring to the "ultradian rhythm." According to this concept, our brains experience a peak of focus every 90-120 minutes, followed by a decline in energy. Research also indicates that attention significantly declines after about 2-2.5 hours, and beyond this threshold, we tend to make more mistakes.

How the 90-Minute Rule works: trying out a few ideas in the futures market

Decades of market history have helped traders summarize some patterns that can serve as a basis for finding the best 90-minute trading windows. For example:

✔ The first 90 minutes after the US stock market opens: the highest volume and most reliable market conditions.

✔ Crude oil, gold, and other commodities: the strongest and clearest fluctuations often occur 60-90 minutes after significant news releases.

✔ Forex futures: The London/New York overlapping period is usually the peak of liquidity.

Next, let's look at some specific ways to try the 90-Minute Rule in practice:

Note: While these ideas are very common among traders, it's best to test them for suitability before drawing any conclusions. For instance, some traders prefer earlier time slots, while others choose later ones, as they may better align with their strategies.

How to build your 90-minute trading process

Creating a 90-minute trading process is not just about "watching the clock." In fact, it is more like establishing a structured way of working that allows you to make the most of every minute within your optimal time window. The goal is to form a repeatable framework that maximizes focus, minimizes randomness, and aligns your trading with the highest probability opportunities.

Step #1: Pre-market preparation (20-30 minutes before the opening)

Treat it as your "warm-up." Use this time to review overnight market conditions, significant news, and upcoming economic data. At the same time, mark key support/resistance levels, confirm the trend direction, and decide which opportunities to pursue and which to avoid.

Essentially, you are running through the trade "in your mind" before the actual opening. This way, when you actually hit the timer (when you make the first trade), your plan is already firmly in place.

Step #2: Execution window (90 minutes)

First, choose your 90-minute window carefully. Most traders decide based on market volatility, timing their trades during the most active and liquid periods. For example, for futures traders, this is usually shortly after the opening or the first hour after significant economic data.

Secondly, eliminate all distractions. Do not open social media, browse websites, or reply to messages. Once you enter your trading time, fully immerse yourself. Only execute trades that align with your pre-market plan. Use limit orders, alerts, or automation tools to keep your execution clean and decisive, avoiding excessive interference with positions (unless your system itself requires it).

While this hardly needs emphasizing, it's worth reiterating: only trade predefined strategy patterns. Or, choose setups that you have already tested, trust, and have statistical advantages. If you can't find such opportunities on a given day, then don’t trade; it’s as simple as that.

Step #3: Post-trade review (10-15 minutes)

Once your 90 minutes are up, stop trading—but don’t immediately close the platform and leave. Use this equally important time to review your trades, take screenshots, and record your emotions.

This is the golden period for you to record trading logs. Document every trade, your emotions, execution quality, and identify any deviations from the plan.

Don’t underestimate this reflection time. In fact, it is a core part of your growth as a trader. It allows your skills to compound over time, turning each day’s 90 minutes into a learning loop of continuous improvement.

Professional advice: what matters is not just creating a 90-minute plan but also sticking to the execution. One approach is to treat your 90 minutes as an "appointment with the market"—no rescheduling, no dragging, must stay focused.

Common misconceptions and avoidance methods

Although the "90-Minute Rule" is a powerful training method, like any trading discipline, if used incorrectly, it can backfire. For example, many funded account traders misunderstand the 90-Minute Rule, thinking it simply means "trade less," without realizing that the key is how to make the most of those 90 minutes; some adhere to the time block regulations but are underprepared in pre-market preparation, leading to hasty execution and chaotic trades; others use the time limits as an excuse for frantic trading, trying to make as many trades as possible before the countdown ends.

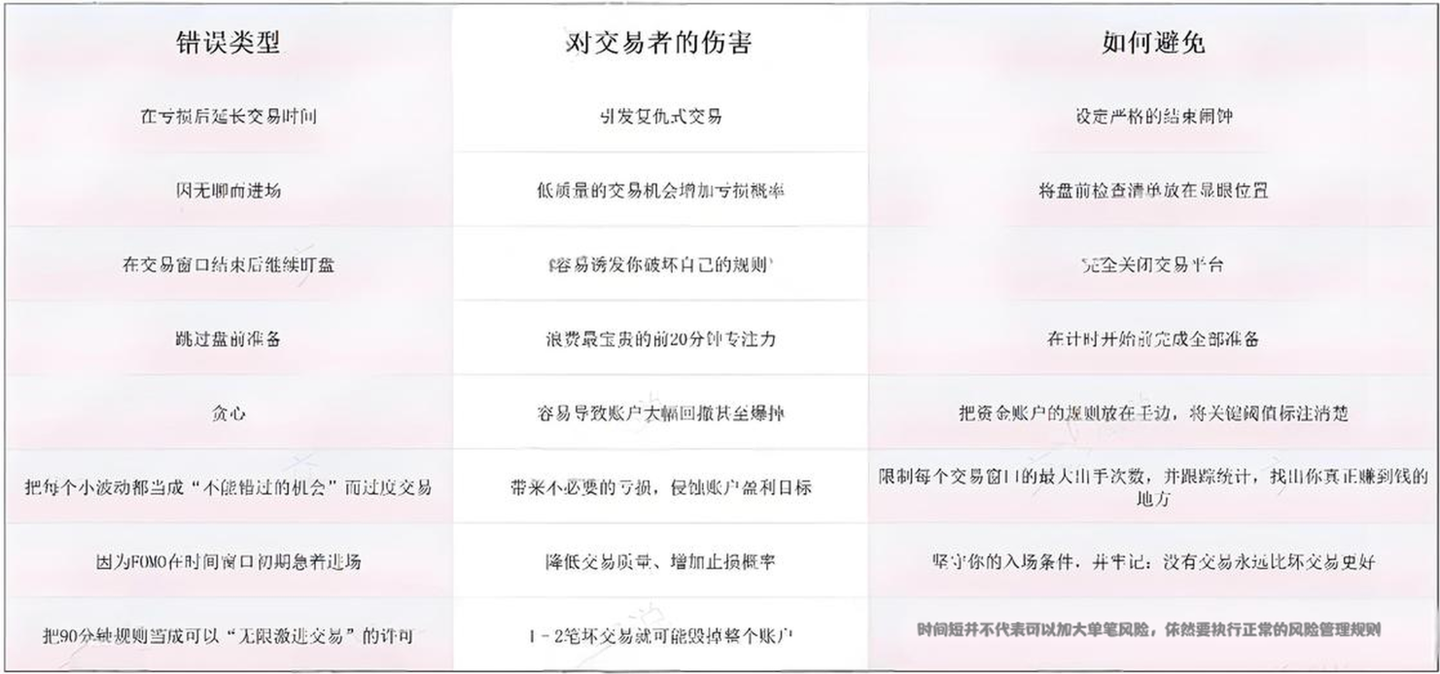

For traders with funded accounts, these issues are not just minor mistakes but can lead to costly errors—not only affecting account qualifications but also undermining trading consistency. Next, we will break down the most common mistakes traders make in the "time box" operation and how to avoid them.

90-Minute Rule: An effective way for traders to avoid burnout

In simple terms, self-directed traders often operate in a "countdown" environment, needing to achieve profit targets during the assessment phase while strictly adhering to drawdown limits. This creates a sense of continuous performance pressure, as if they must watch the market all day to "find enough trading opportunities." This is not necessarily a bad thing, as it helps you adapt to the real market rhythm without risking your own capital; or allows you to judge whether trading suits you in a safer environment.

However, if you find that this pressure is consuming your state, don’t procrastinate. Burnout often appears quietly: at first, you just feel tired after market close every day; later, your motivation decreases, patience wanes, and you lose confidence in your analysis. Funded account traders in this state often fall into a vicious cycle: poor trading → declining confidence → spending more time watching the market → more poor trading.

Therefore, the best way to avoid falling into the "burnout zone" is to set boundaries, such as incorporating the 90-Minute Rule into your daily trading process. The structured limits of time boxes force you to trade only when you are most energized; at the same time, after each trading window, it also gives your brain a clear recovery period. Just as top athletes don’t train at high intensity all day, top traders know when to step back and recover.

Finally, don’t forget that trading with a funded account is not a sprint but a long-term stability contest. Protecting your energy is essential to complete the entire journey.

Summary

Funded accounts require traders to have consistency and discipline, and the 90-Minute Rule is an effective way to integrate these qualities into your trading process. It helps you establish stricter structured habits while freeing up more time for market research and post-trade reviews.

Ultimately, by focusing on executing within a high-energy, high-probability window, you can not only protect your capital but also enhance your ability to survive in the market over the long term. Think of it as trading with a scalpel rather than smashing with a hammer—precise, restrained, and ultimately more profitable in the long run.

This is the trading experience that Yan An shared with everyone today. Often, many profitable opportunities are lost due to your doubts; if you don’t dare to try, engage, and understand, how will you know the pros and cons? You only know what to do next after taking the first step. A warm cup of tea and a word of advice: I am both a teacher and your chatty friend.

Fate brings people together, and knowing each other is fate too. I firmly believe that those destined to meet across a thousand miles will eventually connect, while those destined to pass by are merely coincidence. The journey of investment is long, and a momentary gain or loss is just the tip of the iceberg along the way. Remember, even the wisest can miss, and even the most foolish can gain. Regardless of emotions, time will not stop for you. Pick up your worries and stand up to move forward.

The martial arts secrets have been shared with you; whether you can become famous in the world depends on yourself.

These methods should definitely be saved and reviewed multiple times. If you find them useful, feel free to share them with more people in the crypto trading community, follow me for more insights in the crypto space. Having been through the rain, I am willing to shelter the traders! Follow me, and let's walk together on the path of crypto!