A brother asked me $ZEC if he could buy the dip? I directly showed him the K-line from the past three days: experience the trilogy of 'hope - disappointment - despair'.

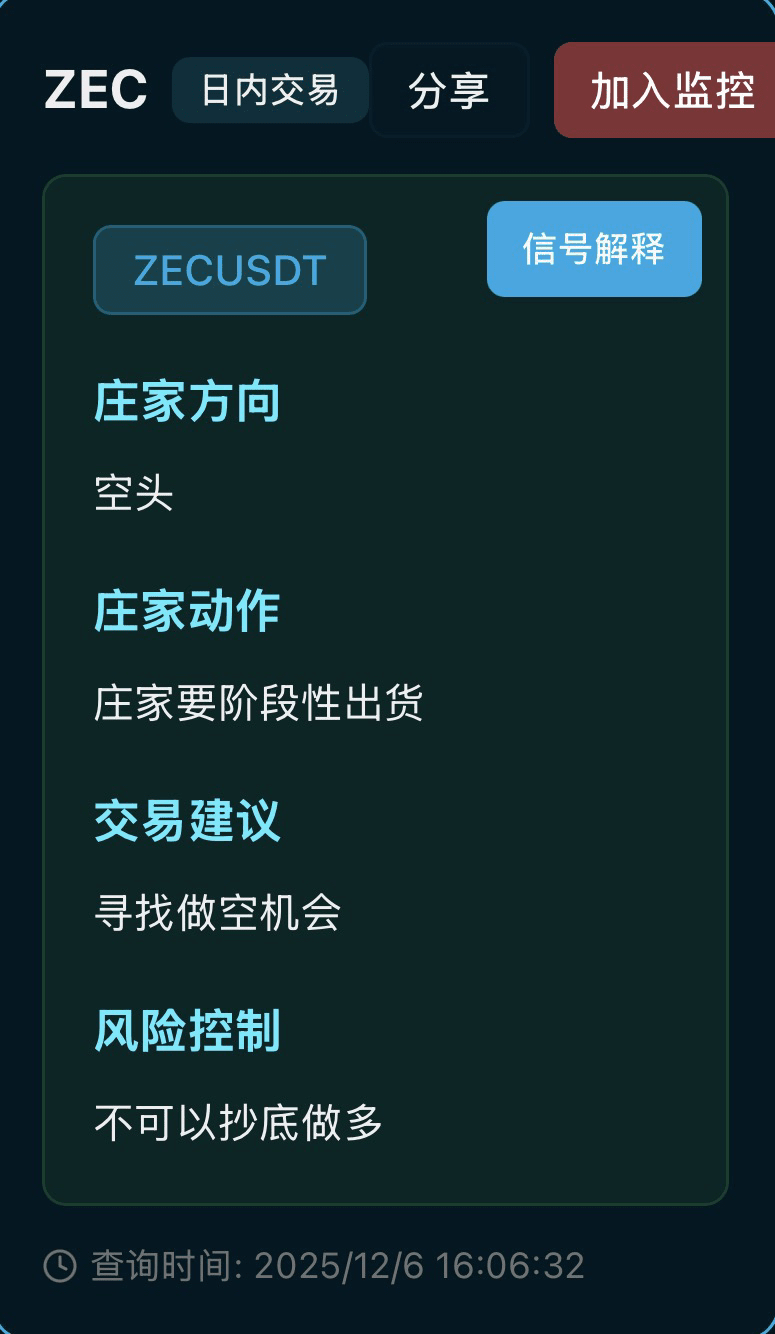

From the latest monitoring, ZEC is still in the standard bearish control rhythm, with the direction given by the market makers being 'bearish'. Coupled with the description of 'needing to offload in stages', it can be understood that: each upward segment is more for offloading and preparing for a bullish wash, rather than starting a new round of major upward wave.

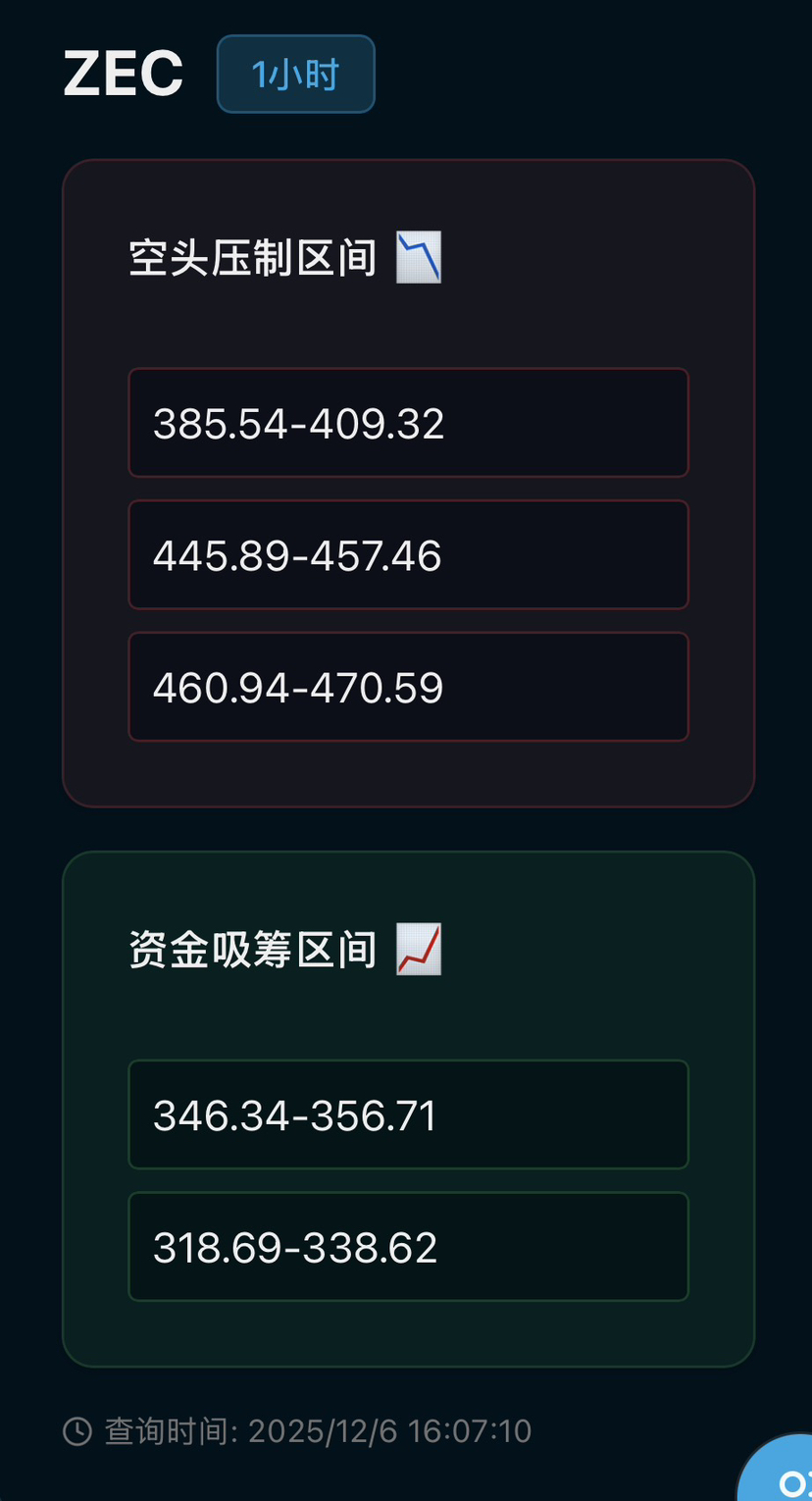

The most intuitive structure in the market is the three groups of bearish pressure zones above:

385.54-409.32

445.89-457.46

460.94-470.59

As the price approaches these ranges, it essentially creates better selling prices for the operator while forcing the long positions and replenishing bulls to take over. Especially in the central suppression zone of 445.89-457.46, if it quickly spikes here but the volume does not keep up, it is easy to see a typical distribution pattern of 'spiking and falling + increased volume', which is a key focus area for short entry points.

Lower two groups of funds accumulation zone

346.34-356.71

318.69-338.62

On one hand, it is the operator repurchasing short positions at low levels, while also taking back some panic selling; on the other hand, it is also a protection zone for short-term shorts to reduce positions: if one has already shorted at the top earlier, they should learn to lock in profits in batches within these ranges, rather than blindly holding on for a 'floor'.

Overall rhythm, currently more like a box-style downward channel of 'selling at the top, replenishing at the bottom', with prices oscillating back and forth between the suppression zone and the accumulation zone, using time to wear down the bulls' confidence. In terms of short-term strategy, it is not advisable to chase shorts below the accumulation zone, as it is easy to encounter sudden upward pulls from the operators that cause floating losses; a more appropriate approach is to wait for the price to approach the upper edge of 385.54-409.32 or even further test 445.89-457.46, then look for countertrend reversal signals in combination with the order book and trading volume, such as: rapid volume increase after a spike, continuous long upper shadows, large orders smashing the market, etc., and then enter short positions in small batches, placing stop-loss orders outside the upper edge of the corresponding range, achieving 'small losses when wrong, capturing the whole segment when right'. At the same time, strictly enforce the risk control requirement of 'do not bottom-fish for longs': as long as the operator's direction remains bearish, and the description still emphasizes 'periodic selling', any subjective impulse to think 'it has dropped too much and should rise' is more like helping the operator take over. In short, the main theme of ZEC currently remains bearish selling + oscillating downward, with trading focused on 'finding shorts at high positions and reducing positions at low positions', using light positions, batch entries, and stop-loss orders. It is better to take one less step than to catch falling knives at emotional price points.