Don't blame $XRP for being too harsh, blame yourself for being too sweet — once you are pulled in, you believe, once you believe, you rush in, once you rush in, you shine.

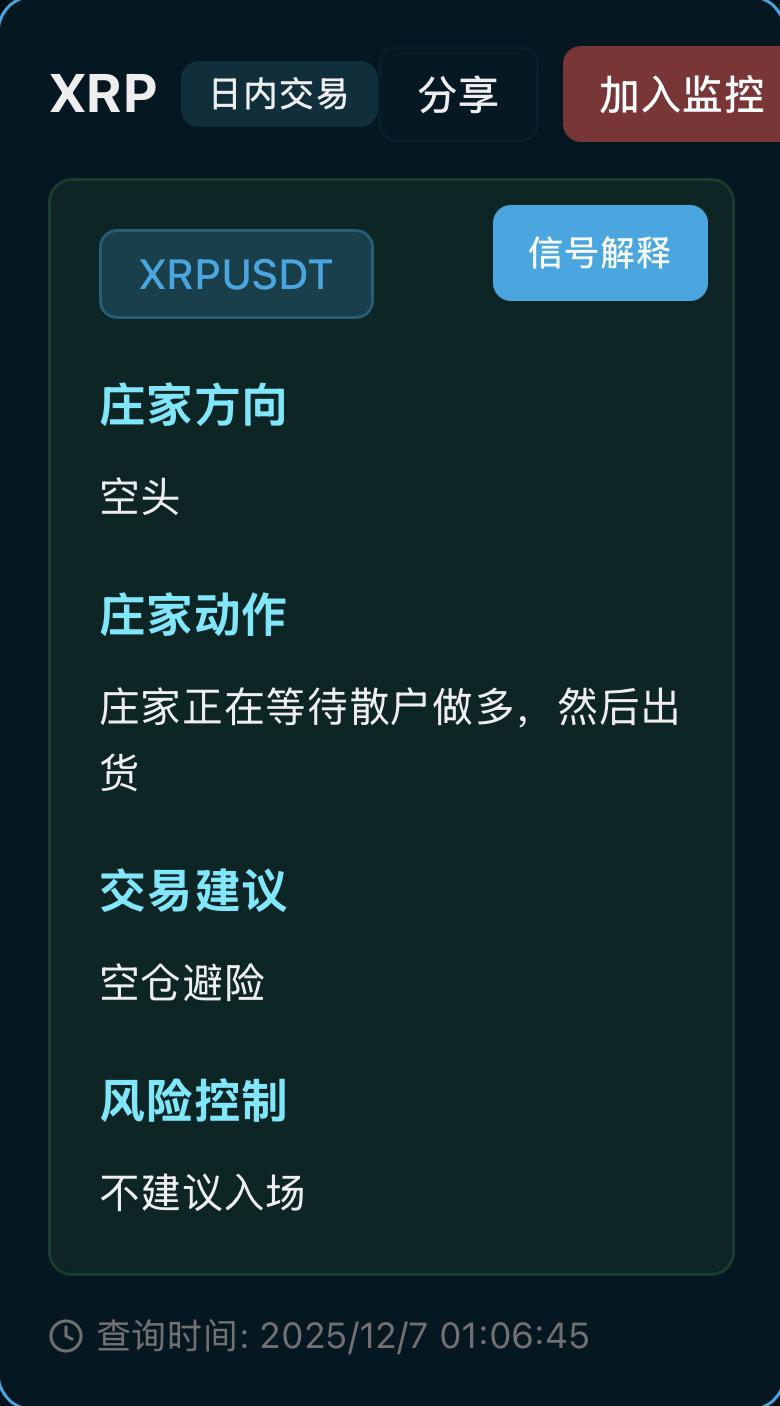

The current monitoring gives the direction of 'bearish', indicating that the overall strategy of the main force is still focused on selling and suppressing, rather than raising and taking over. For retail investors, the most fearful situation is seeing a small rebound and rushing in to go long, which just gives the big players ammunition. As long as the major direction is on the bearish side, any upward rally should be primarily understood as a 'reduction window' and 'inducement process', rather than the starting point of a new round of trend-driven bull market.

Market maker actions breakdown: Waiting for retail investors to go long, then rhythmically offloading.

The signals are written very plainly - 'the market makers are waiting for retail investors to go long, and then offload.' This sentence basically makes the current script of the main force clear:

1) By creating local rebounds, releasing some favorable sentiments, and making the market appear relatively strong, attracting chasing buy orders to rush in;

2) When retail long positions accumulate at high levels, the main force will take advantage of sufficient liquidity to sell off the previously accumulated chips in batches to you;

3) Once the price loses support, it will be pushed down further, burying the latecomers at the peak. In other words, the current XRP does not lack people wanting to catch the falling knife, but the market makers think there are not enough people to catch it, which is why they repeatedly shake and test, making more people mistakenly believe that 'it is about to take off.'

Key price level structure: Above is the bearish ice layer, below is the bullish trap.

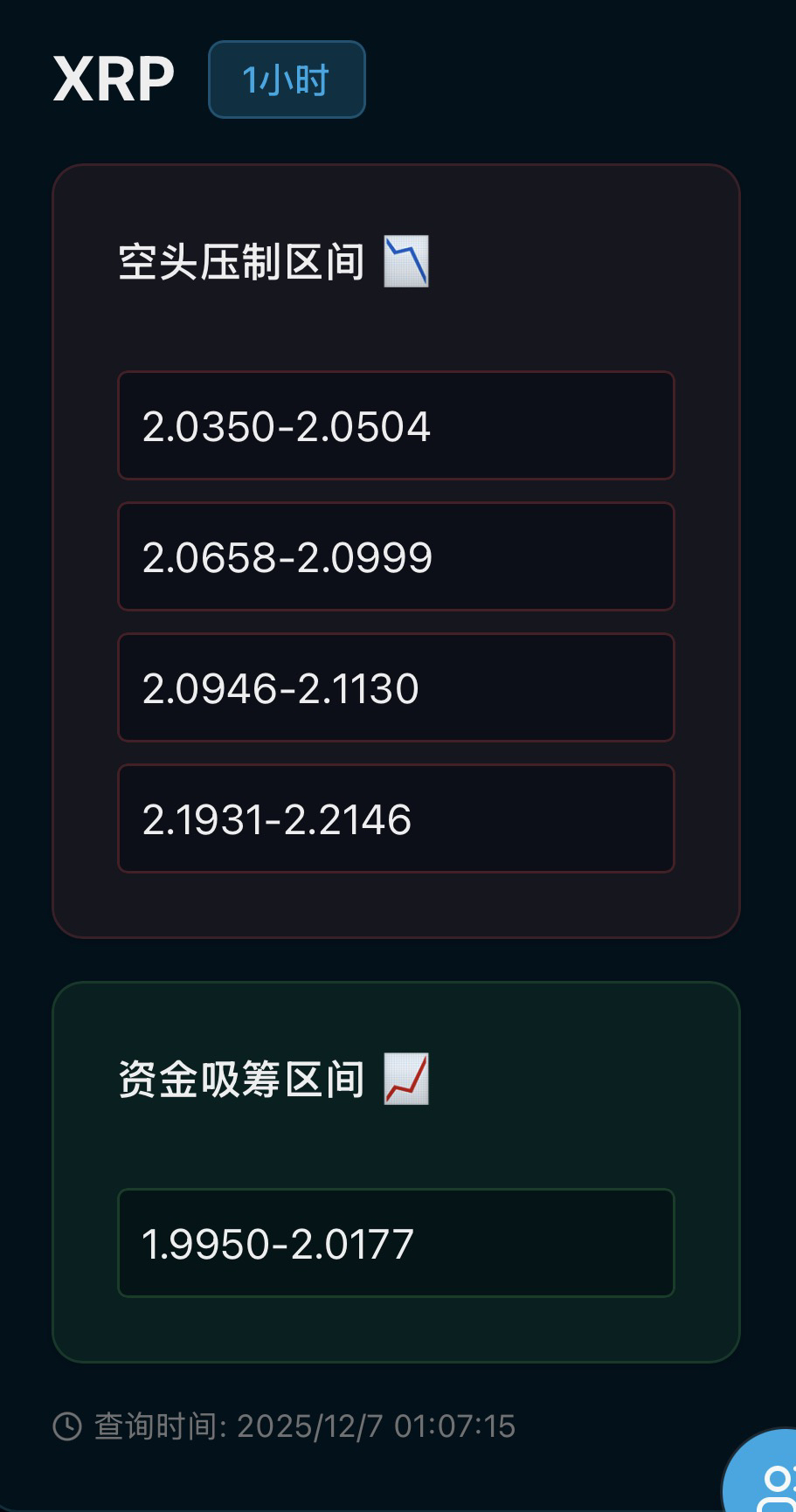

1) Bearish suppression interval:

2.0350–2.0504

2.0658–2.0999

2.0946–2.1130

2.1931–2.2146

These are ideal areas for the main force's offloading, as well as dense areas of the bearish defense line. Every time the price approaches these intervals, one must be vigilant: increasing volume without rising, long upper shadows, surging and falling back, large orders pressing down, this is typical 'pulling while selling.' Especially in those two upper intervals, it is more likely to be the 'last stick' near the stage high point, providing not opportunities but pitfalls.

2) Capital accumulation interval: 1.9950–2.0177; this price range looks more like the main force's low-level acquisition zone. Once the upper selling is completed and the price is pushed down, the main force may buy back a bit here for the next round of high positions to continue selling. For retail investors, this does not necessarily represent a 'safe long position zone,' but rather the main force's 'work zone for chip recovery,' which can defend or step down again.

Intraday trading mindset: What is most feared now is not missing out, but catching the falling knife.

1) Long perspective: From the current structure, the bulls do not have an absolute advantage, and the market makers are still waiting for more retail investors to rush in, which means that the pressure from the chips above has not been released cleanly. Recklessly chasing long positions is equivalent to voluntarily becoming the 'high position catcher' in the script, with risks far outweighing potential rewards.

2) Short perspective: Although the overall direction is bearish, this does not mean that it is suitable to heavily short now. The market makers want 'someone to catch at the top,' so they will repeatedly shake the market, creating hope for the bulls. If bearish positions chase at low levels, they can easily be caught in this enticing bullish rally, leading to floating losses or even being washed out. Shorting is more suitable near several resistance intervals above, combined with obvious surging and falling back patterns, using small positions to test and earn from the 'emotional reversal,' rather than being solitary and reckless when emotions have not fully turned at the current position.

3) Short-term operation: If the current price is oscillating above the accumulation area and below the resistance area, this looks more like the 'mid-stage stage' of the main force, they are setting the scene, and you are watching the play. For ordinary traders, the most rational approach is to reduce the frequency of operations; it is better to miss a segment of the market than to trade frequently in the range set by the main force, as the opposing side will never take advantage.

Risk control: Treating 'not making a move' as a skill.

The advice given by the monitoring is already very clear: stay out of the market to avoid risks + do not recommend entering. Combined with the actions of the market makers and price structure, this period is more suitable for 'understanding, remembering, and waiting,' rather than 'impulsively, getting in, and going all in.' 1) Strictly control positions: If you already have short positions at high levels, you can continue to hold, but do not go all in, to prevent the market makers from executing a 'high pull-off' again, which would hit your stop-loss points. 2) Be cautious about bottom fishing: As long as the main force's script is still 'waiting for retail investors to go long and then offload,' any rebound that looks appealing at low levels should be questioned: Is this an opportunity, or is it just a 'high position catching ticket' served by others? 3) Emotional management: This kind of script for XRP does not cause the greatest harm to people from losing money itself, but from being shaken back and forth, losing judgment on the market, leaving only the phrase 'whatever.' Just remember: this is the period when the market makers control the market, not when retail investors dominate, the more you follow the trend, the less initiative you have.

To summarize: The current XRP intraday pattern is 'bearish overall direction + market makers waiting for retail investors to go long and offload + dense resistance above, with the bottom being just a working area.' For ordinary traders, the most valuable strategy is not to predict every single candlestick that follows, but to understand what the market makers are doing, and then choose to 'make one less move' in this game: do not chase long positions at the top, do not heavily short at awkward positions, use time and patience to exchange for a safety margin, this is the true mindset of a master at this stage.