As a ten-year veteran in the field of digital currency, I firmly believe that I have unique insights in this area. Ten years ago, I dismissed those obscure technical terms, thinking they were nothing but tedious empty talk, and scoffed at so-called technical analysis, firmly believing that my intuition was the most reliable. During those three years of obstinate independence, I blindly invested, only to end up with nothing.

Fortunately, I received generous assistance from my brother-in-law, who lent me 400,000 in funds, allowing me to restart my investment journey. To fully immerse myself in the field of digital currency, I even resolutely resigned from my high-paying job and became a full-time trader. To this day, my assets in the market have reached 91 million, and just from interest income, I can easily earn 50,000 a day.

Before discussing the technology, I will strictly share the following 10 insights from the cryptocurrency world!

1. Popular coins have fragile bubbles. Coins that are heavily speculated during a bull market often rise quickly but fall even faster. The more people chase them, the bigger the bubble becomes; like blowing up a balloon, if you blow it too big, it will inevitably burst, and the risks will also escalate.

2. The harvesting tactics of altcoins. The typical play with altcoins is to first crash the market to accumulate, then pull it up to attract trend followers, and finally switch tactics to continue harvesting. The model is old but effective; be mentally prepared before participating, and don't be deceived by superficial upward trends.

3. The market has been pulling upwards for a long time; looking at higher timeframes, the overall trend of the cryptocurrency market is relatively stable, with short-term violent fluctuations being the norm, but it often slowly rises in the long run. Patience may be a better choice than chasing highs and cutting losses.

4. Potential coins are often overlooked. Coins with true potential are often quietly unnoticed at the bottom, with few people paying attention. On the contrary, those coins that accumulate quietly tend to rise unexpectedly, and discovering them requires vision and patience.

5. Newly listed coins are high-risk. Coins newly listed on exchanges often come with traps of explosive rises and falls, mostly set by market makers. It’s best not to touch those that fluctuate drastically right after listing, as entering could make you a target for getting 'cut.'

6. Price fluctuations are the norm. Buying on dips and selling on rises is common in the crypto market. If you can’t even handle this level of volatility, you need to work on your mindset, otherwise you may easily be led by market emotions.

7. A strong rebound does not equal true potential; the coins with the most severe rebounds are often the result of speculative trading, and may not have long-term value. Coins with true potential tend to have more stable fluctuations, supported by fundamentals. Don’t be deceived by superficial appearances.

8. Be cautious of sudden pullbacks after a surge in prices; it may signal that the market maker is offloading. Pay attention to volume and price changes, and don’t buy at high prices, becoming the one who gets 'cut.'

9. In the second half, dark horse coins in the bull market may explode several times after initially performing mediocrely, much like marathon runners who pick up speed in the latter stages. Such coins often have potential and are worth paying attention to for market rotation opportunities.

10. Sideways coins may welcome an explosion. In a bull market, some coins may experience several times of increase after being stagnant for months, indicating they may be ready to surge. Keep an eye on such coins; if the fundamentals are solid, the next wave of explosion may not be far away.

For all traders, the trend is the 'big picture.' It is the rising tide that can lift everything. For intraday traders, the intraday trend often determines whether a trading day results in wealth or loss. Trading with the intraday trend is like taking the path of least resistance to gain intraday profits.

Since trends belong to a higher level, they often feel somewhat disconnected from current price actions. Therefore, many traders tend to exclude price actions from trend judgments. They rely on distant moving averages to define market trends without considering price actions. These traders overlook an important confirmation tool.

Using indicators to identify intraday trends is entirely reasonable. However, if indicators are combined with price action, the effect will be stronger. Therefore, in this article, we focus on how to combine indicators with price action to track intraday trends, as well as two other methods for finding intraday trends.

1. Moving average combined with price action

This method uses a 20-period simple moving average (SMA) in conjunction with price action to clarify intraday trends. The idea is very simple: look for a shallow pullback followed by a new high (or new low) to confirm a bullish (or bearish) trend.

To confirm the intraday bullish trend, the following conditions must be met.

The logic analysis is in parentheses:

1. The price touches the moving average line. (Establish a baseline, especially suitable for trading days that open with a gap.)

2. The price has at least one K-line staying above the moving average line. (Shows buyer strength.)

3. The price pulls back towards the moving average line, but during the pullback, no K-line's highest point breaks below the moving average line. (Confirming insufficient bearish strength.)

4. When the price breaks above the previous extreme high point, the bullish trend is established. (Confirmation of bullish market structure.)

To confirm the intraday bearish trend, the following conditions must be met:

1. The price touches the moving average line.

2. The price has at least one K-line staying below the moving average line. (Bearish strength.)

3. The price rebounds towards the moving average line, but during the rebound, no K-line breaks the lowest point of the moving average line. (Confirming insufficient bullish strength.)

4. When the price falls below the previous extreme low point, the bearish trend is established. (Confirmation of bearish market structure.)

Next, let's look at an example chart from the Nasdaq Index Futures (NQ).

This trading day opens with a bullish gap.

1. We do not guess whether this gap will start a new bullish trend or close the gap, but rather wait for the price to return to our established baseline—SMA.

2. The price touches the SMA.

3. This K-line stays below the SMA, confirming bearish momentum.

4. Although the next K-line creates a new high, it cannot even test the SMA upwards.

5. When the market breaks down below the previous extreme low point of the SMA, we confirm the establishment of a bearish trend.

Although there was a 50% pullback midway, this intraday bearish trend remained solid throughout the trading day.

For any trader, using just a 20-period moving average is an excellent starting point for trend judgment.

2. Price channel combined with price action

In the second technique, we no longer use simple moving averages based on closing prices, but instead use two moving averages based on the highest and lowest prices of K-lines. These two lines will form a price channel to help us more clearly identify intraday trends.

Expert Jake Bernstein, who focuses on intraday trading strategy research, applied this concept in his Moving Average Channel Day Trade method.

Due to the more complex structure of indicators here, the interpretation rules are actually simpler:

✔ When two consecutive K-lines are completely above the channel, it is defined as a bullish trend.

✔ When two consecutive K-lines are completely below the channel, it is defined as a bearish trend.

The above example shows how the price channel helps define changes in intraday trends.

1. Although the market has risen significantly since the start of this trading session, according to this method, we can only define the trend as bullish at this moment.

2. These two K-lines turn the intraday trend bearish.

There are various methods to construct price channels. In addition to using moving averages based on the highest and lowest prices of K-lines, you can also use Keltner Bands or Bollinger Bands. Since these price channels are constructed differently, you need to adjust the rules for judging intraday trends based on their characteristics.

Finding intraday trends: Comparative analysis

The aforementioned SMA method and the price channel method both clarify price action through indicators but in different ways.

Through comparison, we can better understand these two methods.

✍ The SMA method focuses on finding weakening momentum during pullbacks to identify new trends.

✍ The price channel method judges the beginning of a new trend by looking for strong breakout movements—when the price exceeds the channel range.

So, how do these two methods compare to the next two methods that are purely based on price action (without indicators)?

Now, we will continue to introduce two other methods for interpreting intraday trends. These techniques focus entirely on price action itself.

3. Higher timeframes

As mentioned above, trends belong to the 'big picture,' which is a higher-level market perspective. Therefore, a common method for judging intraday trends is to observe price actions at higher timeframes.

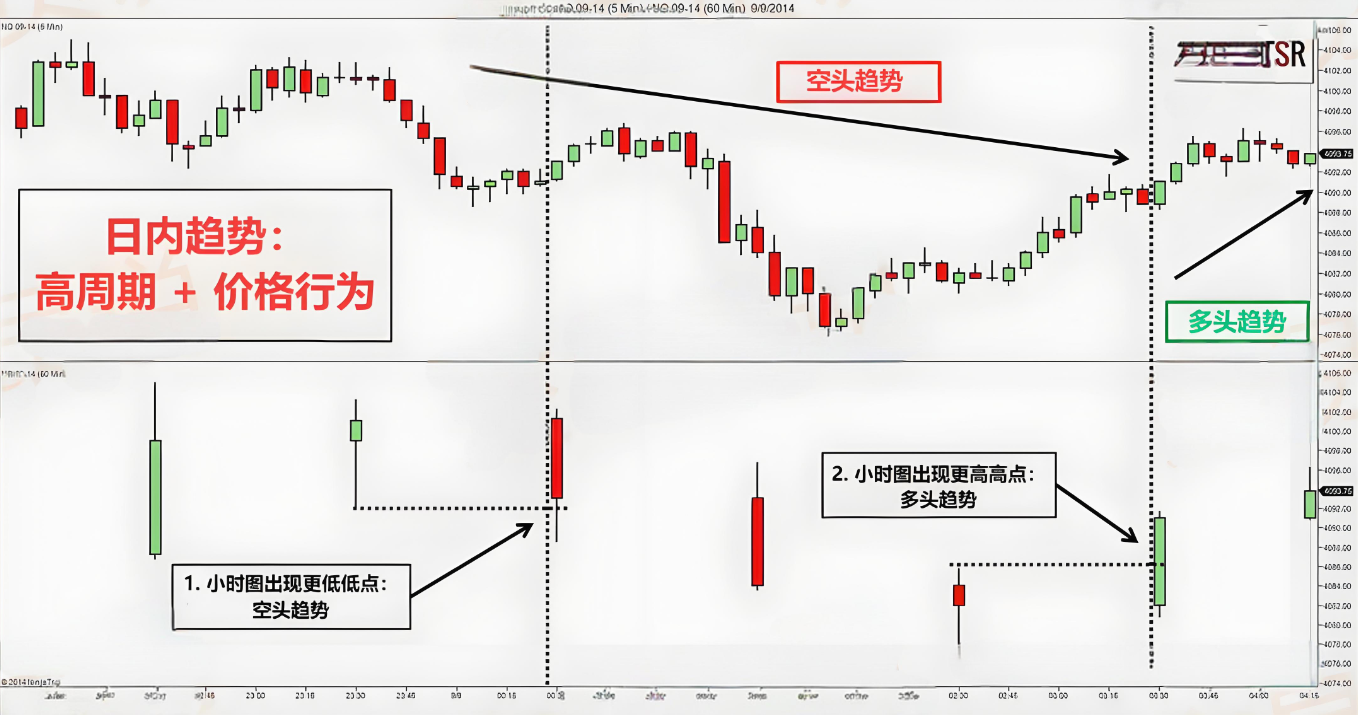

The following example shows how we use the highs/lows of hourly K-lines to judge the intraday trend of the 5-minute timeframe.

In the above image, the top panel shows the 5-minute timeframe, while the bottom panel shows the corresponding hourly timeframe.

1. This hourly K-line creates a lower low, confirming the intraday bearish trend.

2. This K-line creates a higher high, turning the intraday trend bullish.

This is a classic case of using higher timeframes to judge intraday trends: it first assesses the intraday trend using hourly charts, then executes trades on a 5-minute timeframe. In its system framework, it is recommended to adopt the 'five times timeframe' principle when choosing higher timeframes, for example: combinations of 1 minute, 5 minutes, and 25 minutes.

4. Trendline

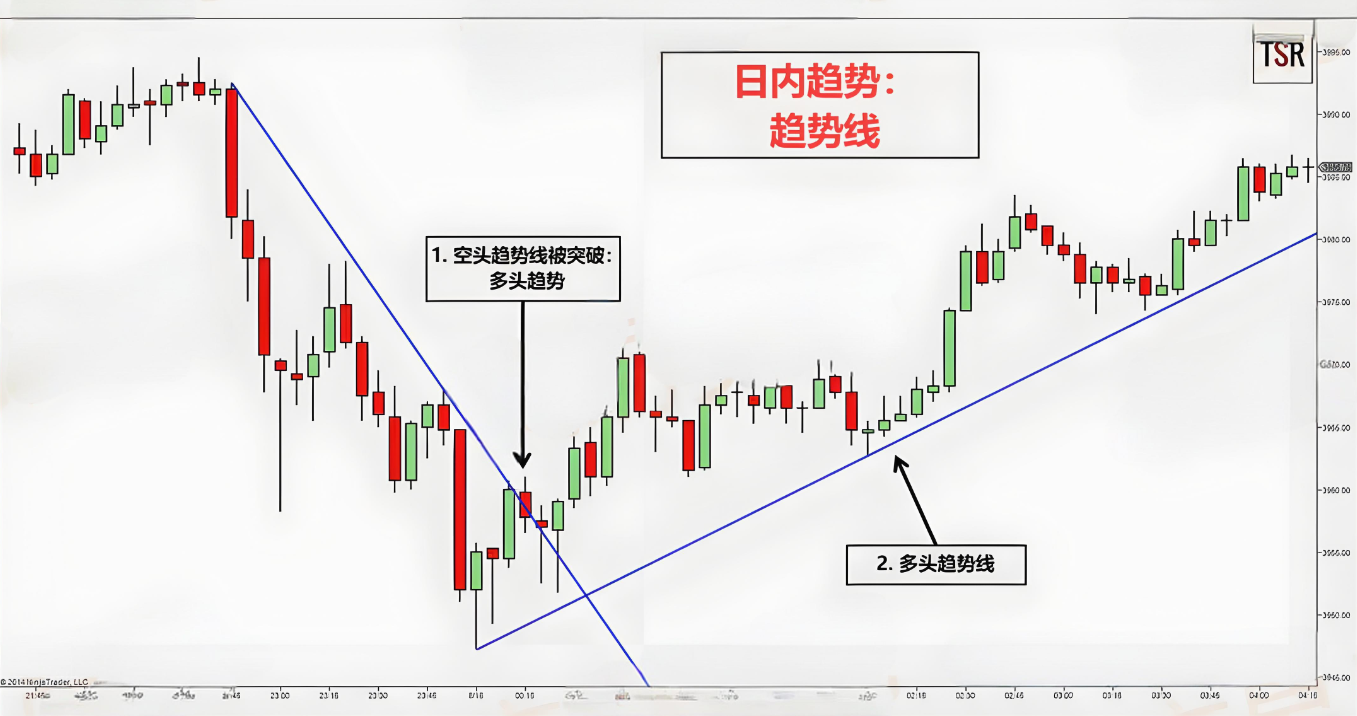

Price action traders are very fond of trendlines—useful for both intraday and long-term analysis.

By connecting volatility points, we can obtain trendlines of different slopes and importance. Trendlines can highlight volatility structures and project their momentum and speed.

The most basic interpretation of a trendline is that when a trendline is broken, the trend may reverse. The example below illustrates how a broken bearish trendline suggests a subsequent bullish trend.

This method is relatively simple because it does not rely on any indicators and only focuses on a single timeframe. However, to make this method truly effective, you must master the skill of drawing trendlines.

The best way to find intraday trends

No single method can perfectly judge intraday trends. The market will always present situations where just as we conclude 'trend reversal,' it returns to the original trend; or when we confirm a trend, the market just starts to reverse. These situations are unavoidable. This is why we need specific trading patterns to accurately enter the market and control risks.

The four methods above each have their flaws.

For the first two indicator-dependent methods, we must decide the lookback period for the indicators. Without a reasonable lookback period, the indicators' help for trend analysis is extremely limited. The suitable lookback period also depends on the ever-changing market volatility.

As for the higher timeframe methods, it depends on which higher timeframe we choose. Which higher timeframe best reflects the intraday trend? The half-hour and hourly charts are quite popular among intraday traders, but forex traders may prefer the 4-hour chart.

For the trendline method, the real challenge is how to draw meaningful trendlines. If trendlines are drawn randomly, we will see far more false breakouts than trends. The key is to consistently draw consistent and valuable trendlines.

This is the trading experience that Yan An shared with everyone today. Many times, you lose many opportunities to make money because of your doubts. If you don’t dare to try boldly, to engage, to understand, how can you know the pros and cons? You must take the first step to know how to proceed with the next step. A warm cup of tea and a piece of advice, I am both a teacher and your talkative friend.

Fate brings us together, and knowing each other is destiny. I firmly believe that if you are destined to meet, you will eventually; if you part ways, it is fate. The journey of investment is long, and short-term gains and losses are just the tip of the iceberg along the way. Remember, even the wisest can make mistakes, and the darkest can find success. No matter how emotions sway, time will not pause for you. Pick up the burdens in your heart and stand up to continue moving forward.

The martial arts secret has been shared with you all; whether you can become famous in the world depends on yourself.

These methods should definitely be saved for reference. Look at them more than once; if you find them useful, please share them with more people around you who trade coins. Follow me for more valuable insights from the crypto world. Having been through the rain, I am willing to hold an umbrella for the chives! Follow me, and let’s walk together on the road of cryptocurrency!