Venturing into the cryptocurrency space may not guarantee overnight wealth, but it can pave a fast track for wealth appreciation.

When money is tight and the dream of sudden wealth looms large, such a mindset often causes one to miss out on profits. After all, even if fifty thousand in capital doubles, it merely adds an extra fifty thousand to the account, hardly alleviating the urgent need. In reality, achieving a doubling of capital within two years is already quite rare, thus the primary task is to solidify the capital base.

Although I do not possess the secret to turning fifty thousand into a million, I have personally experienced the transformation from starting with three hundred thousand to an asset leap to eighty million. Regarding this journey, I believe I am qualified to share a few insights.

Having navigated the turbulent world of cryptocurrency for a decade, I went from losing almost all of my initial 300,000 yuan to now making a living through cryptocurrency trading with stable returns. This success is thanks to the principles I've learned through continuous exploration and practice over the past ten years. Today, I'm willing to share these valuable experiences with you. Whether you're a novice or a veteran in the cryptocurrency world, you'll benefit from them. They're worth carefully studying and treasuring!

Looking back, when I first entered the cryptocurrency world, I was overconfident. With only a few rudimentary tactics and some knowledge of candlestick charts, I was eager to prove myself, only to suffer a painful lesson. When my father found out, he unusually gave me a stern lecture. That night, I knelt on the ground, holding my trading records, filled with remorse. Seeing this, my father felt pity and said earnestly, "There are 360 professions, and every profession can produce an expert, but only a handful reach the top. Those who reach the top have all mastered their chosen path to the utmost. A journey must be taken step by step, water must be accumulated drop by drop; the fundamental principles remain the same. Just like forging a sword, no matter how skilled you are, without iron, it's all in vain."

Before discussing core trading strategies, I will strictly adhere to the following 10 ironclad rules:

1. If you don't have much capital, say less than 200,000 yuan, catching two or three big rallies in a bull market is enough. Don't always think about going all in. Be willing to stay out of the market and wait for the opportunity to use your profits to gamble on the next big surge.

2. You can only earn money you understand. Practice on a demo account first; you need the right mindset and courage. You can try again if you lose on a demo account, but one loss on a real account can be devastating, even forcing you to quit the market. #加密市场回调

3. If a major positive development is announced, you can choose not to sell on the same day, but if the stock opens higher the next day, you should sell immediately, as positive news often turns into negative news.

4. Reduce or go to cash the week before a major holiday, as prices usually fall during holidays.

5. For medium- to long-term investing, you need to keep cash on hand. Sell when prices rise and buy when prices fall, and trade back and forth.

6. For short-term trading, look at the trading volume and chart patterns. If the chart is active, go long; if it's inactive, stay away.

7. A slow drop means a slow rebound; a fast drop means a fast rebound.

8. If you make a mistake, admit it, cut your losses in time, and preserving your principal is the key.

9. For short-term trading, look at the 15-minute candlestick chart. The KDJ indicator can help you find good entry and exit points.

10. There are countless cryptocurrency trading techniques, but mastering a few practical ones is enough. Don't try to learn too many at once.

Today, we'll focus on breaking down the core trading logic of "smart money": how to identify high-quality, high-probability supply and demand zones by recognizing the movements of institutional funds, and then precisely enter the market to profit. This method can help you break free from retail investor thinking, view market trends from the perspective of "big money," and significantly improve your trading win rate.

01 Basic Understanding: Trend Breakout and Trend Reversal

"Trend Signals" of Smart Money

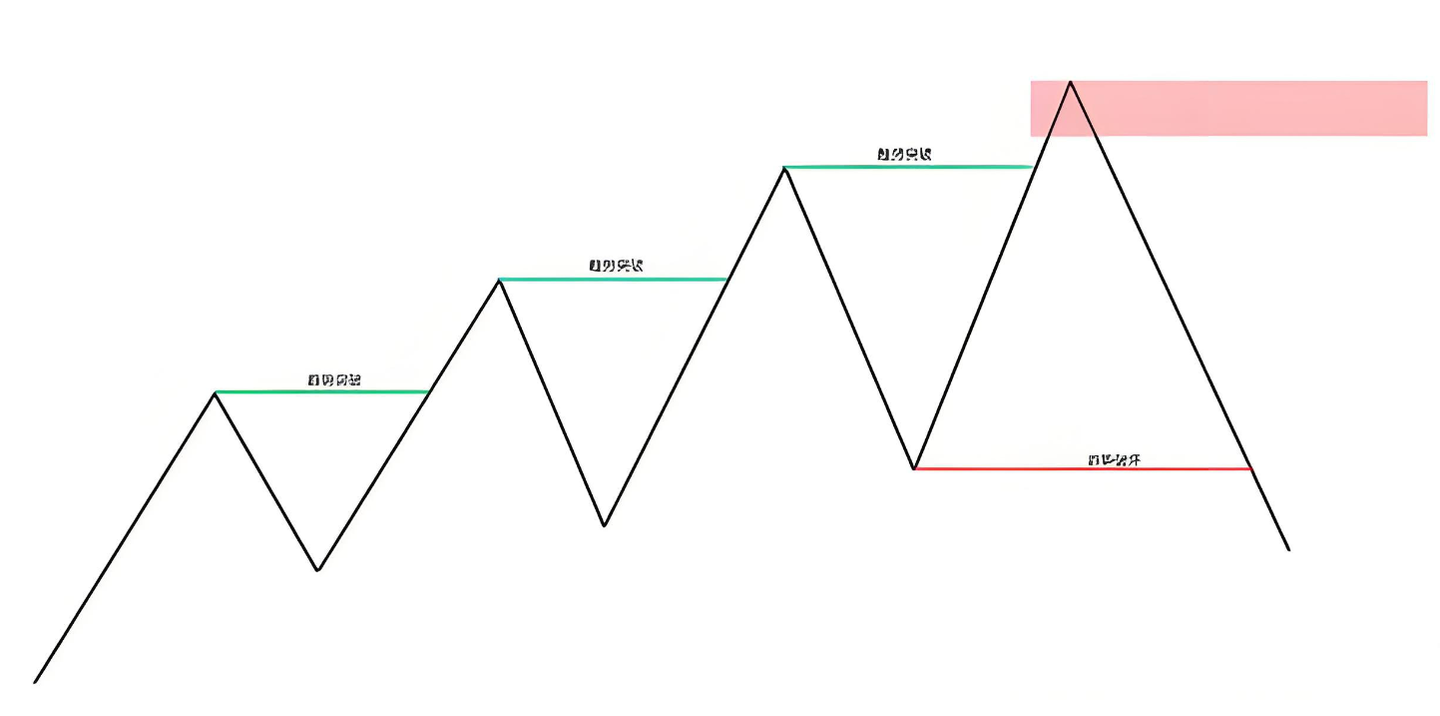

To trade with smart money, you must first understand two core signals: trend breakout (continuation of the existing trend) and trend reversal (reversal of the existing trend).

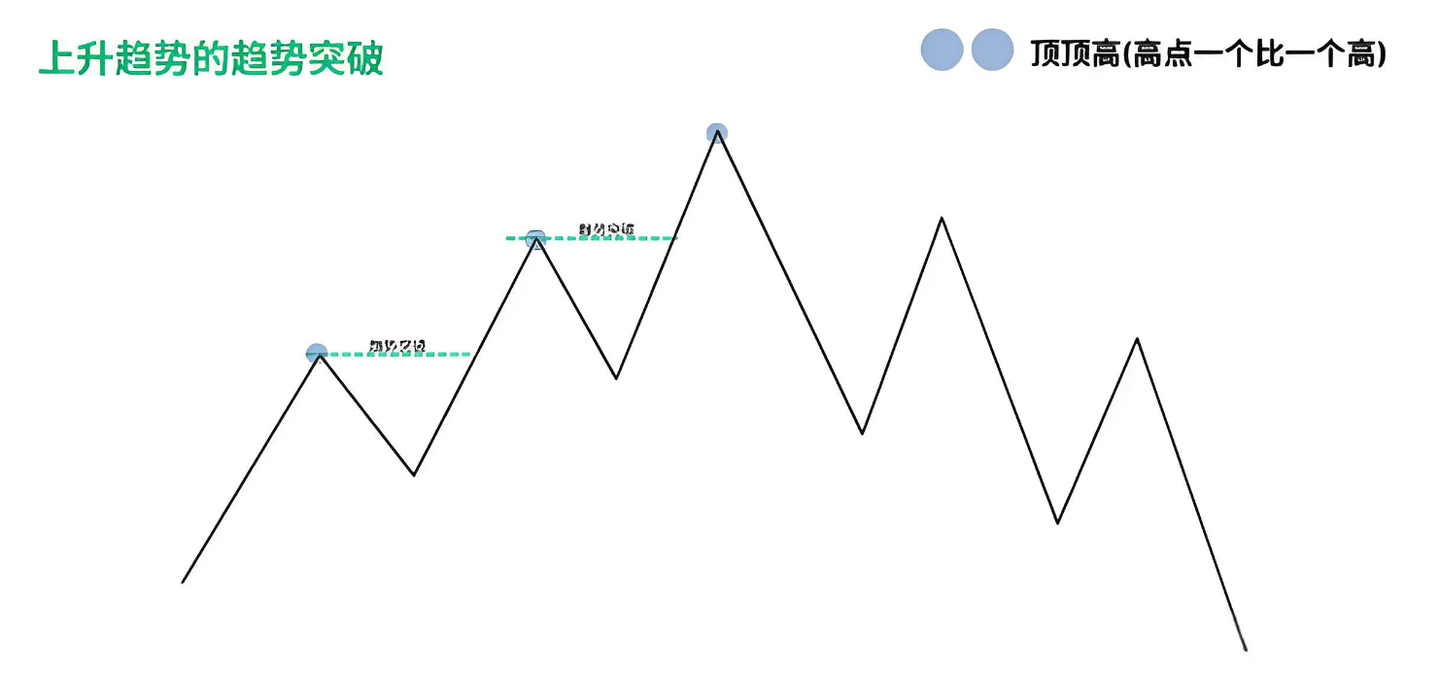

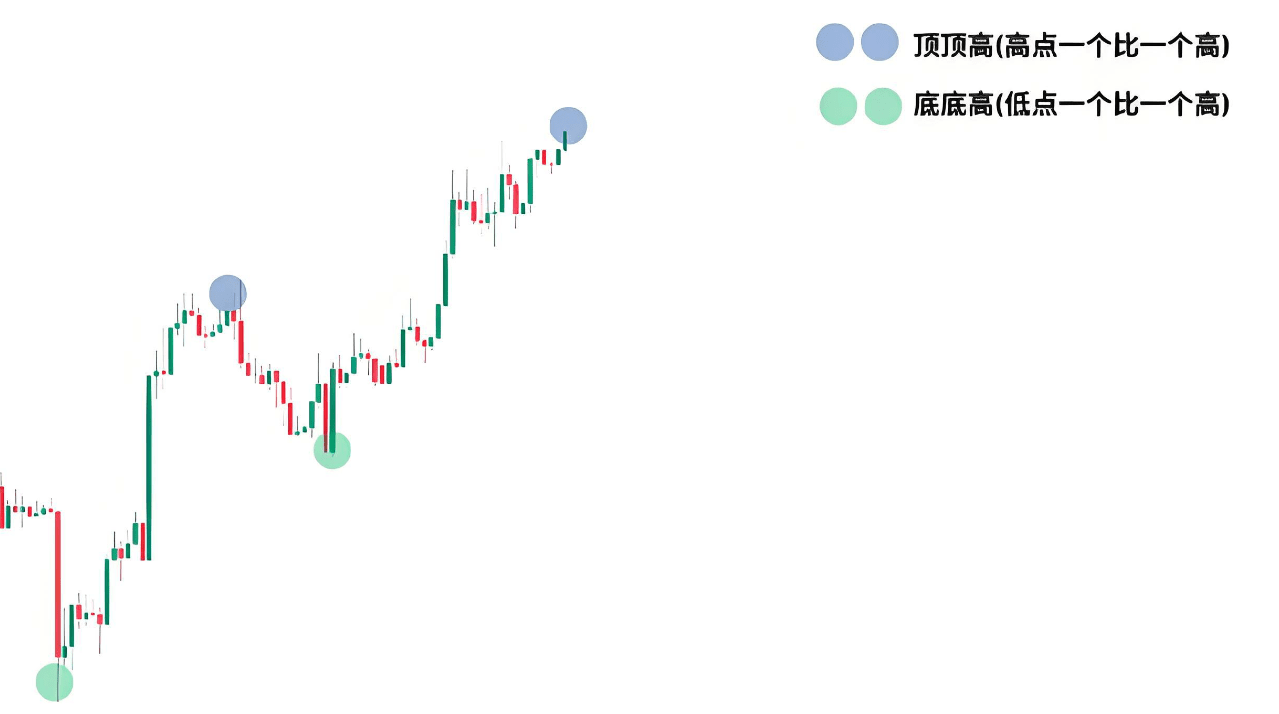

1. Trend breakout: A signal of continued trend.

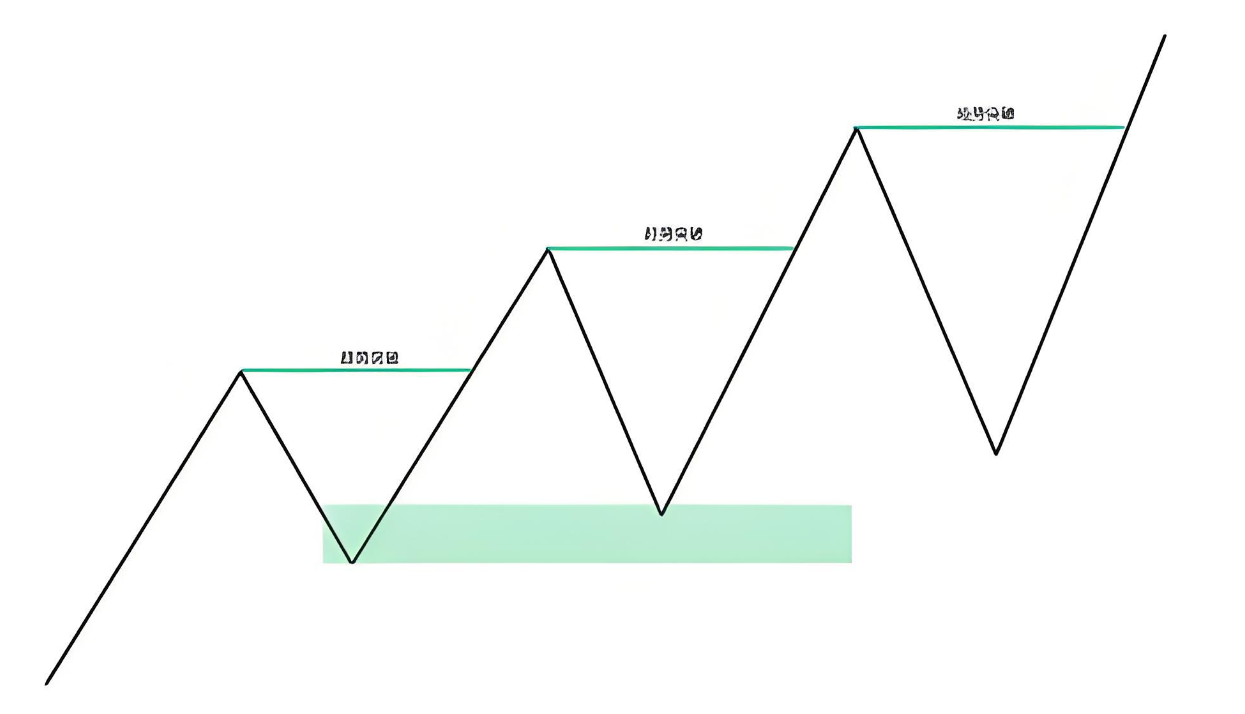

Uptrend breakout: The price breaks through the previous high, forming a "top-top-high" structure, indicating that smart money continues to enter the market and the upward trend will continue.

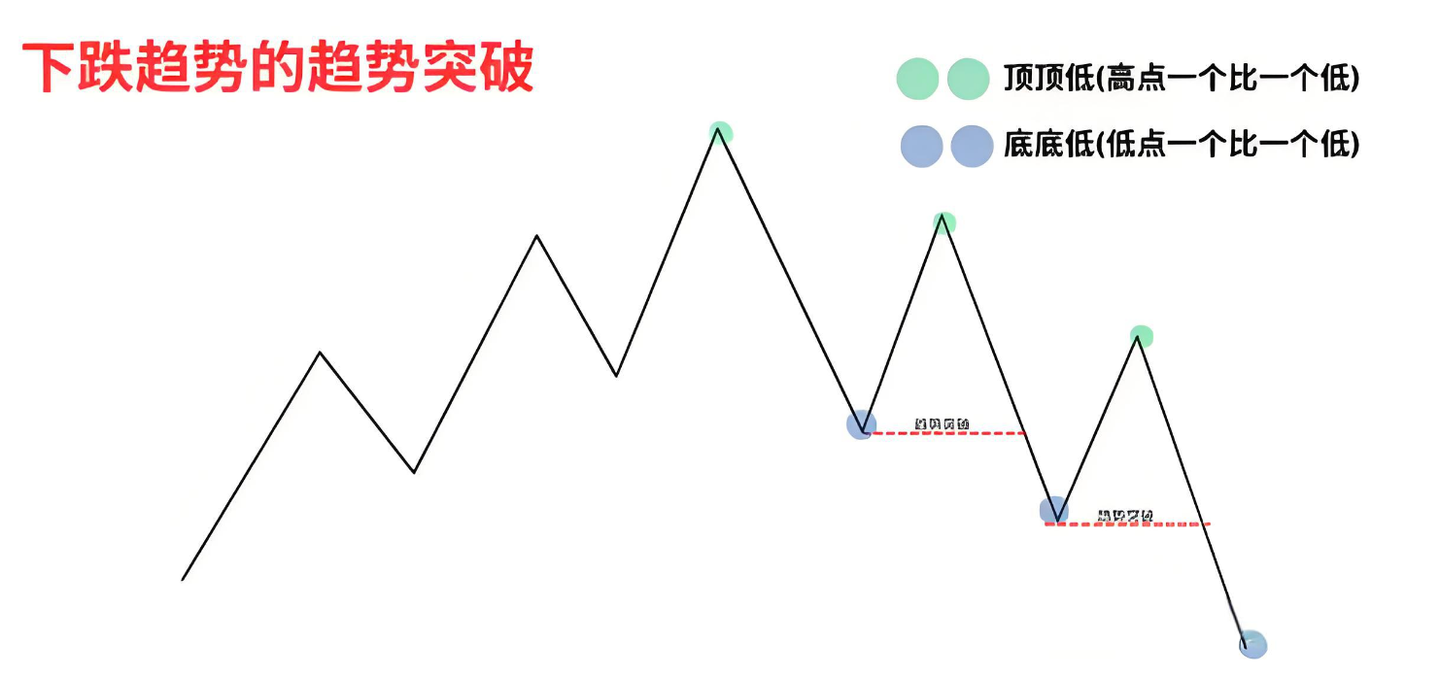

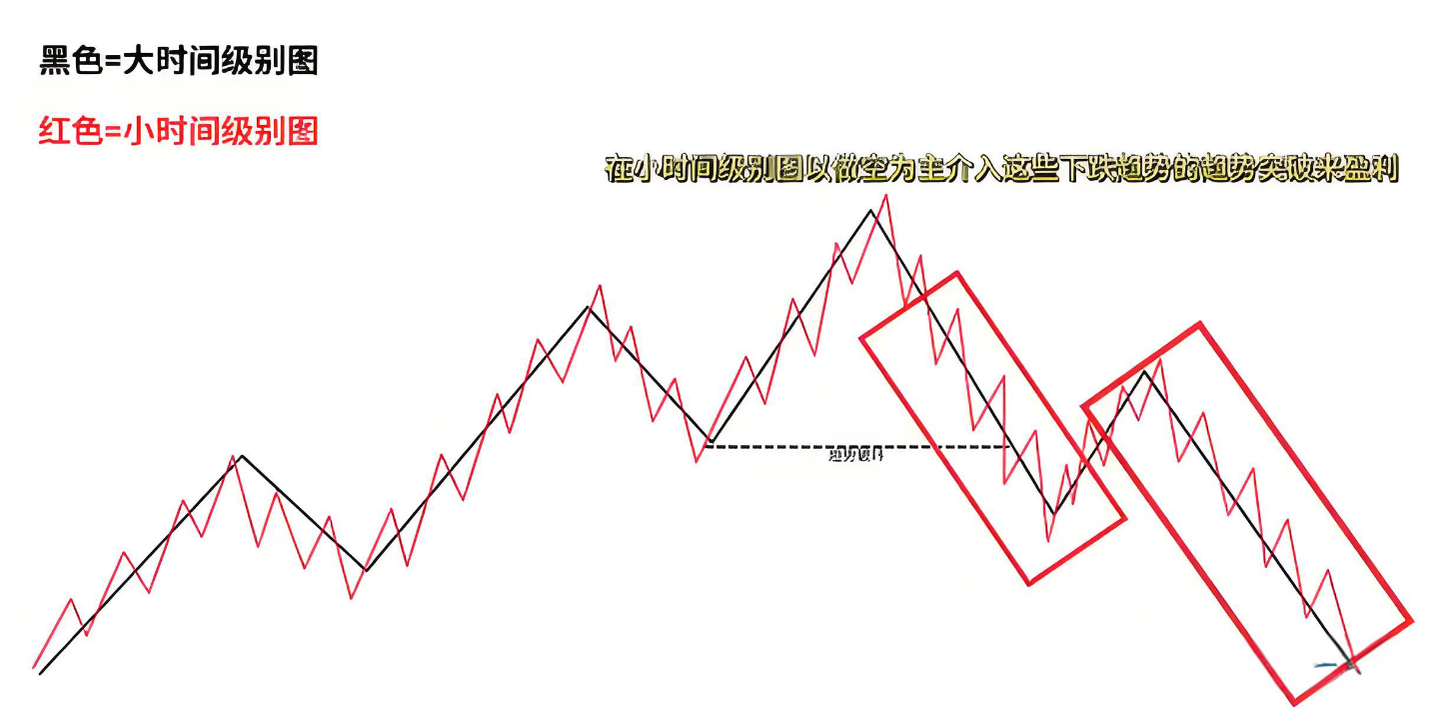

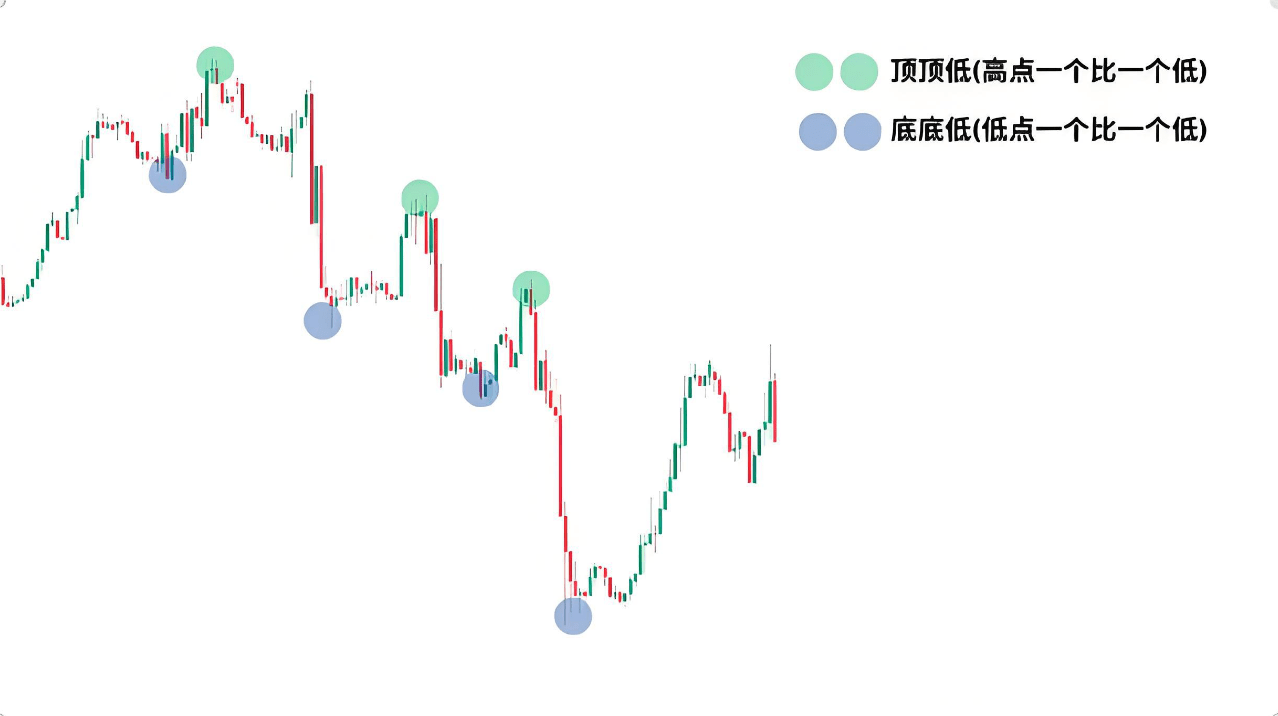

Downtrend breakout: The price breaks below the previous low, forming a "bottom-bottom-low" structure [Figure 3], indicating that smart money is continuing to sell, and the downtrend will continue.

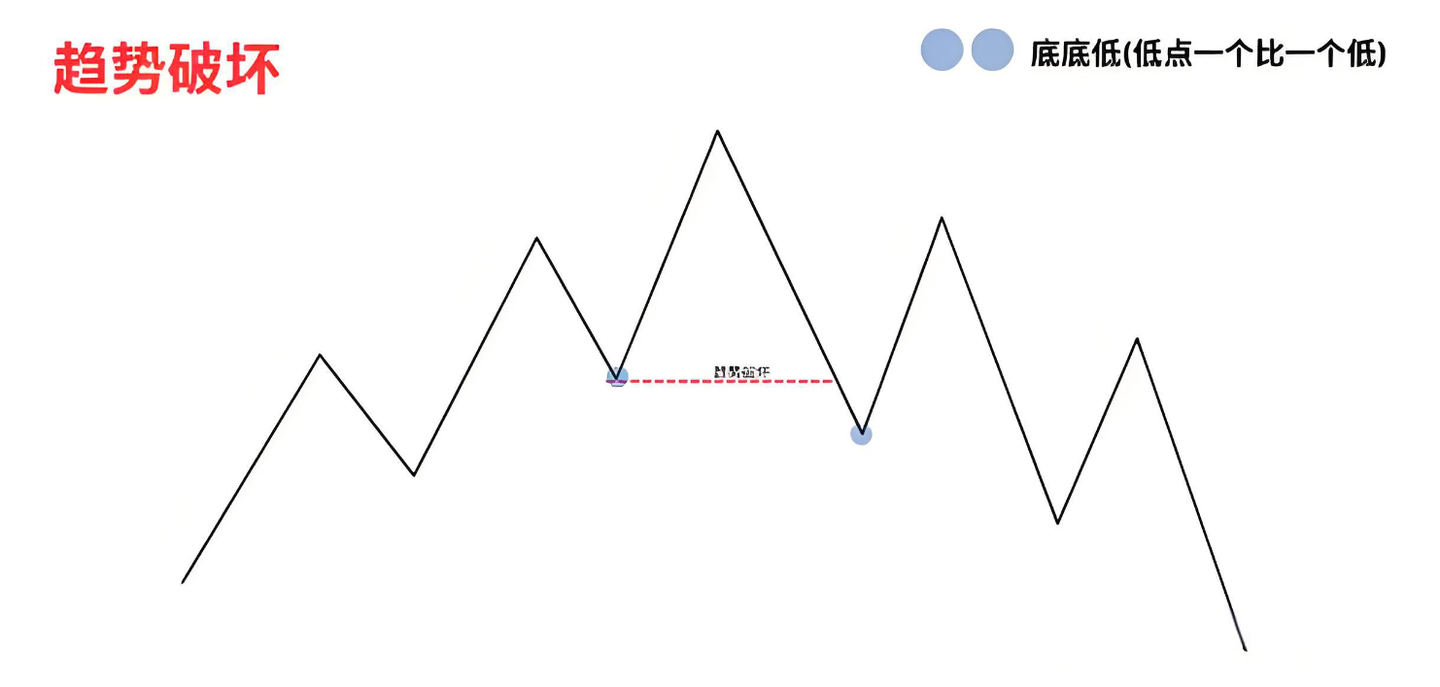

2. Trend Breakdown: A Warning Signal of a Reversal

Prices did not continue their previous trend; instead, they broke through a "key inflection point."

Uptrend broken: The price failed to make a new high and instead fell below the previous low, forming a "bottom-bottom-low" structure, indicating that the bullish momentum was exhausted and the uptrend was likely to end and reverse downward.

Downtrend broken: If the price fails to make a new low and instead breaks through the previous high, forming a "top-top-top" structure, it indicates that the bearish momentum has been exhausted and the downtrend is likely to reverse.

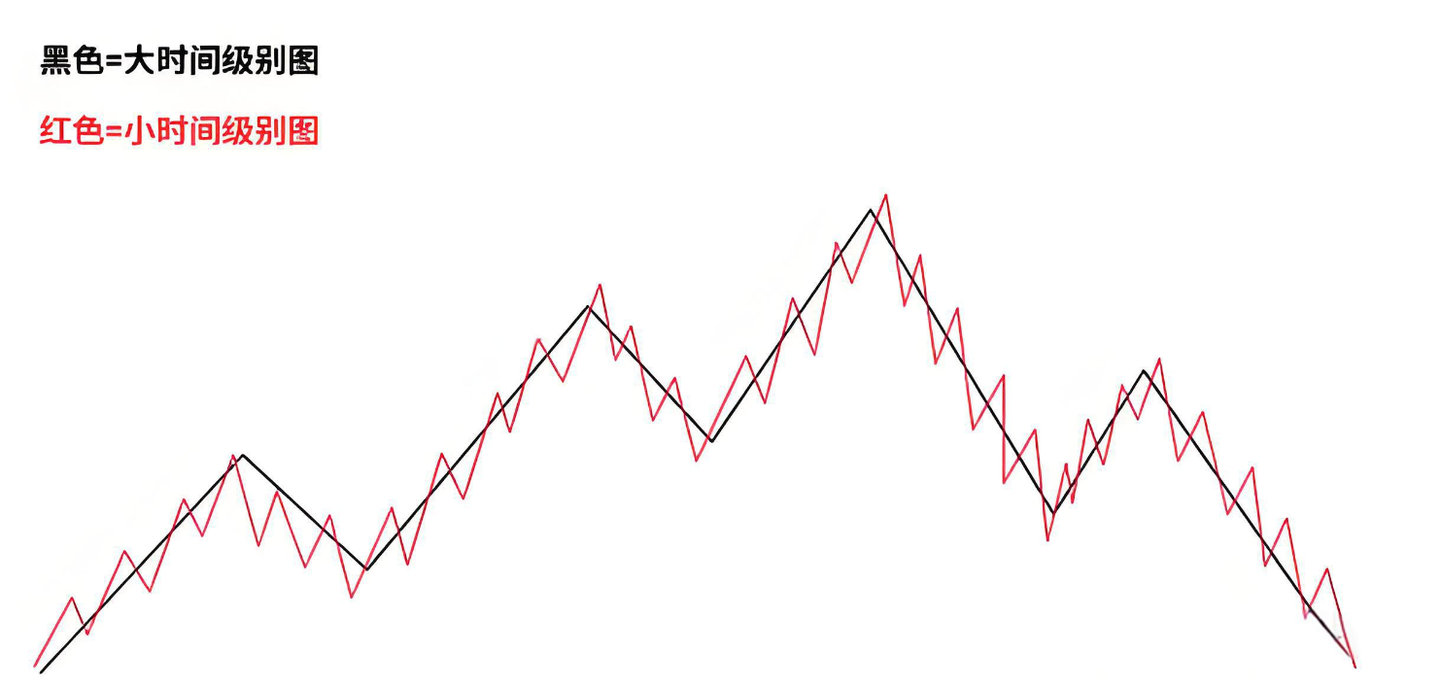

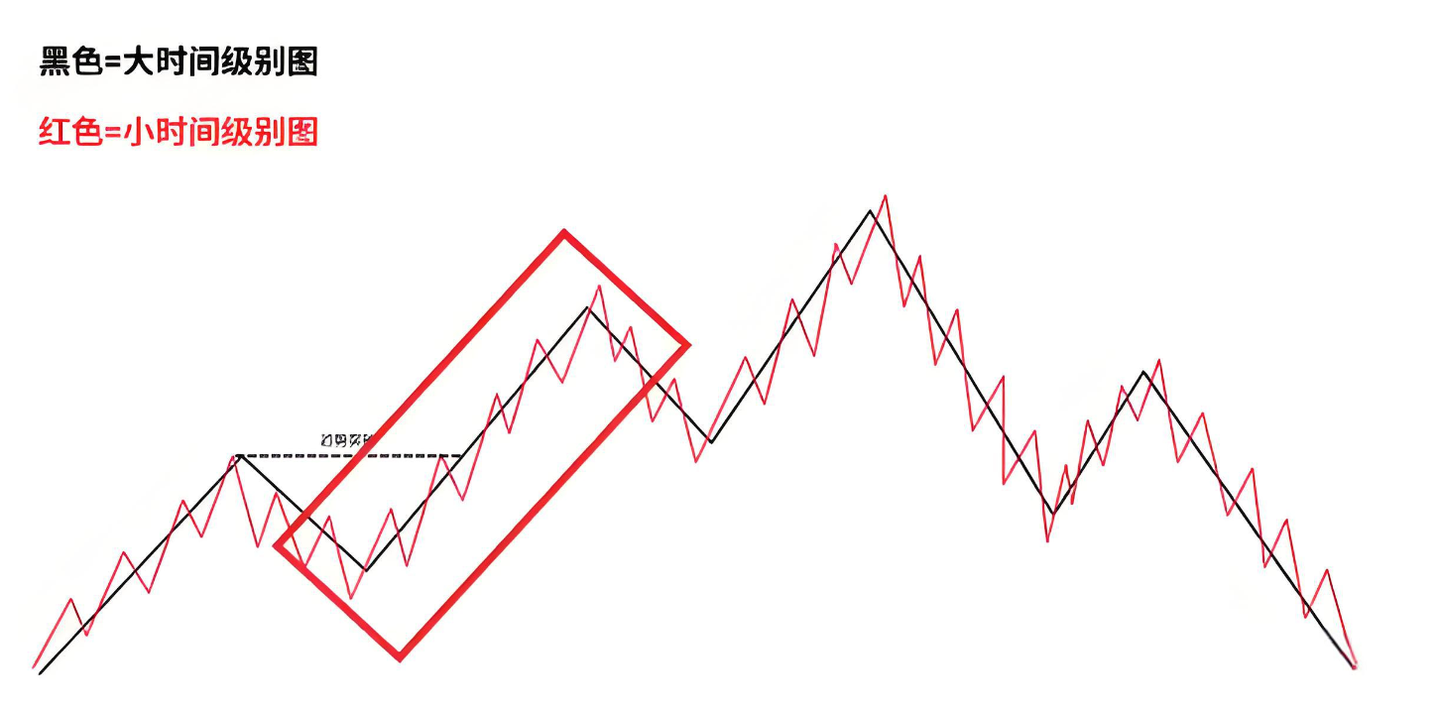

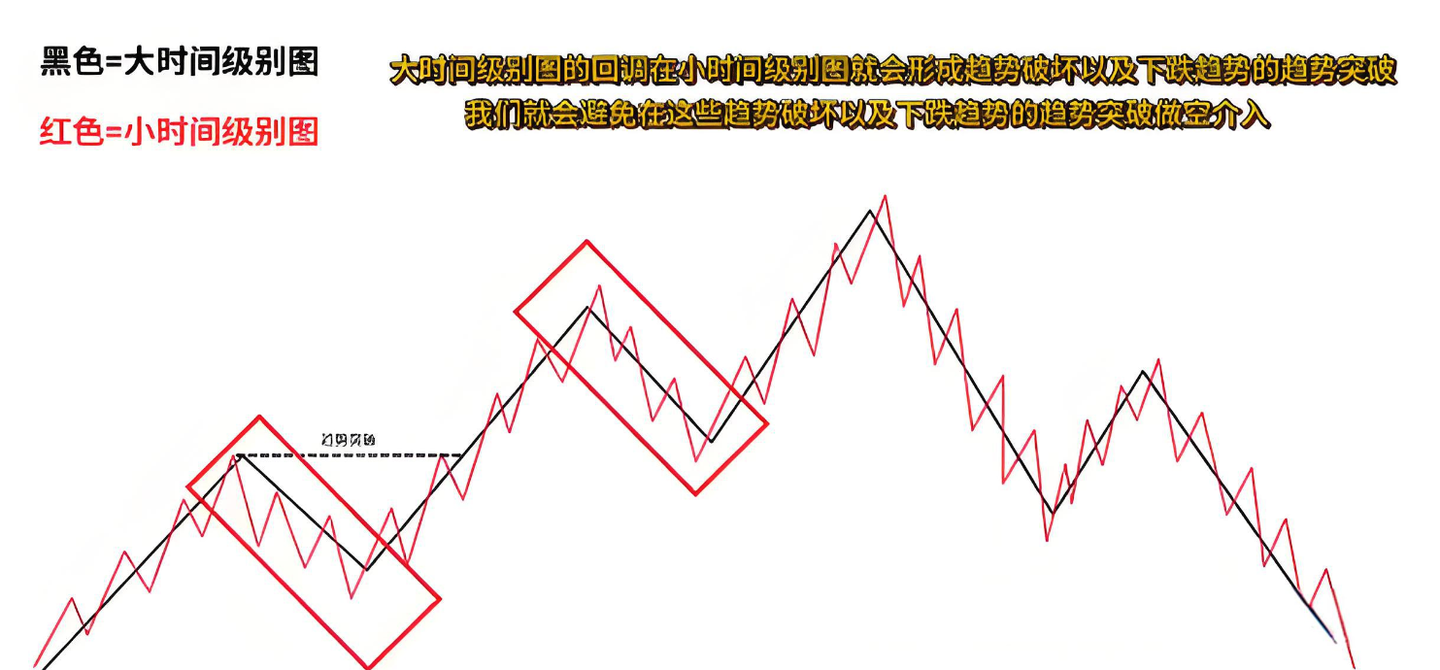

3. Multi-period perspective: internal and external trend signals

Price trends repeat across different timeframes. Using "longer timeframes to determine direction, and shorter timeframes to find opportunities" allows for precise tracking of smart money movements.

Larger timeframes (e.g., 4-hour chart): Determine the overall trend (upward/downward). For example, if the larger timeframe shows an upward trend, focus on going long.

Smaller timeframes (e.g., 15 minutes): A pullback in a larger timeframe will manifest as a "trend breakout + reversal trend breakout" in a smaller timeframe. At this point, avoid trading against the trend in the smaller timeframe and focus on opportunities that follow the trend in the larger timeframe (e.g., if the larger timeframe is rising, go long after the pullback in the smaller timeframe ends).

When a trend is broken in a larger timeframe (such as a shift from an upward to a downward trend), the smaller timeframe should also switch direction accordingly (shorting to short selling).

02 Core Methodology: Identifying High-Probability Supply and Demand Zones

The "Capital-Intensive Zone" of Smart Money

Supply and demand zones are areas where smart money (institutional investors, large funds) concentrate their entry, and they also represent strong support/resistance levels for subsequent price pullbacks. The core of high-quality supply and demand zones is identifying "strong highs and lows":

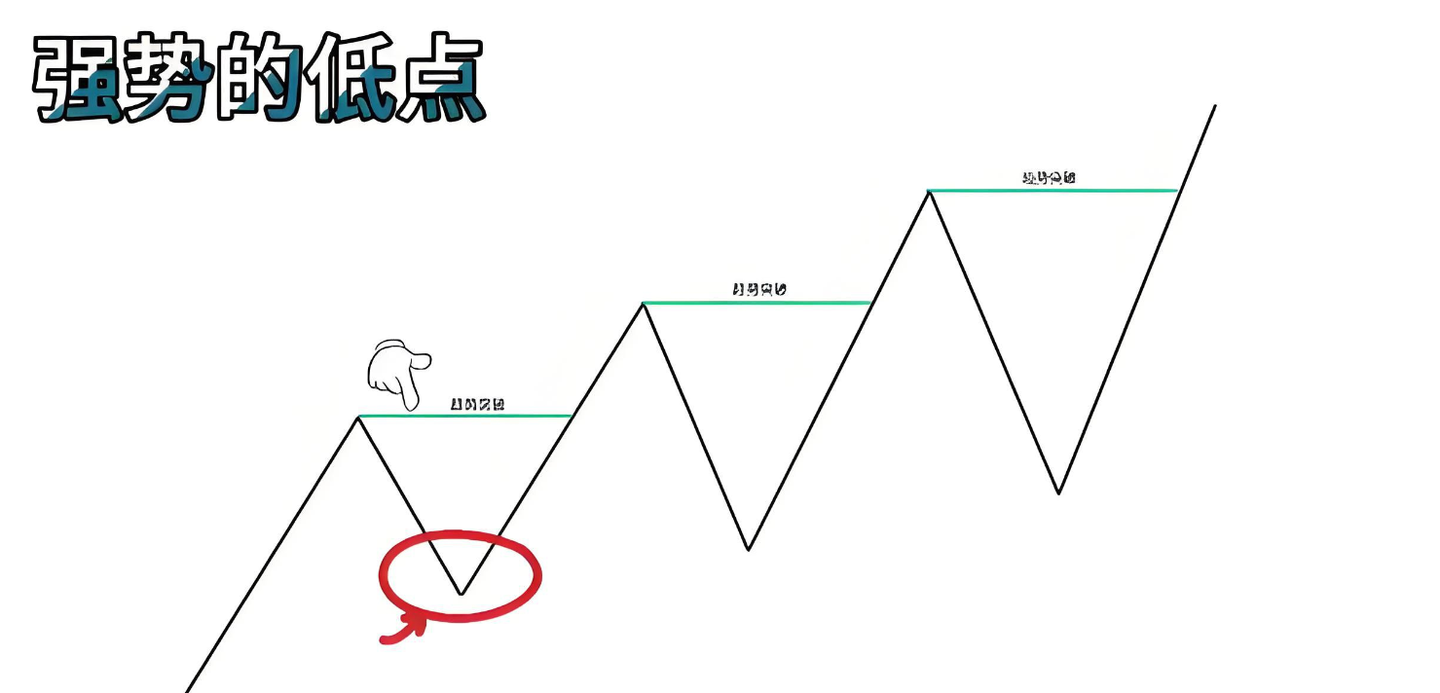

1. Demand Zone (Core Area for Long Positions): Find "Strong Lows"

The demand zone is an area where bullish funds concentrate their buying. The criterion for judgment is that this low point is the starting point that drives the price to break through the previous high point and form a "top-top-top" pattern.

Logic: This low point is the "cost zone" for smart money to enter the market. If the price retraces to this point, it will likely be driven up again by bullish funds.

Operation: Draw a demand zone above the strong low point, wait for the price to pull back to this zone, and enter a long position based on the signal.

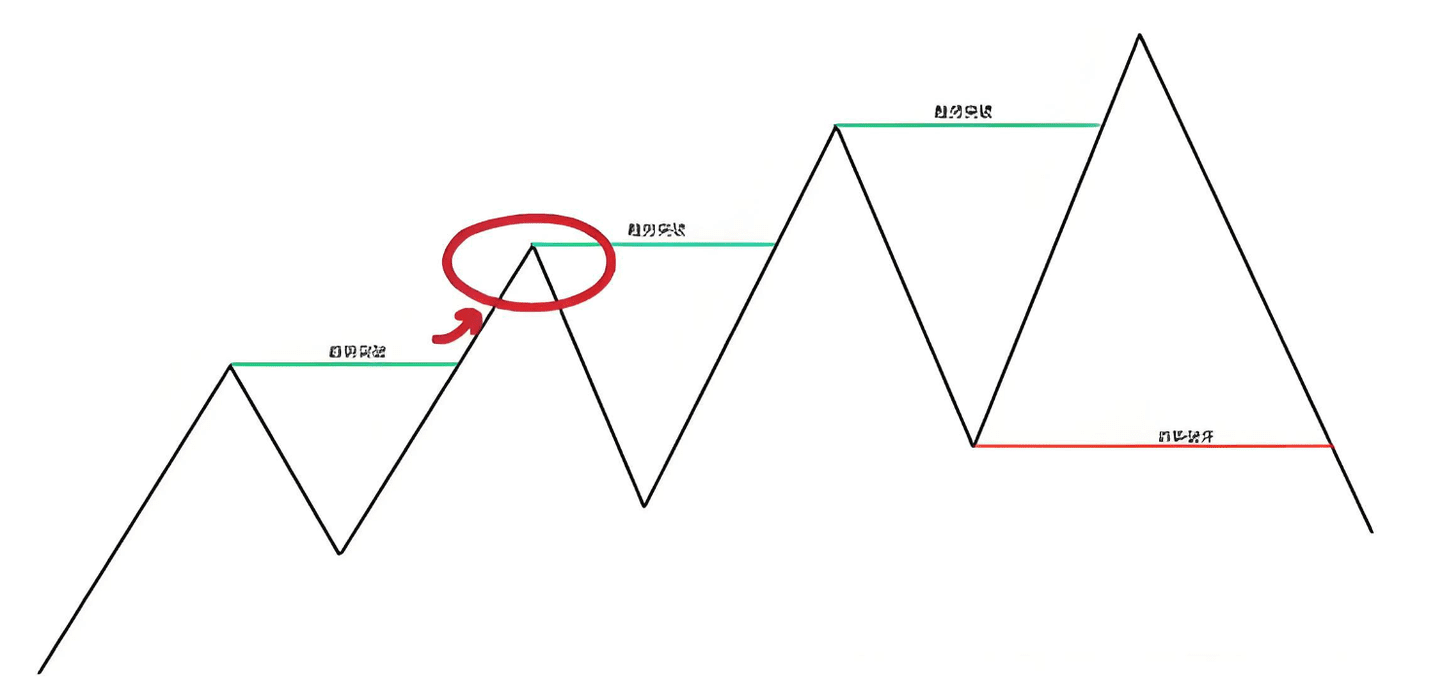

2. Supply Zone (Core Area for Short Selling): Find "Strong High Points"

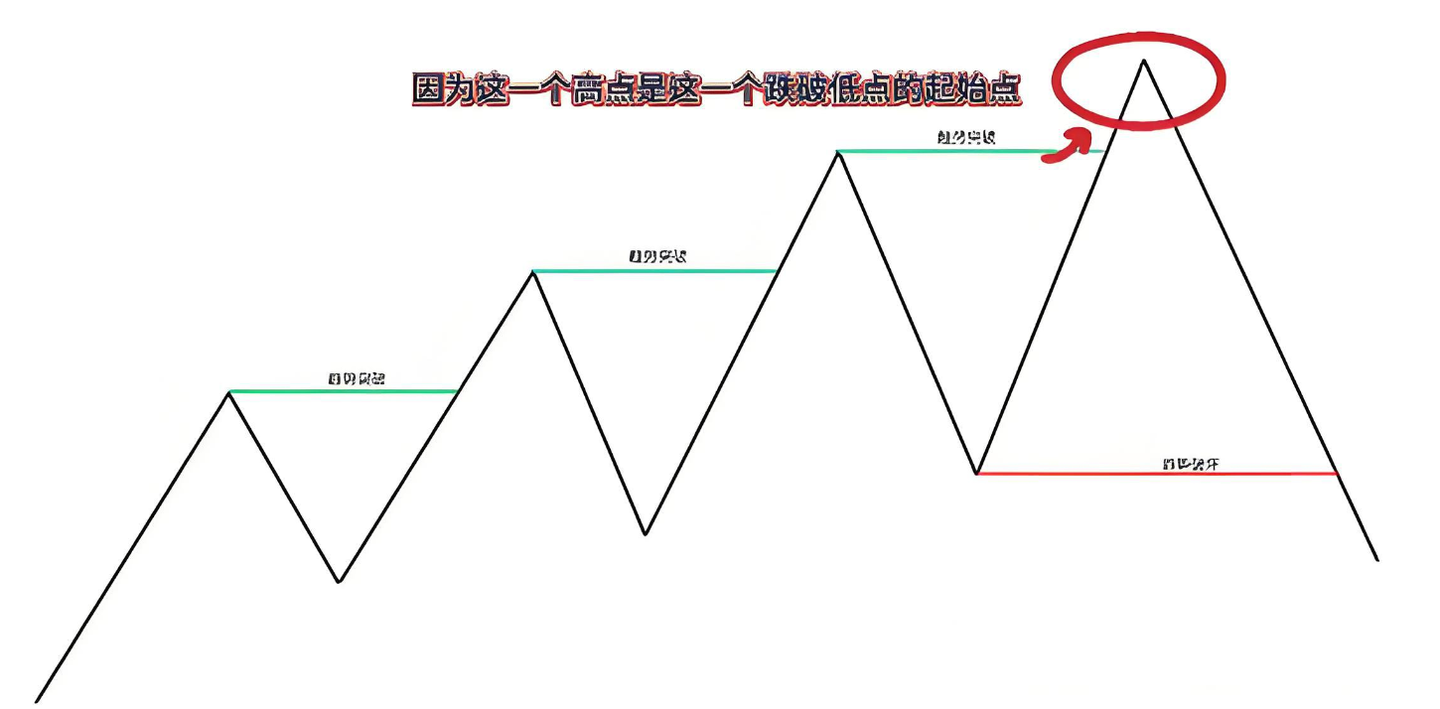

The supply zone is the area where short-selling funds concentrate their selling. The criterion for judgment is that this high point is the starting point that drives the price down below the previous low point, forming a "bottom-to-bottom" pattern.

Logic: This high point is a "resistance zone" where smart money exits. If the price rebounds to this point, it will most likely be suppressed again by short-selling funds.

Operation: Draw a supply zone below the strong high point, wait for the price to rebound to this zone, and enter a short position based on the signal.

Key pattern:

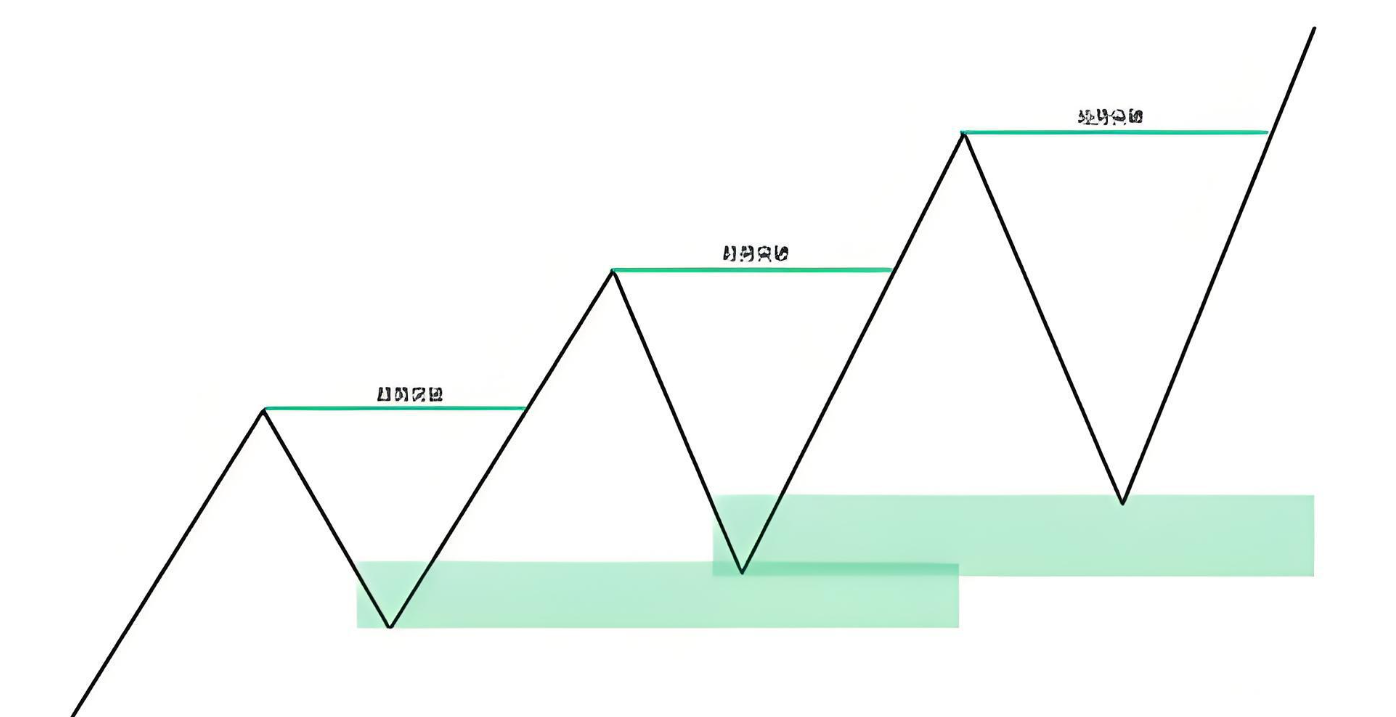

In an uptrend: prices will continuously form "strong lows + weak highs". Each new strong low can draw a new demand zone, and a pullback to the demand zone is a buying opportunity.

In a downtrend: prices will continuously form "strong highs + weak lows". Each new strong high can draw a new supply zone, and a rebound to the supply zone is a shorting opportunity.

03 Practical Application: Supply and Demand Zones + Imbalance Zones + Liquidity

Triple resonance improves win rate

A single supply and demand zone is not precise enough; it must be combined with "imbalance zones" and "liquidity" to form a triple resonance in order to lock in high-probability opportunities—this is the core essence of smart money trading.

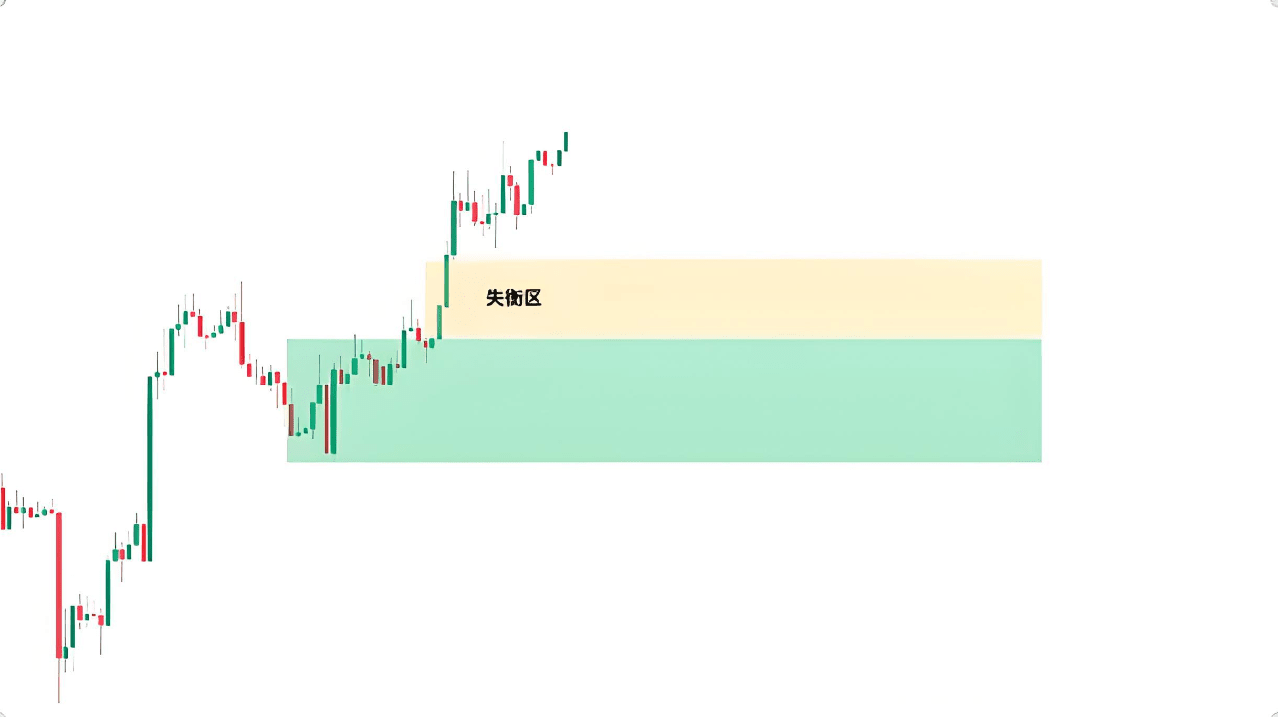

1. Imbalance Zone: The "Funding Gap" That Prices Must Fill

The imbalance zone is a "price gap/rapid movement range" caused by a severe imbalance between the buying and selling forces, with almost no trading volume.

Logic: Large institutional funds entered the market in this range, causing prices to move rapidly, and the market will tend to fill this "gap";

Function: If there is an imbalance zone above the demand zone (upward trend) or an imbalance zone below the supply zone (downward trend), the effectiveness of the supply and demand zone will be greatly enhanced. When prices pull back/rebound, the imbalance zone will be filled first, and then the momentum of the supply and demand zone will be triggered.

2. Liquidity: The "target" of smart money.

Liquidity is the area where retail investors' stop-loss orders are concentrated, typically below/above the same high and low points (short-term support/resistance levels):

Logic: Smart money will first drive prices to trigger retail investors' stop-loss orders (capturing liquidity), and after accumulating sufficient positions, it will then move in the direction of the trend;

Function: In areas near the supply and demand zone where there is liquidity, prices are likely to first reach the liquidity level before reversing and triggering the supply and demand zone – this is an important entry signal.

Real-world case study 1: Uptrend + Demand Zone + Imbalance Zone + Liquidity – Entering a Long Position

Determine the trend: The long-term cycle shows an upward trend with "higher peaks and higher troughs", which determines the direction to go long;

Find the demand zone: Locate the "strong low point" that drives the price to break through the previous high, and draw the demand zone;

Find resonance signals: There is an imbalance zone above the demand zone (must be replenished), and there are similar low points below (concentrated liquidity).

Waiting for entry signals: Price pullback to fill the imbalance zone → touches the demand zone → triggers the lower liquidity (stop-loss order) → forms a "bullish engulfing" candlestick pattern (the body of the bullish candlestick completely covers the previous bearish candlestick);

Entry and Risk Control: Go long after a large bullish candlestick closes, set the stop loss below the low point of liquidity, and take profit at the previous high point (you can take profit in batches, and set the remaining position at a higher target).

Case Study 2: Downtrend + Supply Zone + Imbalance Zone + Liquidity - Short Selling Entry

Determine the trend: The long-term cycle shows a downward trend with "higher highs and lower lows", which determines the direction for shorting;

Find the supply zone: Locate the "strong high point" that pushed prices below the previous low and draw the supply zone accordingly;

Find resonance signals: There is an imbalance zone below the supply zone (must be replenished), and there are similar high points above (concentrated liquidity).

Waiting for entry signals: Price rebounds to fill the imbalance zone → touches the supply zone → triggers the upper liquidity twice (stop-loss order) → forms a "bearish engulfing" candlestick pattern (the body of the bearish candlestick completely covers the previous bullish candlestick);

Entry and Risk Control: Short after a large bearish candlestick closes, set the stop loss above the high liquidity point, and take profit at the previous low (a passive take profit can be set to follow the downward trend).

04 Core Summary

3 Key Elements of Smart Money Trading

First determine the trend: use a breakout/breakout of a major cycle trend to confirm the direction, and do not trade against the trend;

Next, identify supply and demand: only select supply and demand zones corresponding to "strong highs and lows," and avoid weak zones without trend support;

Finally, wait for resonance: it must meet the four confirmations of "supply and demand zone + imbalance zone + liquidity + K-line pattern", and do not enter the market with a single signal.

The essence of smart money trading is "following in the footsteps of institutional funds"—supply and demand zones are the institutions' "cost zones," imbalance zones are their "inevitable paths," and liquidity is their "targets." By combining these three elements and using candlestick patterns to confirm momentum, one can accurately capture high-probability trading opportunities and avoid the "false breakouts and false support" traps often encountered by retail investors. Trading is not about guessing market trends, but about understanding the movement of funds and positioning oneself on the side of high probability.

The above is the trading experience that Yan'an shared with you today. Many times, you miss out on many money-making opportunities because of your doubts. If you don't dare to try, explore, and understand, how will you know the advantages and disadvantages? Only by taking the first step will you know what to do next. With a cup of warm tea and a word of advice, I am both a teacher and a good friend to you.

Meeting is fate, understanding is destiny. I firmly believe that those destined to meet will eventually meet, even from afar; those not destined will simply pass each other by. The road of investment is long, and temporary gains or losses are merely the tip of the iceberg. Remember, even the wisest can make a mistake, and even the most cunning can have a stroke of genius. No matter your emotions, time will not stand still for you. Pick yourself up from your troubles, stand up again, and move forward with renewed vigor.

The martial arts manual has been given to you all; whether you can become famous in the martial arts world depends on yourselves.

Be sure to save these methods and review them multiple times. If you find them useful, please share them with other cryptocurrency traders. Follow me to learn more about the crypto world. Having weathered the storm, I'm here to help those who are already struggling in the crypto market! Follow me, and let's journey together in the crypto world!