I have been trading cryptocurrencies for almost 11 years, starting with 300,000 to 87,500,000, and now achieving financial freedom. My greatest realization is: simplify complex events and repeat simple tasks! When you reach the top of the mountain, you will have an epiphany. Today, I share my insights with those climbing below, hoping the following article will help you understand the truth and essence of the cryptocurrency world!

Having said goodbye to the previous routine of working, I have taken back the time that originally belonged to me.

Leaving the work life actually means that one has detached from the group. However, the attribute of humans living in groups has been deeply imprinted in our genes since ancient times.

I once saw a piece of information that a psychologist conducted a survey on how many words people say on average each day. After the survey, it was found that ordinary men say an average of 2000 to 4000 words per day, while ordinary women say 8000 to 10000 words daily. After leaving the working life, I found that the amount I could say decreased because there was no one to converse with. However, instinct is instinct; the more it is suppressed, the more it will protest in other forms!

I feel that countless originally weak emotions will be infinitely magnified! Loneliness, repression, despair, ecstasy, extreme confidence, extreme helplessness....

I don't want to live as an isolated island because of trading. I always believe that trading is just a means, not an end. The purpose of life must be about experiencing! Everyone's life and death are the same, so whoever has a better experience is the winner. Professional trading can give me the opportunity for financial freedom, and financial freedom is merely for that experience!

There are countless people who have gone through this path of trading, but many have failed! I once asked myself, what is my greatest advantage in this market?

This low-threshold trading market, saying that thousands of troops cross a narrow bridge is not an exaggeration, and why do I have a chance? I answer myself: time!

The most important point in cryptocurrency trading is to control your mindset, followed by technical analysis, fundamentals, and news. If your mindset collapses, you are basically doomed to lose money, and your life and spirit will be greatly affected. Therefore, you must stabilize your mindset; otherwise, you will be tricked by the market.

So how do we control our mindset?

The following seven insights can tell you the answer; learning is understanding!

1. Understand the essence of cryptocurrency trading: distinguish between primary and secondary; mainly, cryptocurrency trading is just a sideline for you, treating it as a new way of wealth management, a capability of earning extra money. Of course, if you treat it as your main job (professional trader), then I won't say anything.

2. There is no need to watch the market every day: There is no need to watch the market daily. Watching the market is the duty of those who are in the circle. Most people only need to slowly invest idle money, wait for it to grow in the pool, and then take it out; cryptocurrency trading is that simple, not as exhausting as you think.

3. View price fluctuations calmly: During the investment process, we need to maintain a calm mindset and not calculate daily how much we lost or earned.

Because no matter what commodity it is, the price will always fluctuate within a cycle. During crazy times, it will drop, and during a recession, it will recover. These fluctuations are very normal. If you focus too much on short-term gains and losses, your mindset will follow price fluctuations, and in the end, you will definitely be the loser.

4. Control your panic and greed: Buffett once said, 'I am greedy when others are fearful, and I am fearful when others are greedy.' Dance to the rhythm of the market; you can still walk lightly on the blade. Rhythm is always the rhythm of the market; a market participant without a sense of rhythm will always face torment. Let go of your greed and fear and listen to the market's voice. As long as you can follow the rhythm, no one can stop you.

5. Remember not to be greedy: The speed at which wealth is created in the cryptocurrency world is astonishing, but you must believe that only a few people will get rich. Our investment goal is certainly to make money, but be careful not to be greedy. You may lament why you didn’t hold onto small ants back then; otherwise, you would be financially free now. If you have such thoughts, then you have already given rise to greed.

In fact, you should know that those who could buy small ants for 1 dollar to get to where they are now are either crazy or foolish, but most of us are normal people, including many trading masters. They are also normal people; they almost certainly could not get there for just 1 dollar.

Because this probability is very small, so small that it is unpredictable, those who have bought small ants should not regret it, and those who haven't bought should not envy. Focus on the present, this is the only opportunity you can grasp.

6. Control the emotion of chasing after rising prices: Chasing is a big taboo in investing. If you miss an opportunity, don't chase it. When your soaring emotions start to get out of control, remember past experiences of losing money and being stuck. Distract yourself from the thought of chasing after rising prices. After calming down, you'll see that the price often drops back down.

7. Learn more knowledge: Try to understand the essence of digital currency and blockchain. During your spare time, buy some books or search for articles online to study. Transform speculation into an investment; your mindset will undergo a complete transformation. When you see the future situation clearly and set reasonable expected returns, the temporary fluctuations in price will no longer affect your mood.

So how can we do well in cryptocurrency trading? Once a person enters the financial market, it is hard to turn back. If you are currently losing and still confused, and plan to treat cryptocurrency trading as a second profession in the future, you must know the 'MACD indicator strategy.' Understanding it can save you a lot of detours; these are personal experiences and feelings, and I suggest you save it and ponder over it repeatedly!

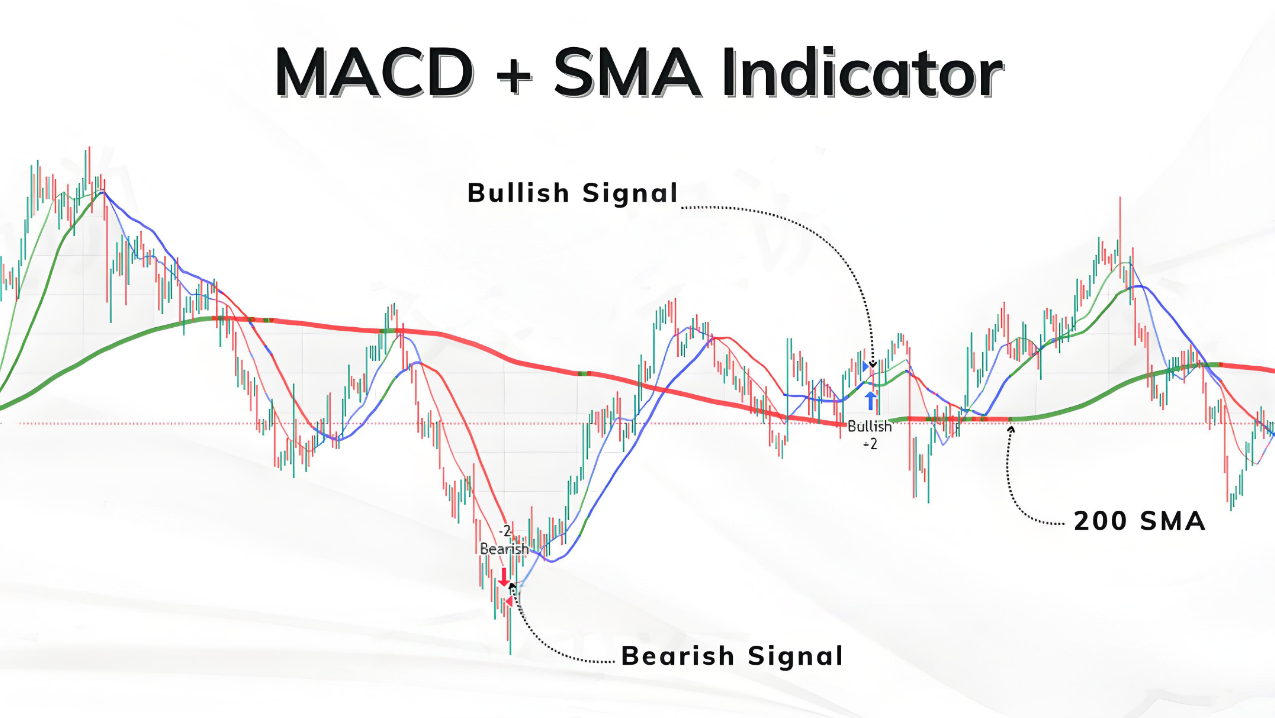

Combining MACD (Moving Average Convergence Divergence Indicator) with SMA (200-day Simple Moving Average) appears to be a very basic and simple strategy design at first glance. However, it can provide valuable market information to traders, helping them make more informed judgments while trading.

Before we delve deeper into this strategy, let’s first understand how MACD and SMA work.

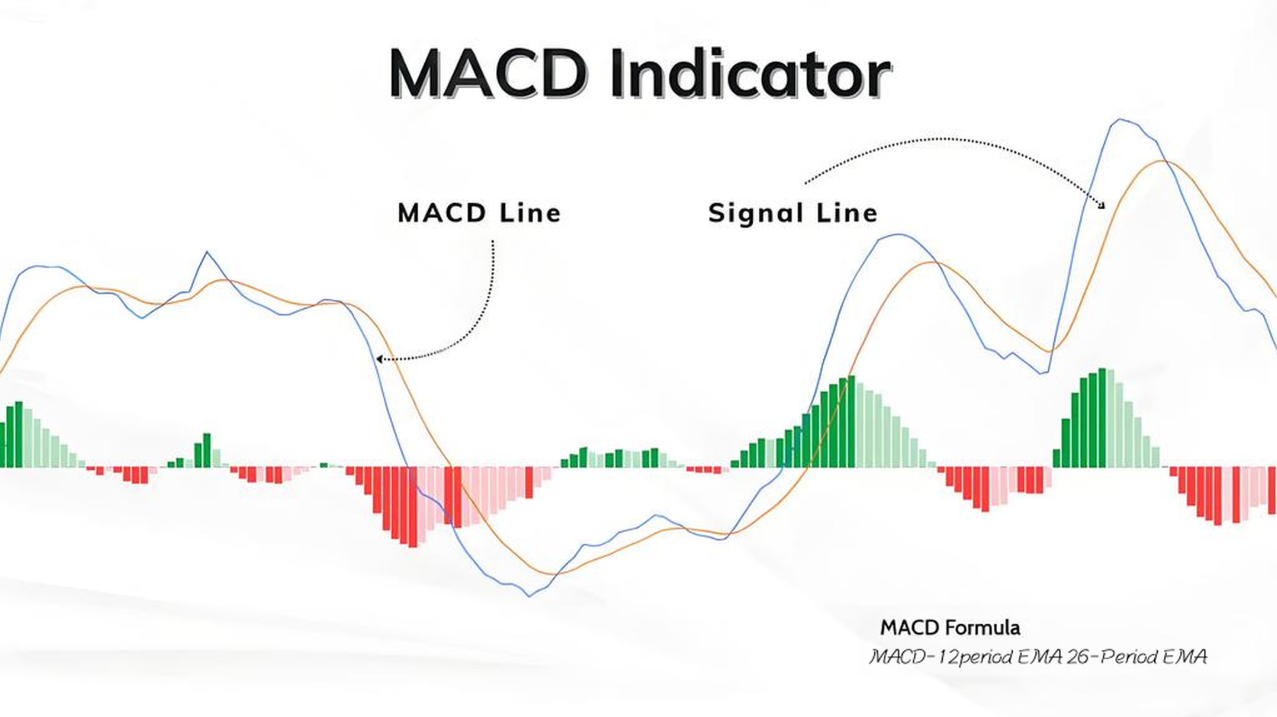

What is MACD?

MACD (Moving Average Convergence Divergence Indicator) is a technical indicator used to identify price trends, trend momentum, direction, and potential reversals. It is based on the relationship between two exponential moving averages (EMA). The calculation of MACD is very simple: subtract the 26-period EMA from the 12-period EMA.

MACD = 12-period EMA – 26-period EMA

Every trader has their own way of interpreting MACD, but the most common methods are the golden cross and death cross, divergence, and the rapid rise or fall of the MACD line.

So how do we trade the MACD line?

MACD is mostly displayed with a histogram, which reflects the distance between the MACD line and its signal line.

✍ When the MACD line falls below the signal line → indicates a bearish signal

✍ When the MACD line rises above the signal line → indicates a bullish signal

However, one disadvantage of MACD is that it is prone to many false signals.

Although there are many ways to trade MACD, the above brief explanation mainly serves as a foundation for understanding the MACD + SMA strategy.

Next, let's continue to understand SMA.

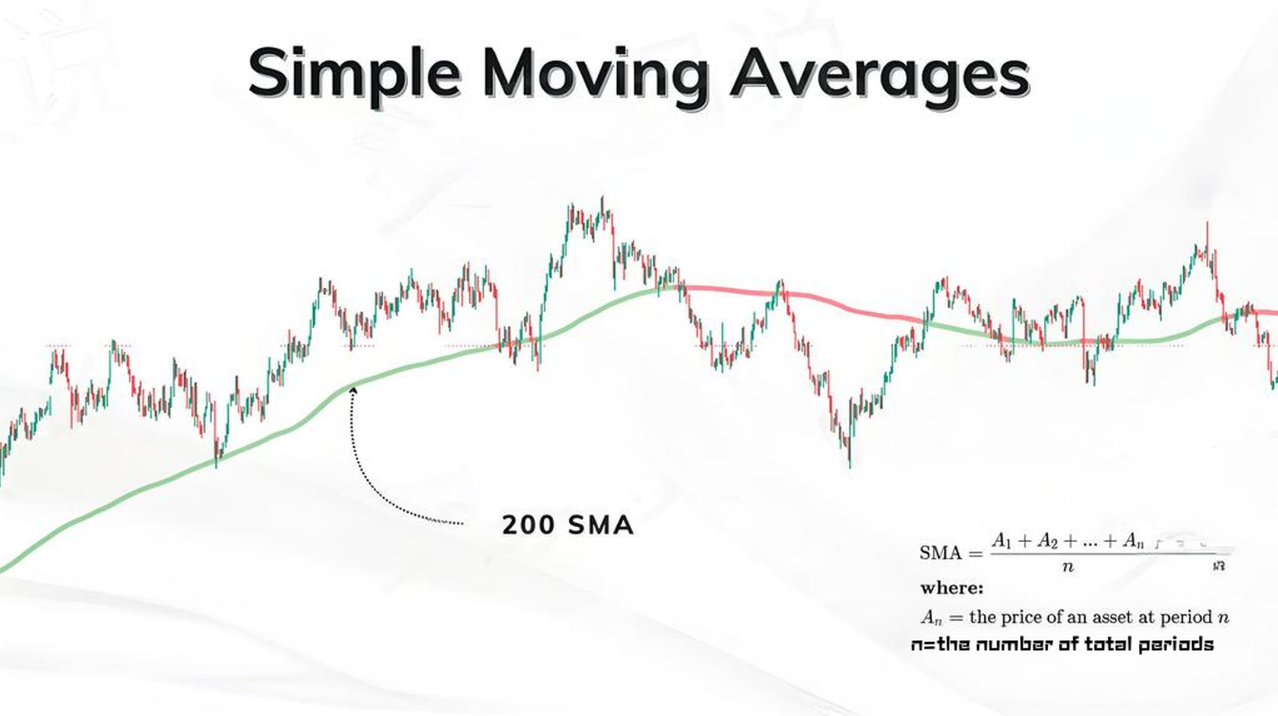

What is SMA?

SMA (Simple Moving Average) is the easiest type of moving average to construct. Simply put, it represents the average price over a specific time period, and the term 'moving' means that this average will change continuously as the chart updates with each K-line, hence it is called a simple moving average.

Its calculation method is also very straightforward: add the prices of the last few periods and then divide by the selected number of periods.

SMA = (A1 + A2 + A3 + …) / n

A = the price of the asset within a certain period

n = total number of periods

The most common use of SMA is to identify trend direction and indicate potential changes in trends.

Commonly used SMAs include:

✍ 200-day SMA (the average of the past 200 K-lines): measures long-term trends

✍ 50-day SMA (the average of the past 50 K-lines): measures short-term trends

Now you have a clearer understanding of how MACD and SMA work, we can officially enter the strategy part.

MACD + SMA 200 strategy analysis

Combining the classical MACD (Moving Average Convergence Divergence Indicator) with the 200-period SMA (Simple Moving Average) is a trading strategy that is both simple to use and highly effective.

It can help identify the main market trend while filtering out counter-trend trading signals. By using the 200 SMA as a long-term trend filter and then using the short-term momentum of MACD for confirmation, traders can often build trading combinations with higher win rates.

Core principle of the strategy:

❍ When the MACD histogram and MACD momentum are both above the zero line, and the MACD fast line is above the slow line, we go long. This allows us to trade with the trend, rather than against it.

❍ 200 SMA serves as an additional trend filter - the price must be above the 200 SMA to confirm going long.

❍ In other words, the trend (200 SMA) and momentum (MACD) must be consistent for the strategy to be effective. The logic for shorting is the opposite of going long.

In the worst-case scenario, if everything does not go as expected, this strategy also has a risk filter built in: the maximum drawdown limit is 50%. Once the account equity reaches this bottom line, the strategy will automatically stop trading. This can protect the account during fluctuations and trendless markets, avoiding huge losses.

Let's break down this logical strategy in detail:

First, let's explain the underlying logic. The basic condition in this strategy is to look for 'continuous divergence,' with an emphasis on 'continuity.'

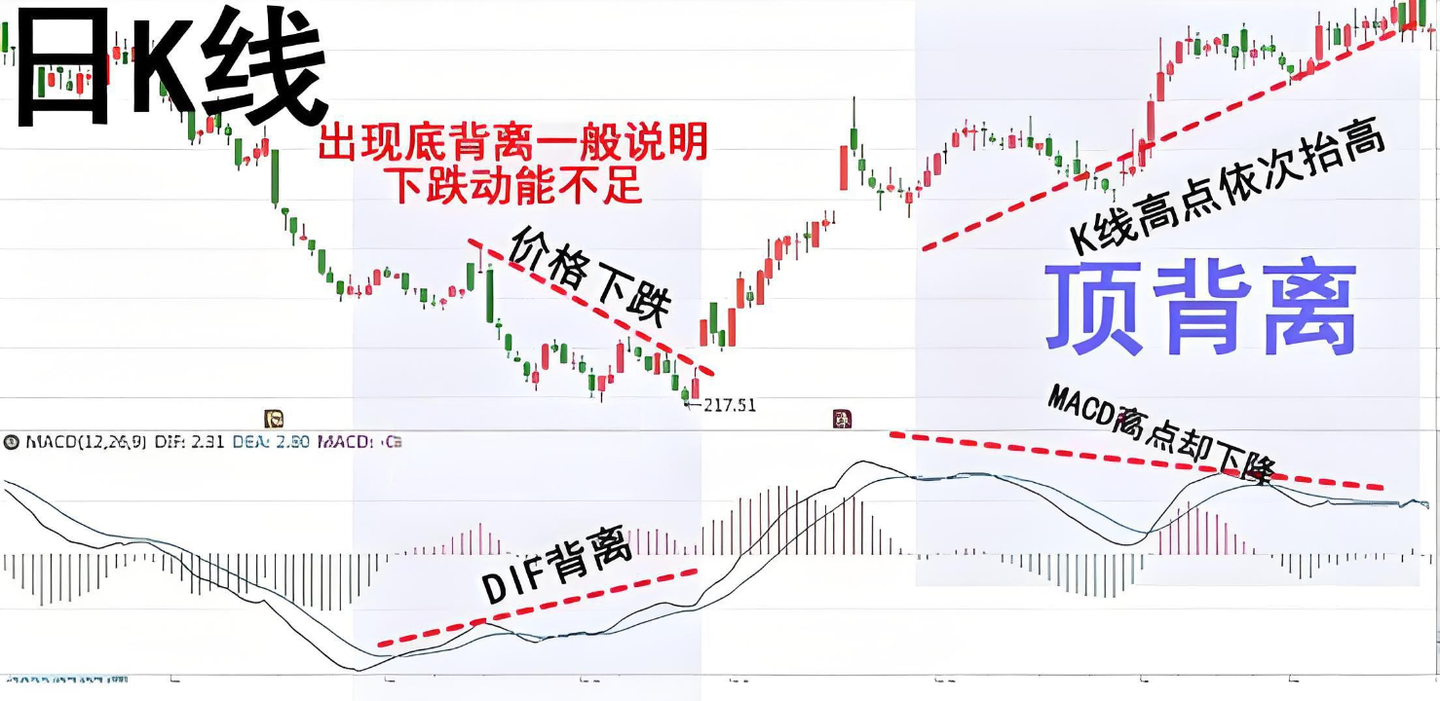

'Divergence' is a pattern that friends who often trade know well; it is composed of MACD and K-line prices, specifically characterized by:

The peaks of MACD are gradually lowering (or rising), while the stock price is gradually rising (or falling).

In other words: the direction of the MACD trend is inconsistent with the trend direction of the stock price, which is 'divergence.'

According to the price trend when the 'divergence' pattern appears, it is divided into: 'bottom divergence' and 'top divergence.'

Knowing about 'divergence,' there is another element in this strategy, which is 'continuity,' and this element is key.

The so-called 'continuity' refers to: after the MACD is above the zero axis and shows a peak pattern, it does not fall below the zero axis again before rising again to form another peak (or drops below the zero axis and quickly crosses back up to show a peak), forming a continuous peak pattern.

In this MACD strategy, both conditions must be met to achieve the opening standard.

The reason this set of indicators is useful is that the reason for the appearance of the divergence pattern in the market is that the market experiences 'stagnation (or stagnation in decline)', meaning 'not moving up or down.'

In such cases, demigods also require a more extreme form: 'MACD Continuity!' They believe that only when the MACD form appears continuously can the strength of bulls or bears be reflected as reaching a peak (or bottom).

This is the trading experience that Yan An shared with everyone today. Many times, you lose many opportunities to make money because of your doubts. If you don't dare to try boldly, to approach, to understand, how will you know the pros and cons? You only know how to take the next step after taking the first step. A warm cup of tea and a word of advice; I am both a teacher and your talkative friend.

Meeting is fate, knowing each other is parting. I firmly believe that where there is fate, we will meet, and where there is no fate, we will pass by. The road of investment is very long; a moment's gain or loss is just the tip of the iceberg. Remember, even the wisest can make mistakes, and even the foolish can gain from many considerations. No matter how emotions fluctuate, time will not stand still because of you. Pick up the troubles in your heart, stand up again, and prepare to move forward.

The martial arts secrets have been shared with everyone; whether you can become famous in the martial arts world depends on yourself.

These methods must be saved and viewed repeatedly. If you find them useful, please share them with more people in the cryptocurrency trading community. Follow me for more insights into the crypto world. Having weathered the rain, I am willing to hold an umbrella for the leeks! Follow me, and let’s walk hand in hand on the road of cryptocurrency!