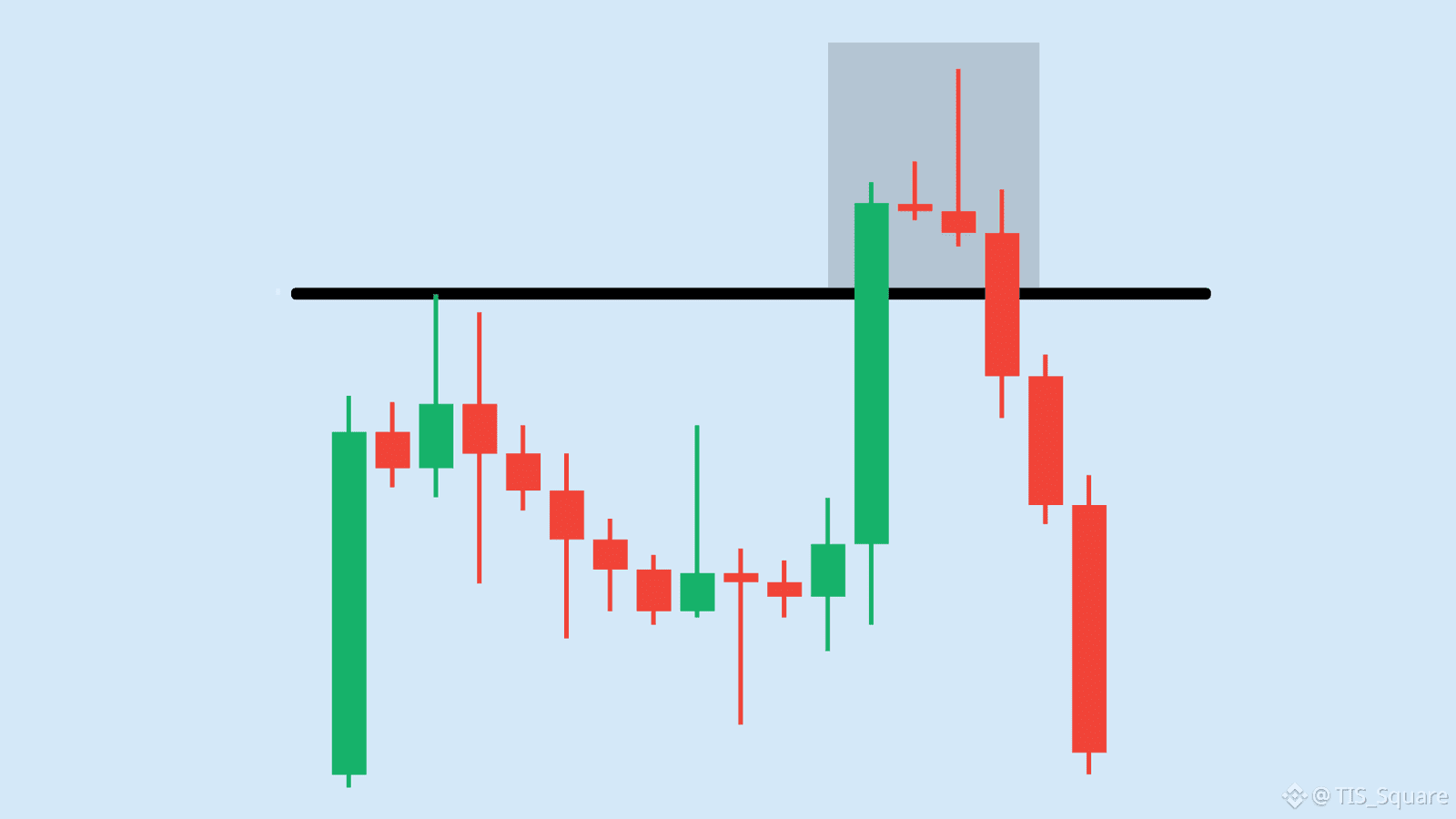

When you see a long candle wick sweep across a resistance level and then quickly retract, thats not a sign of panic. its a sign that smart money is reversing the trend.

🔹 Price pierces old highs/lows to hunt Stoplosses but fails to close outside and reverses back inside the old range

🔸 Never catch a falling knife but wait for a Market Structure Shift or strong reversal candle to confirm the opposing side has taken control

🔹 The safest entry is when price returns to Retest the swept zone or fills the Fair Value Gap instead of chasing the wick tip

🔸 Place Stoploss right below the sweep wick and Take Profit at the opposite liquidity zone to optimize gain

Would you have the courage to use this strategy yourself?