In the lead-up to the highly anticipated Federal Reserve interest rate decision, Bitcoin prices are showing a typical 'pre-event driven' fluctuation pattern. According to the latest data, Bitcoin is currently priced around $92,400, having briefly broken above $94,000 during the day but then retracing, maintaining an overall upward trend in the past 24 hours. The market is holding its breath for the Federal Reserve policy statement, which will be announced tomorrow (December 11) at midnight, serving as a key catalyst to break the current stalemate and determine the medium-term direction.

1. Analysis of Macroeconomic News

The current market is in a complex macro environment, where good news and bad news are pulling against each other, causing prices to hesitate at high levels.

1. Core Bullish Factors

· Rising Expectations for Fed Rate Cuts: The market has almost fully priced in a 25 basis point rate cut at this meeting, and expectations for monetary policy easing have historically been a key foundation supporting the valuation of risk assets (including cryptocurrencies). Additionally, the end of the balance sheet reduction on December 1 will be a major factor boosting the market!

· Short-term Price Resilience: Despite facing selling pressure, Bitcoin's price has stubbornly held above the key psychological level of $90,000, without showing signs of panic selling, indicating that there is some buying support in the market.

2. Major Bearish and Risk Factors

· The Hawkish Risk of 'Good News Fully Priced In': The core of this Federal Reserve decision is no longer 'whether to cut rates', but rather the guidance on the policy path afterward. If the Fed releases a hawkish tone (such as emphasizing that the fight against inflation is not over, suggesting a slowdown in rate cuts next year) while cutting rates, the market may interpret this as 'good news fully priced in', leading to a decrease in risk asset prices.

· Global Liquidity Tightening Concerns: The Bank of Japan has released strong signals for interest rate hikes, and the market's expectations for a rate hike in December have risen to 80%. As a significant source of low-cost funds globally, a shift in Japan's monetary policy may trigger the unwinding of global arbitrage trades and liquidity tightening, putting pressure on all high-risk assets. (Recent focus)

· Institutional Funds Short-term Withdrawal: Data shows that Bitcoin spot ETFs experienced a net outflow last week of approximately $10.5 billion (1,160 BTC), withdrawing funds from the market. This has weakened the most direct buying power driving prices up and is one of the main reasons for the recent stagnation below resistance levels.

· Annual Profit-taking Pressure: Bitcoin significantly corrected after reaching a historical high in October, and it may record its first annual decline since 2022 in 2025. As the year-end approaches, it is not ruled out that some investors will choose to exit and lock in profits and losses, exacerbating market volatility.

Surely everyone has felt that whether going long or short has been incredibly difficult lately, and this may be due to macro news affecting market sentiment and volatility! So recently, regardless of long or short positions, please do not be too big!

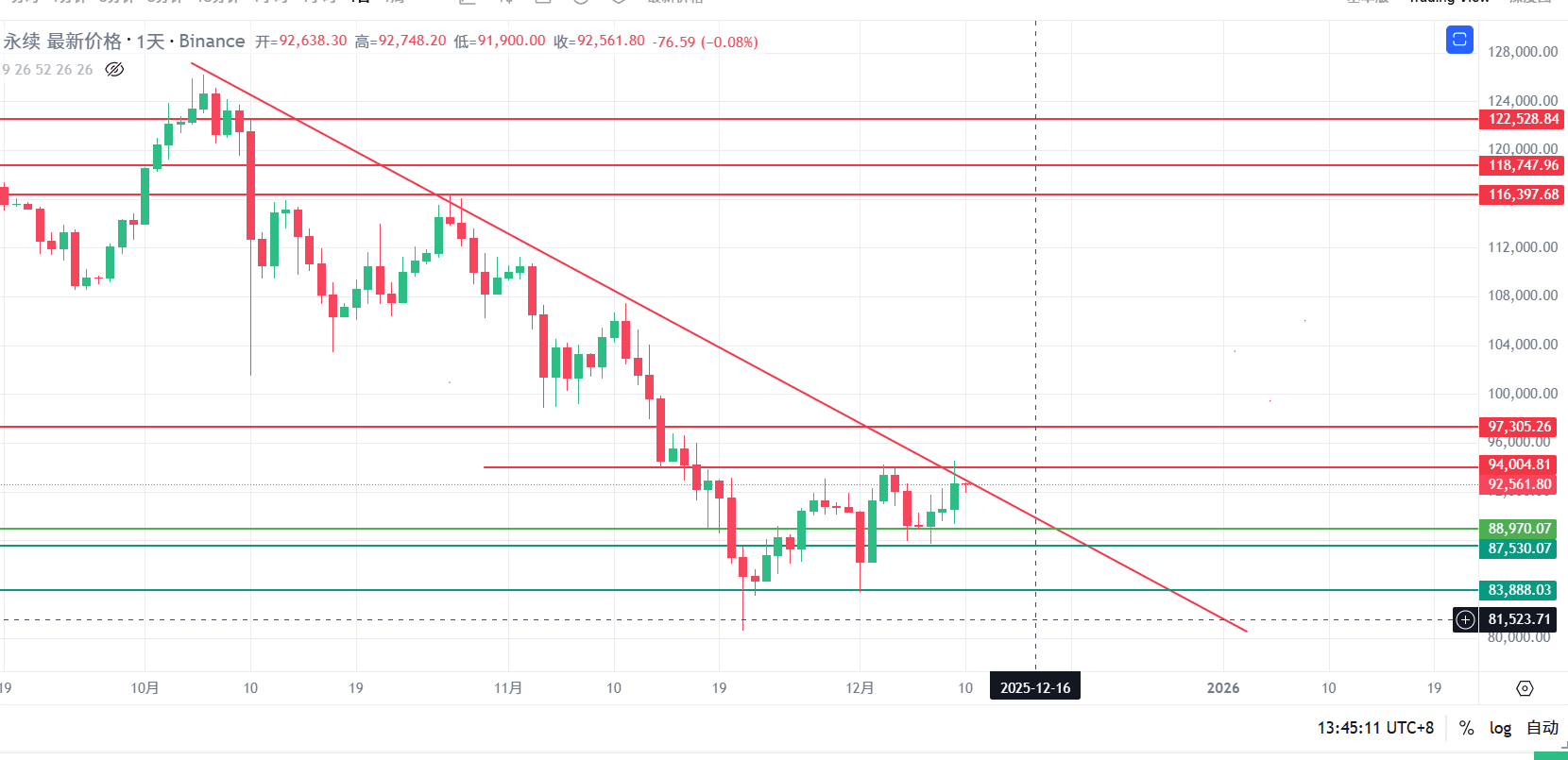

2. Technical Market Analysis: Key Price Levels Compressing, Awaiting Directional Breakthrough

From the technical chart, Bitcoin has entered an extremely compressed oscillation range, with volatility significantly reduced, indicating an imminent major directional choice.

• Key Resistance Range: $94000-$96000-$98000

This is the first 'wall' for the bulls. The price has tested this area multiple times without being able to effectively hold, especially $94,000 is regarded as the dividing line determining short-term strength. If it can break through strongly and hold above $94,000, the upward space will be reopened. (Note that 94000 has already been pushed up 3 times and has been pushed down, there is a risk of direct breakthrough)

• Core Support Range: $89000-$87500

There are multiple layers of support below. First, $87500 is an important support area recently. Second, the range between $88,000 and $89,000 is generally considered the 'lifeline' for maintaining the current upward trend structure. Once breached, the depth of adjustment will increase.

Currently, the short-term support reversal line is near 91900, and the support near 91100 is mainly referenced around 89000. A valid breakdown will maintain the bearish trend!

3. Trading Strategies and Entry/Exit Point References

Before significant macro events unfold, market sentiment will mainly be cautious, with strategies focused on 'caution' and 'flexibility'.

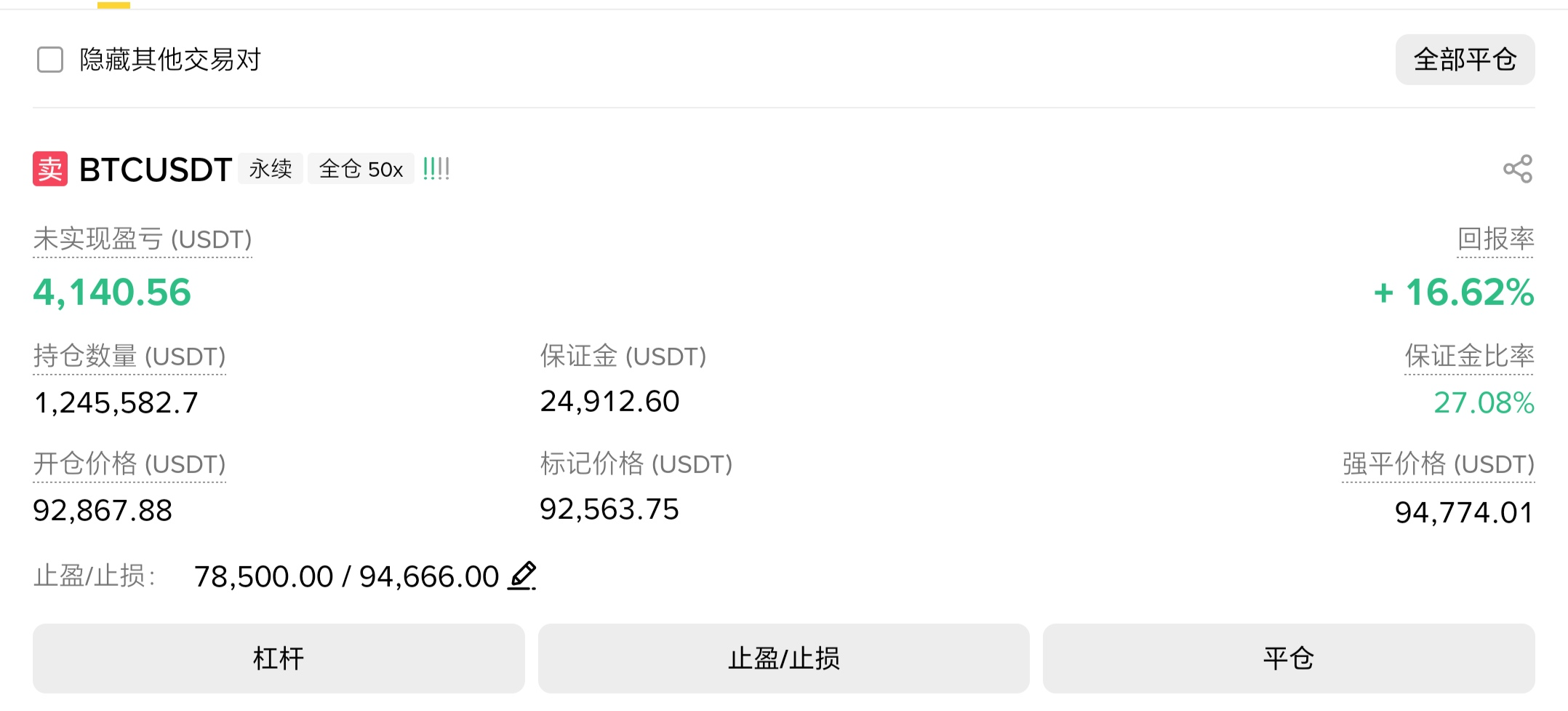

10% Position Arbitrage Strategy: (Long-term Short Position)

Wait for the price to reach the previous resistance level near 96000 and 98000 to set up long-term short positions, focusing on the support near 91900 and 91100, mainly referenced around 89000, with an ultimate target around 78500 (specific take-profit exit points will be updated in real-time according to the market).

Friends who added short positions near 94000 yesterday should promptly reduce their positions by 80%, ensure stop-loss protection before making further bets, as tonight is destined to be a sleepless night! Everyone must control their positions and reduce leverage!

News-driven Operation Suggestions: Adaptive Strategy (Follow-up Orders)

1. Aggressive Trading Strategy (Event Arbitrage)

· Buying Opportunity: If the price confirms a solid position above $94,000 after the Federal Reserve's decision, it can be seen as a short-term strong signal. Consider light long positions, targeting $96,000 or even higher. The stop loss can be set below $93,000. Reduce positions by 80% after hitting 98000 and take protective losses to continue betting!

· Short Selling Opportunity: If the price rapidly breaks below the key support of $89,000 after the decision, or if the Fed's statement is significantly hawkish leading to a market plunge, consider going short with the trend. The primary target below is $87,400, with further targets looking towards the $84,000-$85,000 range.

2. Conservative Trading Strategy (Key Level Defense and Counterattack)

· Buying Opportunity: It is not recommended to enter at the current mid-price level. The ideal long position is to wait for the price to pull back and show a clear stabilization rebound signal in the support range of $87,500-$89,000 (such as a long lower shadow on the hourly chart, bullish engulfing pattern, etc.). The risk-reward ratio for entry here is relatively better, with a stop loss set below $87,000.

· Cautious Approach: Before the Federal Reserve's decision is announced, the safest strategy is to remain on the sidelines, holding capital and waiting for the market to choose a direction. Avoid frequent short-term trading in the middle of price compression zones, as the risk-reward ratio is poor at this time.

• Short-term (next 24-48 hours): The market will be completely driven by the Federal Reserve's interest rate decision and Chairman Powell's press conference. Any 'clue' regarding inflation, economic outlook, and future interest rate paths may be magnified by the market, leading to violent fluctuations. Please manage your positions well to guard against extreme market conditions of 'up and down spikes'.

• Medium-term (until the end of the year): The market is still in the stage of digesting the significant volatility following the historical high in October. The upward direction should continue to monitor whether ETF funds can turn back into net inflows; the downward direction should be cautious of key support being lost, which may trigger deeper adjustments, targeting $82,000 or even $78,000.

The above analysis is based on publicly available market information, solely represents personal views, and is for market research reference only, not constituting any specific investment advice.

Written by: ErB Trader