Swissblock: the crypto market received a soft tone from Powell, but is now beginning to reassess Hasset, a likely next head of the Fed. And this changes the "balance of power" for #BTC.

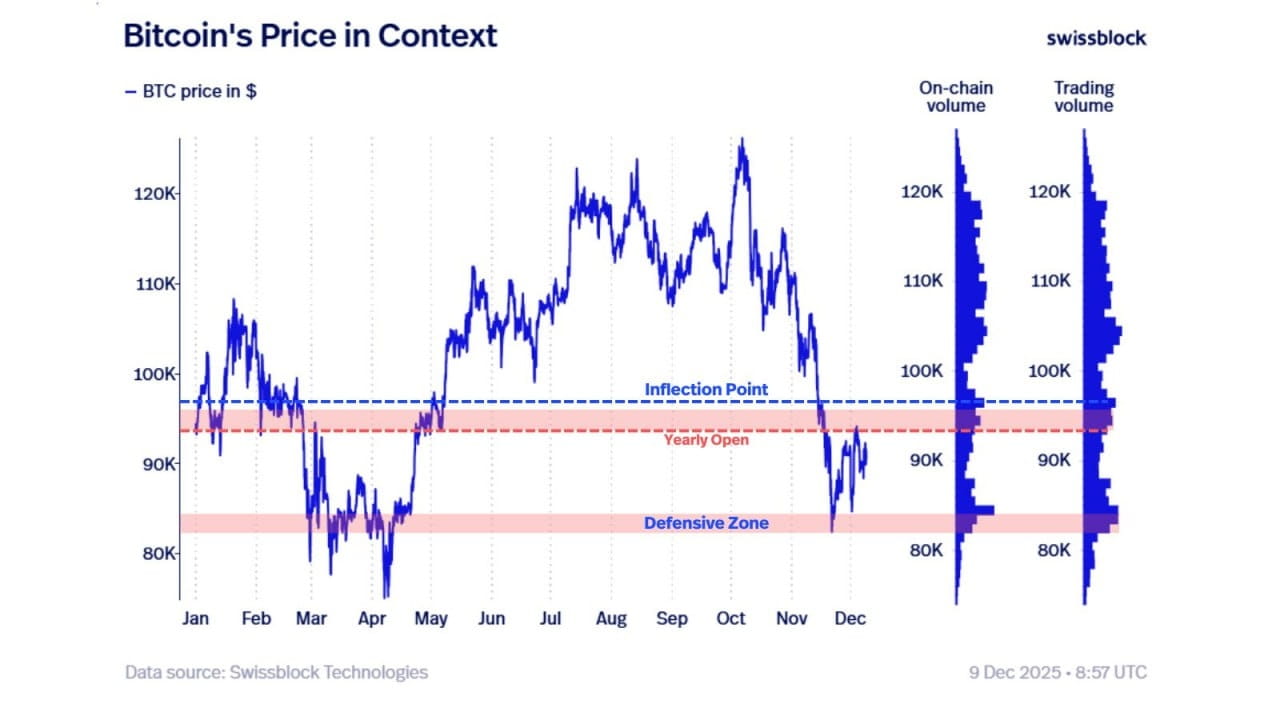

The current structure, according to analysts at #Swissblock, shows two key levels:

1. Level of Break (Inflection Point) - around $95,000. This is the zone where:

- key trading volume for the year,

- boundary between bearish and neutral structures,

- technical mark, overcoming which opens movement to higher ranges.

Swissblock notes: if BTC consolidates above $95,000, this will signal a regime change and a transition to a phase of more sustainable recovery.

2. Yearly Open level - around $92,000-$93,000. BTC is trading near the year's opening - this is a classic zone of uncertainty, where strong movements often occur after breaking through the range.

3. Defensive Zone - $80,000-$85,000. This is a support area where volumes are concentrated and key reversals have occurred. As long as BTC remains above it, the structure remains bullish in the medium term.

Powell + Hasset - this is a macro factor for the chart. Powell gave the market a "soft" signal - readiness for a more comfortable policy. But the market looks ahead: Hasset, the likely next head of the Fed, may be even more inclined to lower rates for economic growth. This increases the chances of a shift towards risk assets.

For BTC, this potentially (!) means:

- increase in the probability of breaking through $95,000,

- return of liquidity,

- strengthening of capital inflow from stablecoins and bonds.

Meanwhile, BTC stands at the boundary of the most important structural levels. And as long as BTC holds above the Defensive Zone ($80,000-$85,000), analysts believe the strategic picture remains bullish.