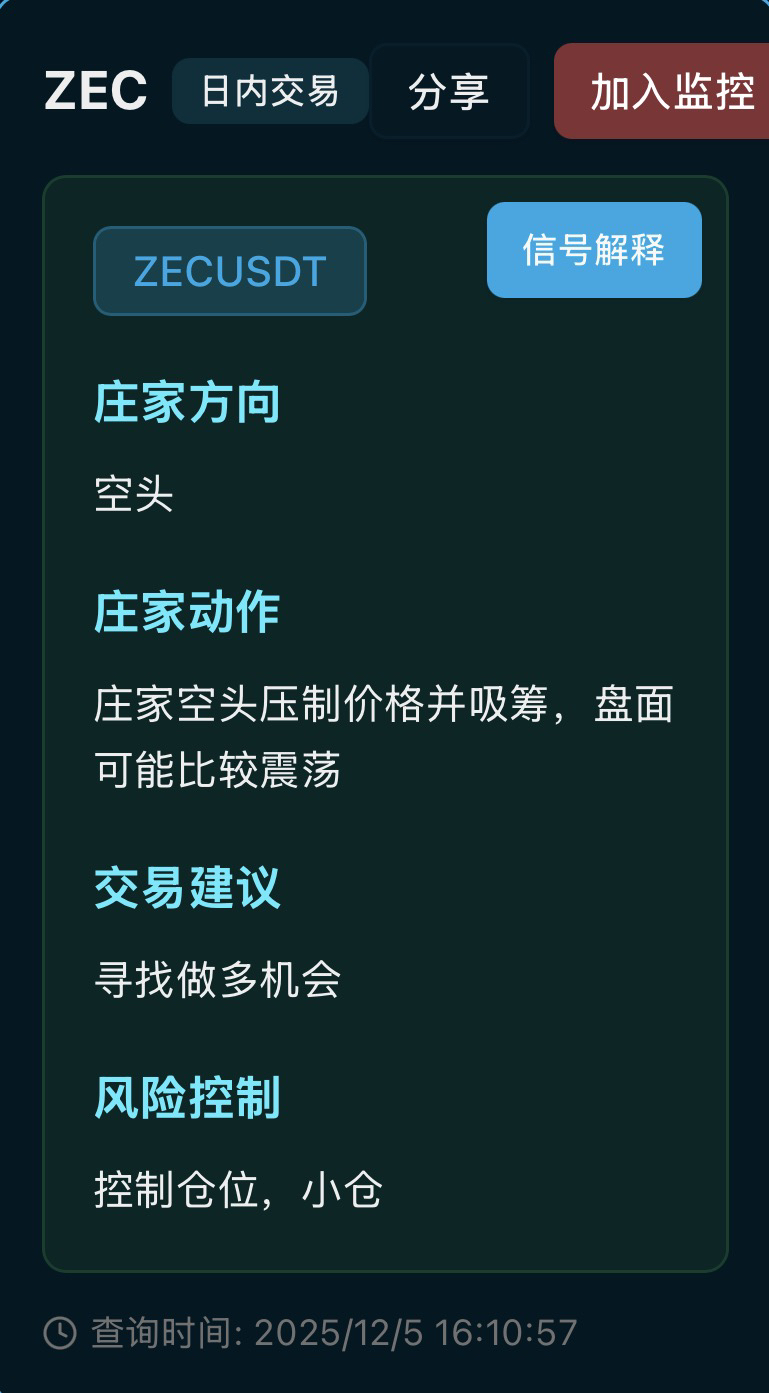

Congratulations to everyone for surviving to the day when the dealer's performance desire is strongest, today he is cosplaying as the 'king of the sea who wants to be both a ruler and a servant.'

The current main direction of the dealer is still defined as bearish, but from the structure of the market, it is not a one-sided sell-off. Instead, it is suppressing prices from above while absorbing orders from below, belonging to a 'pressure above, absorption below' oscillation reshuffle rhythm.

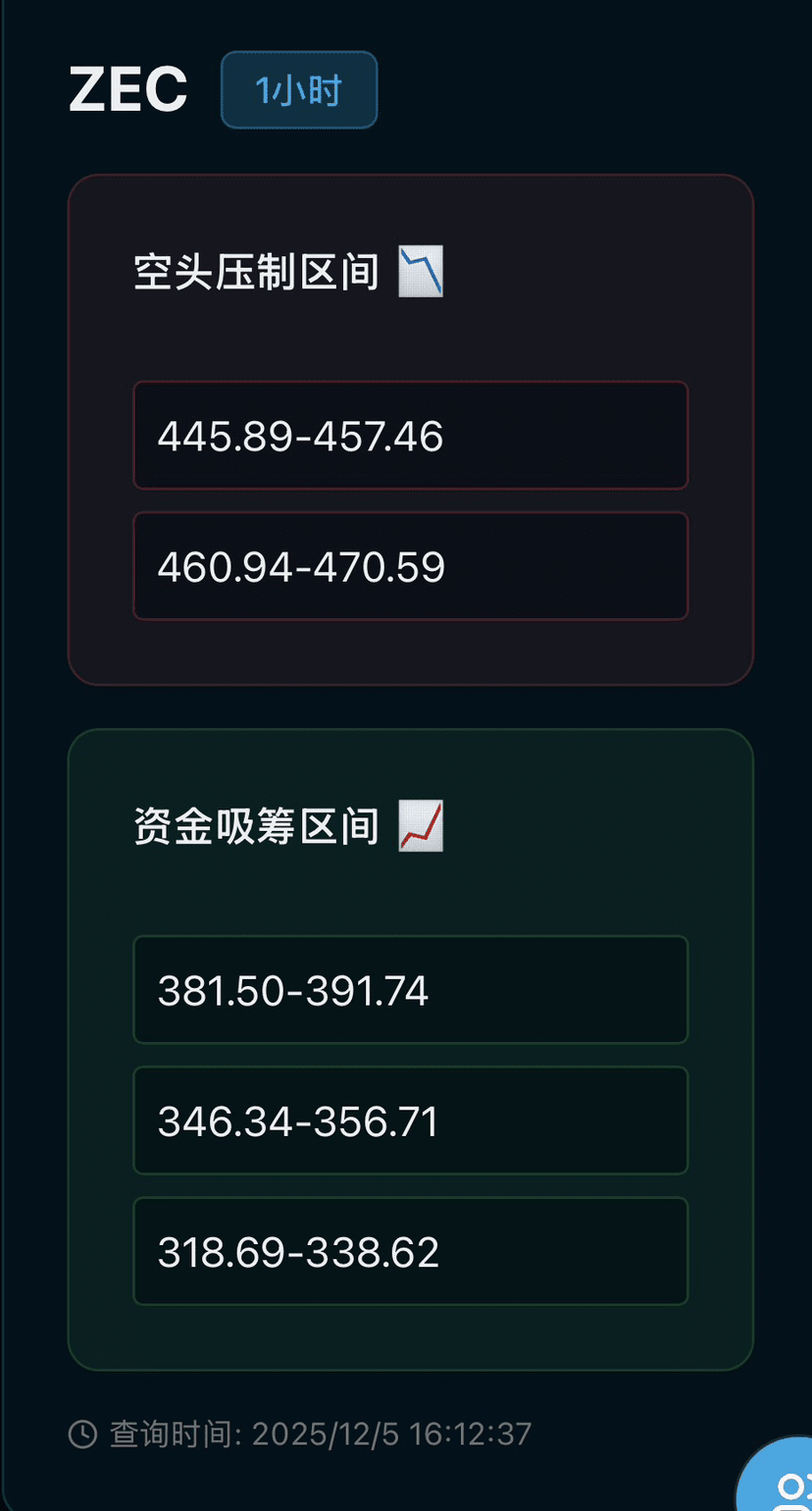

The two upper groups of bearish suppression zones

445.89–457.46

460.94–470.59

This can be seen as the selling pressure zone controlled by the dealer. Once the price approaches these ranges, there is a high probability of a strong confrontation between bulls and bears, making it a key area for short-term long position take profits and aggressive short position attempts.

Below are three groups of capital accumulation zones

381.50–391.74

346.34–356.71

318.69–338.62

It resembles the 'receiving zone' where the dealer accumulates chips in batches. Whenever the price falls into these areas, if the trading volume increases but the price remains stable, it often indicates that chips are being exchanged quietly, preparing for the subsequent rebound.

Combining the 'bearish suppression + lower accumulation' combination signal, it can be deduced that the dealer's thinking roughly has two points:

First, utilize the bearish sentiment and the overhead pressure zone to continuously shake out the chasing long positions and high-level floating positions, while accumulating cheap chips below;

Second, repeatedly saw back and forth within the oscillation range, creating a bearish technical pattern. After the concentration of chips increases, take the opportunity to make a quick rebound upwards, attracting back those who were washed out earlier.

Therefore, in terms of trading strategy, it is not advisable to emotionally chase shorts or blindly bottom-fish with heavy positions. A more prudent approach is to focus on the capital accumulation zones below: if the price pulls back to 381–392 and shows increased volume while halting the decline, you can test long positions in small batches, controlling both the individual position size and overall leverage, with a stop loss closely following the lower edge of the range. Once it breaks below, patiently wait for the next group at 346–357 or further below at 318–339 to observe the performance of support; if the price oscillates directly above the current range or even tests above 445, then maintain a wait-and-see attitude, treating it as the dealer's 'performance' zone, prioritizing profit-taking and reducing positions for longs, which is much safer than trying to push against the pressure zone. In terms of risk control, this round is still classified as a bearish-dominated oscillation market, with a faster pace and more false breakthroughs. Strictly adhere to the principles of 'small positions, building positions in batches, and immediately stopping losses if the price is not right,' treating each pullback into the accumulation zone as a tactical test rather than a definitive all-in opportunity. This way, you can follow the dealer's rhythm to seek long windows and also retreat unscathed when the trend deteriorates.