Brothers, the big player in the $ZEC has once again donned the bullish vest today, but please note, he has already changed into running shoes...

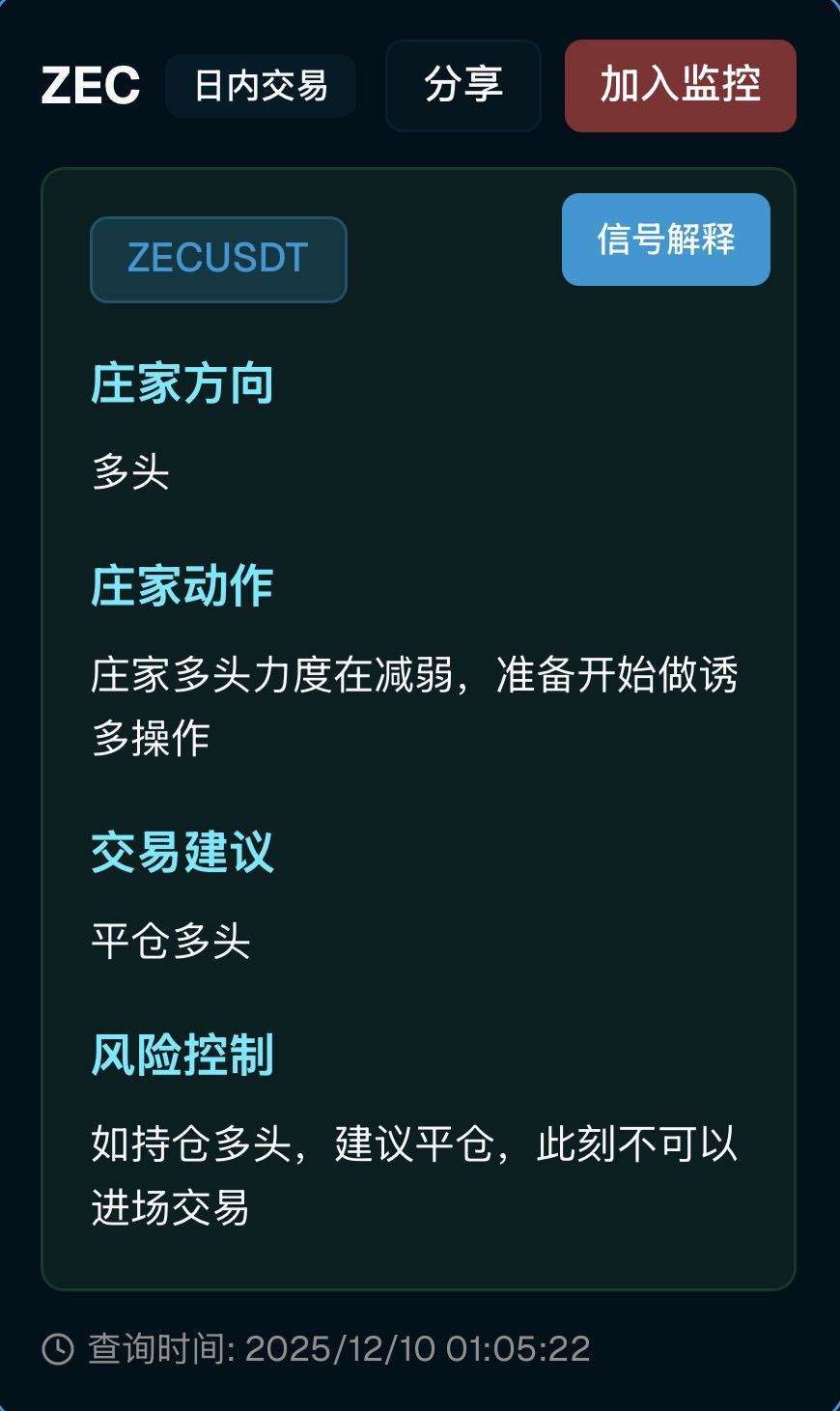

From the latest ZEC intraday monitoring, it appears that the direction of the big players is still 'bullish', indicating that the major trend has not completely reversed yet. However, the key lies in the details: the monitoring indicates that the actions of the big players are 'bullish momentum is weakening, preparing to start a baiting operation', which is a typical stage of the bullish climax— the previous rise has completed the main profit space, and the big players are no longer willing to continue pushing up with real money. They are only using the remaining trend and emotions to do one or two more rounds of baiting, bringing in the last batch of latecomers, and then they will exit the market at high prices.

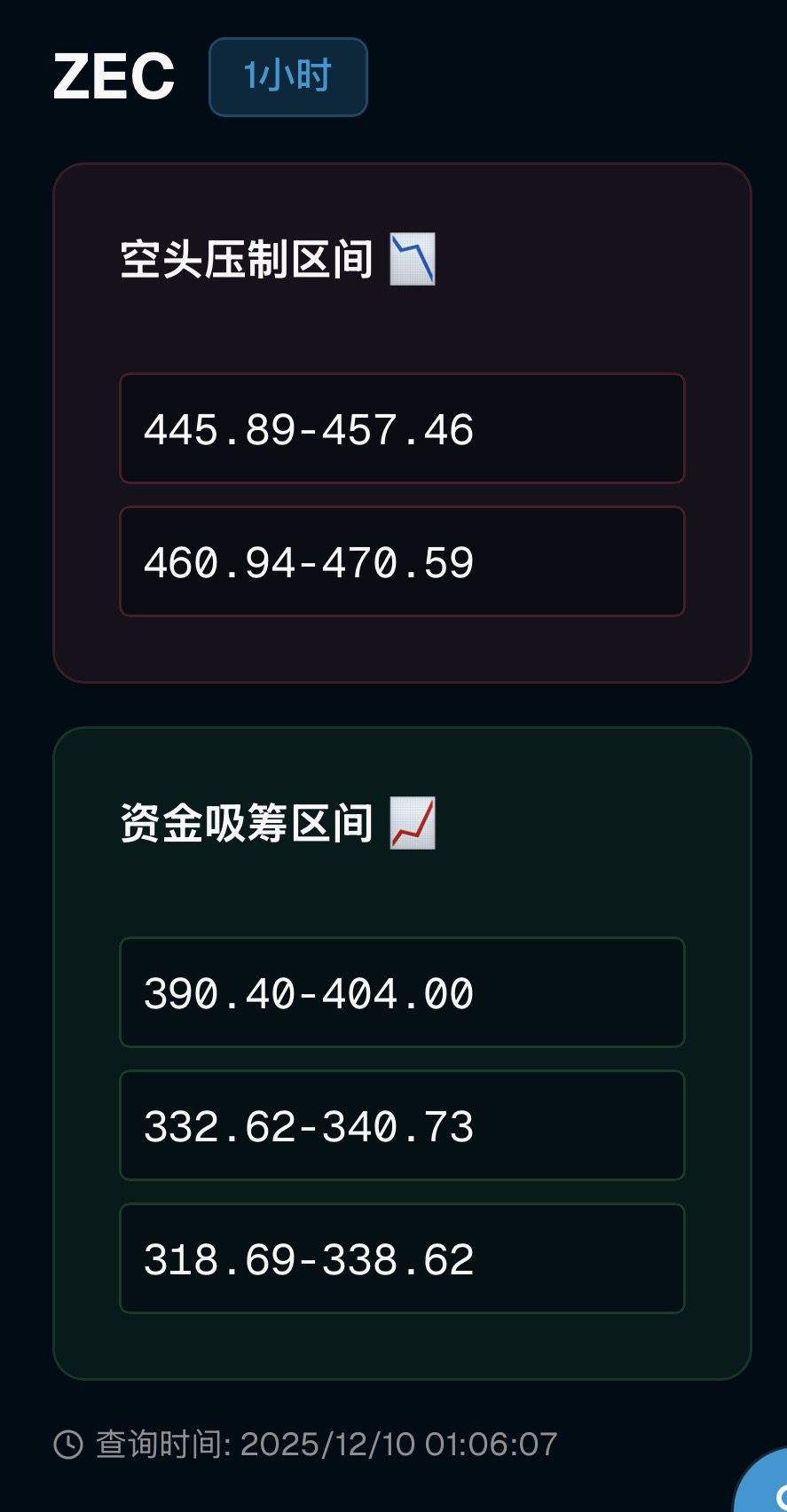

Combining the 1-hour structure, let's look at the price distribution above.

445.89-457.46

460.94-470.59

The two levels are currently obvious short-selling pressure areas, and there is a high probability of inducement and distribution occurring in these regions. Once the price is pulled to these areas, it is easy to see a surge in volume, long upper shadows, and rapid declines. For the main trader, this is an excellent 'high selling area,' while for latecomer bulls, it is a risk-intensive area. As for the lower side,

390.40-404.00

332.62-340.73

318.69-338.62

In the three-stage capital accumulation area, it can be regarded as the cost zone for the actual position building and increasing of the main trader before and after the last round of major upward movement. The current price has significantly deviated from these accumulation areas, and the chips are highly concentrated at high levels. Once the inducement ends and a real adjustment begins, it is very common for the price to retrace to these areas for a shakeout, even burying some latecomers who chased the rise directly at the peak. This is a very common scenario.

Because of this, the trading advice given by monitoring is very straightforward - 'Close long positions.' The risk control also clearly states, 'If holding long positions, it is recommended to close them; trading should not be entered at this moment.' This essentially tells us that the optimal solution at this stage is to protect the profits that have already been secured, rather than fantasizing about how much more of the main upward wave can be taken. For bystanders without positions, it is better not to rush in during this inducement preparation period. In terms of practical thinking, if you previously ambushed long positions near the accumulation zone at around 330-340, or even lower at the 318 line, and now the price approaches 445-457 or even tests 460-470, you should consider cashing out in batches rather than adding positions. Adopt a rational approach of 'accepting some loss on selling' by raising stop-loss to take profit, rather than leaving risk exposure at high levels where the main trader can dump at any time. If currently holding no positions, strictly follow the risk control advice of 'no trading allowed,' treating this time as an observation of how the main trader induces and distributes. Watch more and act less, waiting for future prices to truly complete distribution at higher levels and return to accumulation areas before considering a new round of layout, as the cost-performance ratio will be far better than betting on that last little upward move at high levels.

Overall, ZEC is currently in a sensitive stage of 'bullish end + inducement preparation period.' Although the directional label is still bullish, the odds have quietly shifted from 'favorable to bulls' to 'favorable to main trader's selling.' At this point, the correct posture of going with the trend is not to add long positions, but to follow the guidance given by monitoring: close long positions in a timely manner, watch more and act less, and patiently wait for the next truly high-probability opportunity. The above is just my personal understanding of the monitoring data and does not constitute any investment advice.