Main Highlight:

• Ethereum holds steady above the psychological level of $3,000

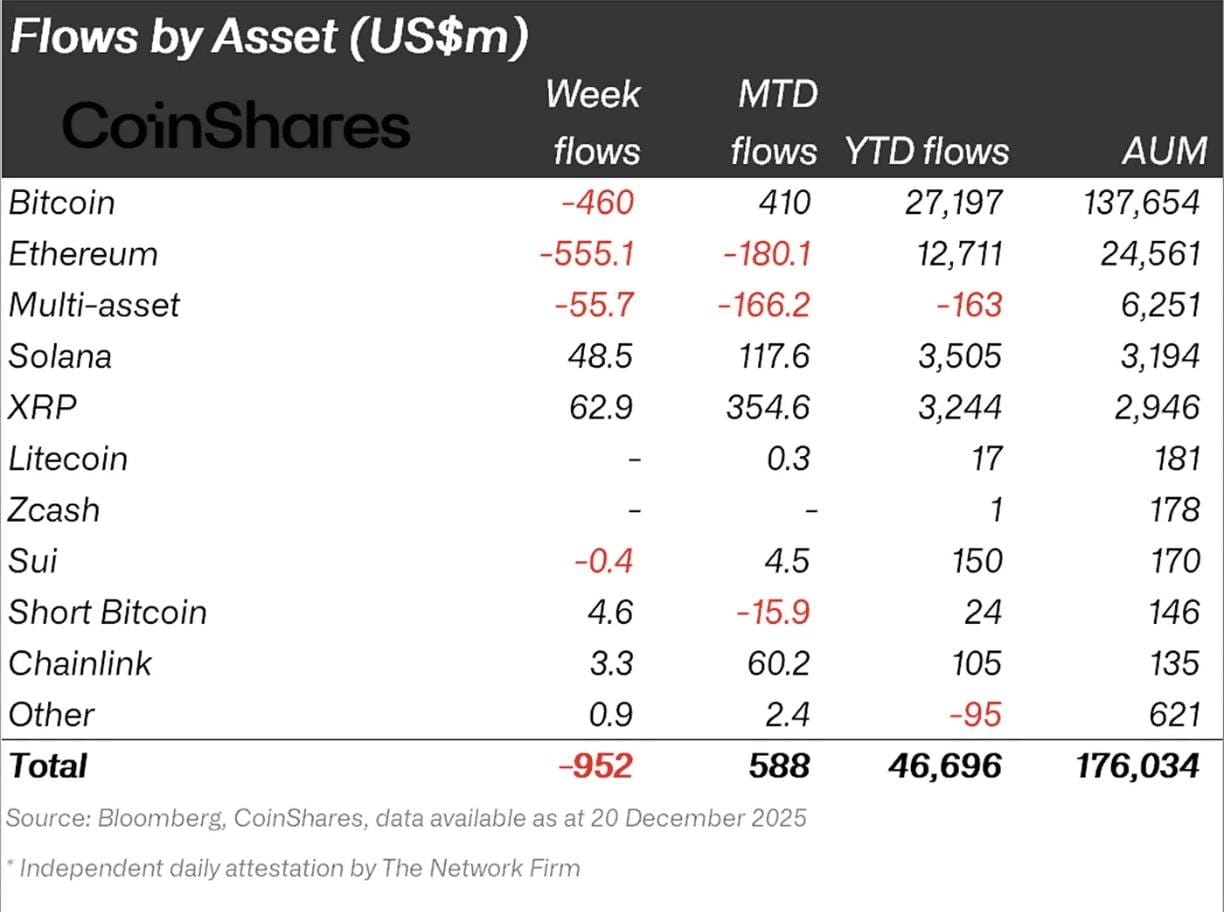

• ETH ETF recorded an outflow of $555 million last week

• Selling pressure exists around the resistance range of $3,161–$3,450

Ethereum has bounced back above the $3,000 mark this week, although the sentiment is affected

by the increased ETF capital withdrawal and network activity slowing down.

Short-term price action shows positive upward momentum, but

the broader market signal shows a mixed sentiment trend on

the entire cryptocurrency space.

ETH Trading Above $3K Amid Contrarian Signals

Currently, Ether is trading at $3,063.96, holding above

the psychological support zone of $3,000. This development shows short-term strength after

the accumulation phase, with short-term moving average indicators

tilting towards a bullish trend.

Specifically, the 10-day EMA ($3,002.5) and the 20-day EMA ($3,030.7) are acting as support. However, ETH still remains below the 50-day SMA ($3,161), indicating that selling pressure from above still exists and the upper resistance zone is challenging the current uptrend.

ETF Outflows: A Factor Reducing Short-Term Confidence

Despite the price recovery, the outflow situation from Ethereum ETFs continues to exert

pressure on the market. Last week, ETH ETFs listed in the U.S. recorded

a net outflow of $555 million from the market, contributing to a total of $952 million

in cryptocurrency ETF outflows.

This trend occurs amid stagnation in U.S. financial regulations —

including the delayed Clarity Act — alongside a growing risk-averse sentiment

in the global market.

Institutional Cash Flow Remains Stable

In contrast, institutional demand remains resilient despite the ETF

outflow trend. According to a press release, Bitmine currently holds 4,066,062 ETH, increasing by 98,852 ETH in just one week.

The company's total cryptocurrency assets — including the amount of ETH above, 193 BTC, a $32 million investment in Eightco Holdings (NASDAQ: ORBS), along with $1.0 billion in cash — have reached a value of $13.2 billion. Specifically, the amount of ETH held by Bitmine accounts for 3.37% of the total circulating supply.

ETH Outlook: Key Milestones to Watch

Analysts point out strong resistance in the 50-day SMA zone ($3,161) up to $3,450. If ETH is rejected at this area, the price could return to the support zone of $2,700–$2,623.

If the price breaks through that support zone, ETH may face the risk of a deep drop to $2,250. Conversely, if it clearly breaks above the $3,450 zone, the current bearish structure may be invalidated, opening up the potential for further gains to the $3,918 area.