Author: 0xjacobzhao | https://linktr.ee/0xjacobzhao

This independent research report is supported by IOSG Ventures. The research and writing process was inspired by related work from Raghav Agarwal (LongHash) and Jay Yu (Pantera). Thanks to Lex Sokolin @ Generative Ventures , Jordan@AIsa, Ivy @PodOur2Cents for their valuable suggestions on this article. Feedback was also solicited from project teams such as Nevermined, Skyfire, Virtuals Protocol, AIsa, Heurist, AEON during the writing process. This article strives for objective and accurate content, but some viewpoints involve subjective judgment and may inevitably contain deviations. Readers' understanding is appreciated.

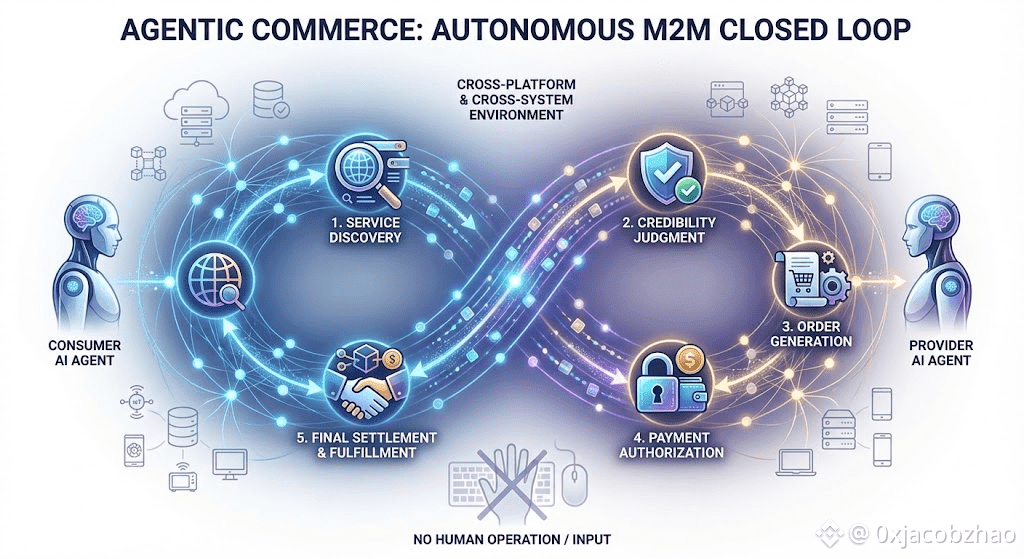

Agentic Commerce refers to a full-process commercial system where AI agents autonomously complete service discovery, credibility judgment, order generation, payment authorization, and final settlement. It no longer relies on step-by-step human operation or information input, but rather involves agents automatically collaborating, placing orders, paying, and fulfilling in a cross-platform and cross-system environment, thereby forming a commercial closed loop of autonomous execution between machines (M2M Commerce).

In the crypto ecosystem, the most practically valuable applications today are concentrated in stablecoin payments and DeFi. Therefore, as AI and Crypto converge, two high-value development paths are emerging:

Short term: AgentFi, built on today’s mature DeFi protocols

Mid to long term: Agent Payment, built around stablecoin settlement and progressively standardized by protocols such as ACP, AP2, x402, and ERC-8004

Agentic Commerce is difficult to scale quickly in the short term due to factors such as protocol maturity, regulatory differences, and merchant/user acceptance. However, from a long-term perspective, payment is the underlying anchor of all commercial closed loops, making Agentic Commerce the most valuable in the long run.

I. Agentic Commerce Payment Systems and Application Scenarios

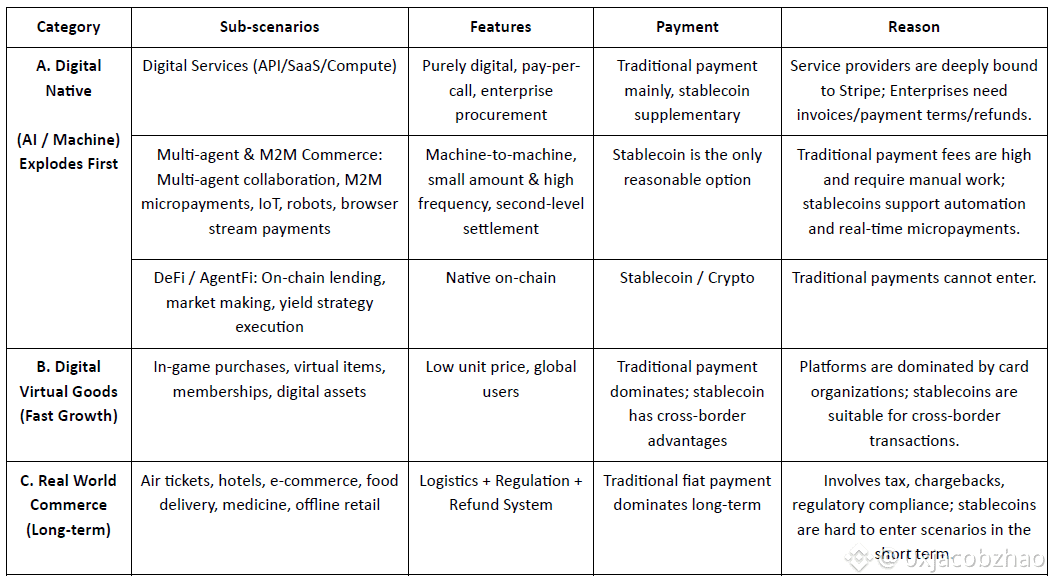

In the Agentic Commerce system, the real-world merchant network is the largest value scenario. Regardless of how AI Agents evolve, the traditional fiat payment system (Stripe, Visa, Mastercard, bank transfers) and the rapidly growing stablecoin system (USDC, x402) will coexist for a long time, jointly constituting the base of Agentic Commerce.

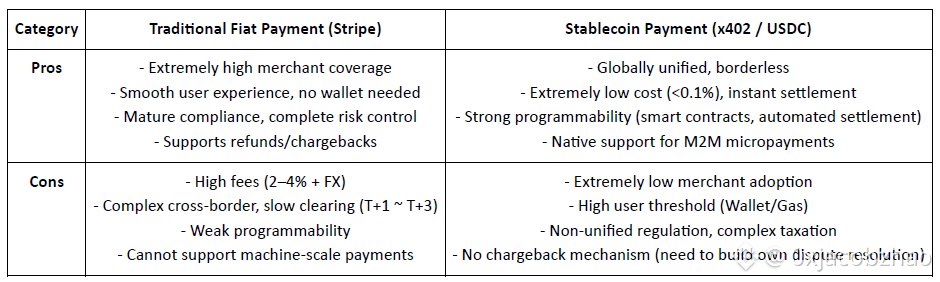

Comparison: Traditional Fiat Payment vs. Stablecoin Payment

Real-world merchants—from e-commerce, subscriptions, and SaaS to travel, paid content, and enterprise procurement—carry trillion-dollar demand and are also the core value source for AI Agents to automatically compare prices, renew subscriptions, and procure. In the short term, mainstream consumption and enterprise procurement will still be dominated by the traditional fiat payment system for a long time.

The core obstacle to the scaling of stablecoins in real-world commerce is not just technology, but regulation (KYC/AML, tax, consumer protection), merchant accounting (stablecoins are non-legal tender), and the lack of dispute resolution mechanisms caused by irreversible payments. Due to these structural limitations, it is difficult for stablecoins to enter high-regulation industries such as healthcare, aviation, e-commerce, government, and utilities in the short term. Their implementation will mainly focus on digital content, cross-border payments, Web3 native services, and machine economy (M2M/IoT/Agent) scenarios where regulatory pressure is lower or are native on-chain—this is precisely the opportunity window for Web3-native Agentic Commerce to achieve scale breakthroughs first.

However, regulatory institutionalization is advancing rapidly in 2025: the US stablecoin bill has achieved bipartisan consensus, Hong Kong and Singapore have implemented stablecoin licensing frameworks, the EU MiCA has officially come into effect, Stripe supports USDC, and PayPal has launched PYUSD. The clarity of the regulatory structure means that stablecoins are being accepted by the mainstream financial system, opening up policy space for future cross-border settlement, B2B procurement, and the machine economy.

Best Application Scenario Matching for Agentic Commerce

The core of Agentic Commerce is not to let one payment rail replace another, but to hand over the execution subject of "order—authorization—payment" to AI Agents, allowing the traditional fiat payment system (AP2, authorization credentials, identity compliance) and the stablecoin system (x402, CCTP, smart contract settlement) to leverage their respective advantages. It is neither a zero-sum competition between fiat and stablecoins nor a substitution narrative of a single rail, but a structural opportunity to expand the capabilities of both: fiat payments continue to support human commerce, while stablecoin payments accelerate machine-native and on-chain native scenarios. The two complement and coexist, becoming the twin engines of the agent economy.

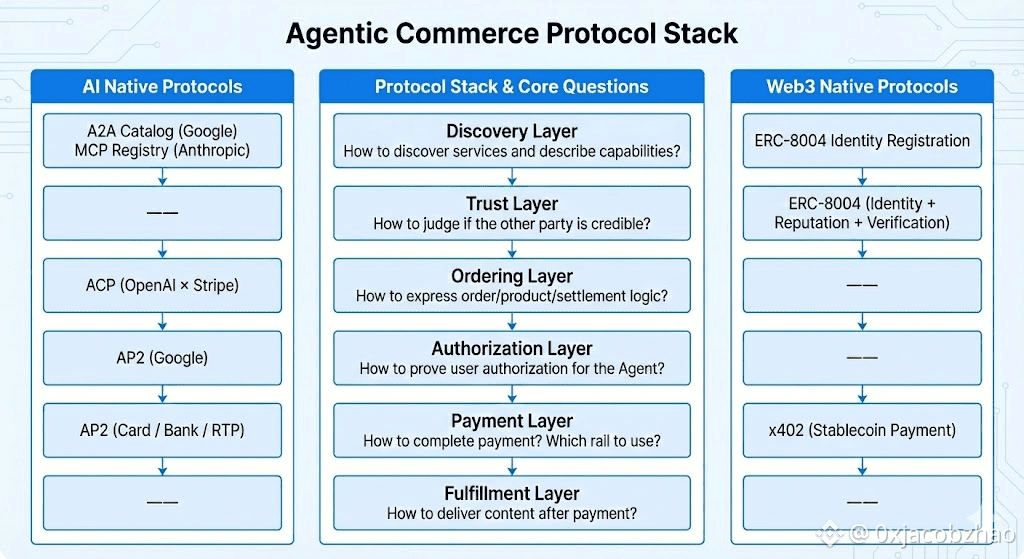

II. Agentic Commerce Protocol Standards Panorama

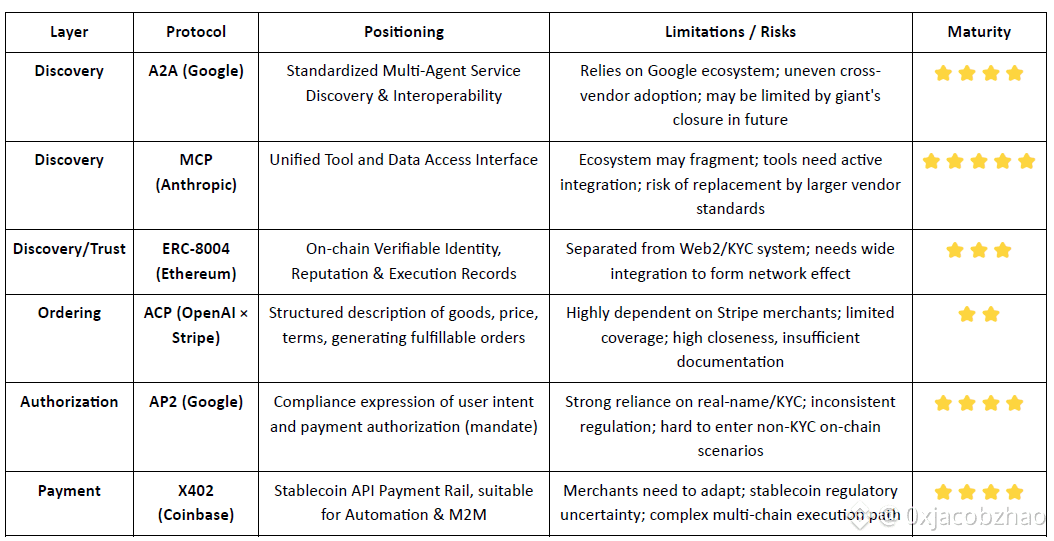

The protocol stack of Agentic Commerce consists of six layers, forming a complete machine commerce link from "capability discovery" to "payment delivery". A2A Catalog and MCP Registry are responsible for capability discovery, ERC-8004 provides on-chain verifiable identity and reputation; ACP and AP2 undertake structured ordering and authorization instructions respectively; the payment layer is composed of traditional fiat rails (AP2) and stablecoin rails (x402) in parallel; the delivery layer currently has no unified standard.

Discovery Layer: Solves "How Agents discover and understand callable services". The AI side builds standardized capability catalogs through A2A Catalog and MCP Registry; Web3 relies on ERC-8004 to provide addressable identity guidance. This layer is the entrance to the entire protocol stack.

Trust Layer: Answers "Is the other party credible". There is no universal standard on the AI side yet. Web3 builds a unified framework for verifiable identity, reputation, and execution records through ERC-8004, which is a key advantage of Web3.

Ordering Layer: Responsible for "How orders are expressed and verified". ACP (OpenAI × Stripe) provides a structured description of goods, prices, and settlement terms to ensure merchants can fulfill contracts. Since it is difficult to express real-world commercial contracts on-chain, this layer is basically dominated by Web2.

Authorization Layer: Handles "Whether the Agent has obtained legal user authorization". AP2 binds intent, confirmation, and payment authorization to the real identity system through verifiable credentials. Web3 signatures do not yet have legal effect, so they cannot bear the contract and compliance responsibilities of this layer.

Payment Layer: Decides "Which rail completes the payment". AP2 covers traditional payment networks such as cards and banks; x402 provides native API payment interfaces for stablecoins, enabling assets like USDC to be embedded in automated calls. The two types of rails form functional complementarity here.

Fulfillment Layer: Answers "How to safely deliver content after payment is completed". Currently, there is no unified protocol: the real world relies on merchant systems to complete delivery, and Web3's encrypted access control has not yet formed a cross-ecosystem standard. This layer is still the largest blank in the protocol stack and is most likely to incubate the next generation of infrastructure protocols.

III. Agentic Commerce Core Protocols In-Depth Explanation

Focusing on the five key links of service discovery, trust judgment, structured ordering, payment authorization, and final settlement in Agentic Commerce, institutions such as Google, Anthropic, OpenAI, Stripe, Ethereum, and Coinbase have all proposed underlying protocols in corresponding links, jointly building the core protocol stack of the next generation Agentic Commerce.

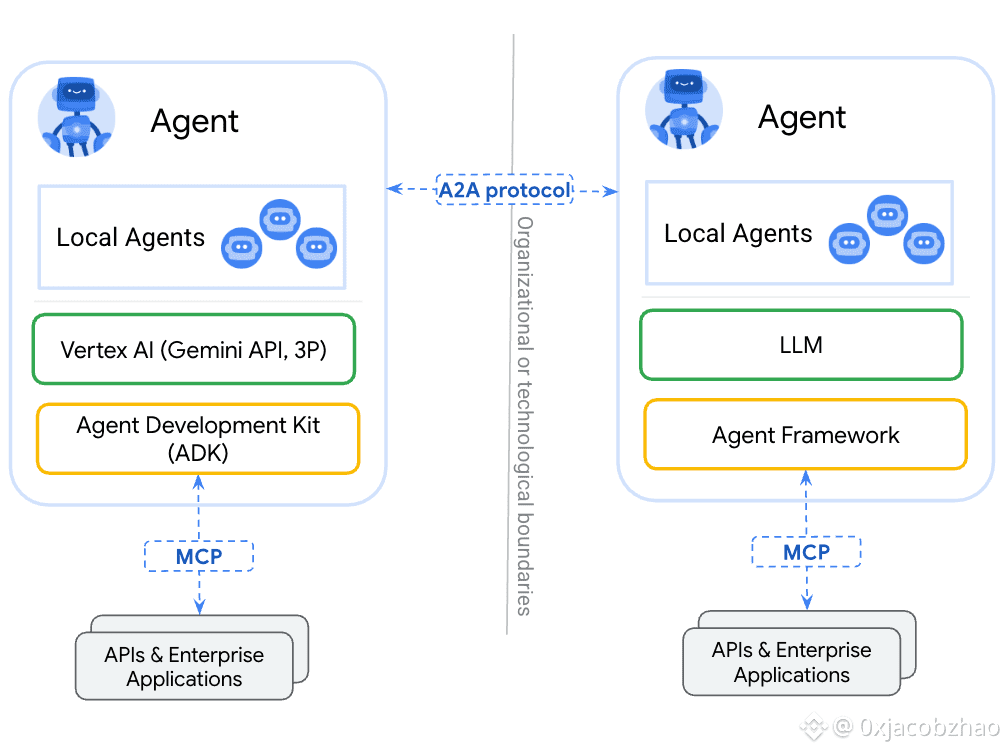

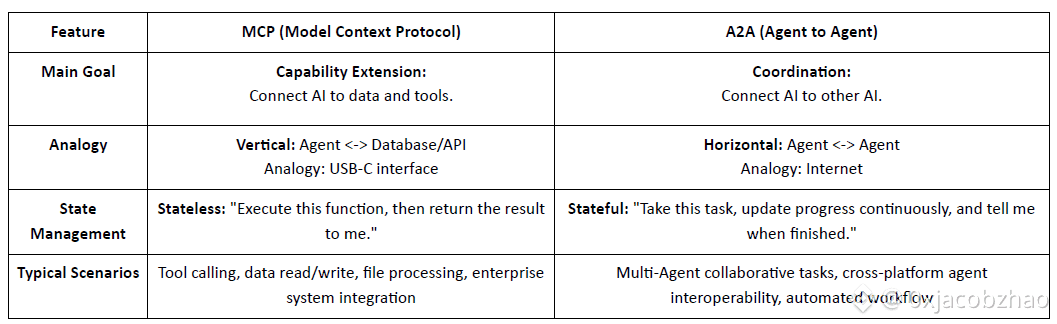

Agent-to-Agent (A2A) – Agent Interoperability Protocol (Google)

A2A is an open-source protocol initiated by Google and donated to the Linux Foundation. It aims to provide unified communication and collaboration standards for AI Agents built by different vendors and frameworks. Based on HTTP + JSON-RPC, A2A implements secure, structured message and task exchange, enabling Agents to conduct multi-turn dialogue, collaborative decision-making, task decomposition, and state management in a native way. Its core goal is to build an "Internet of Agents", allowing any A2A-compatible Agent to be automatically discovered, called, and combined, thereby forming a cross-platform, cross-organization distributed Agent network.

Model Context Protocol (MCP) – Unified Tool Data Access Protocol (Anthropic)

MCP launched by Anthropic, is an open protocol connecting LLM / Agents with external systems, focusing on unified tool and data access interfaces. It abstracts databases, file systems, remote APIs, and proprietary tools into standardized resources, enabling Agents to access external capabilities securely, controllably, and auditably. MCP's design emphasizes low integration costs and high scalability: developers only need to connect once to let the Agent use the entire tool ecosystem. Currently, MCP has been adopted by many leading AI vendors and has become the de facto standard for agent-tool interaction.

MCP focuses on "How Agents use tools"—providing models with unified and secure external resource access capabilities (such as databases, APIs, file systems, etc.), thereby standardizing agent-tool / agent-data interaction methods.

A2A solves "How Agents collaborate with other Agents"—establishing native communication standards for cross-vendor, cross-framework agents, supporting multi-turn dialogue, task decomposition, state management, and long-lifecycle execution. It is the basic interoperability layer between agents.

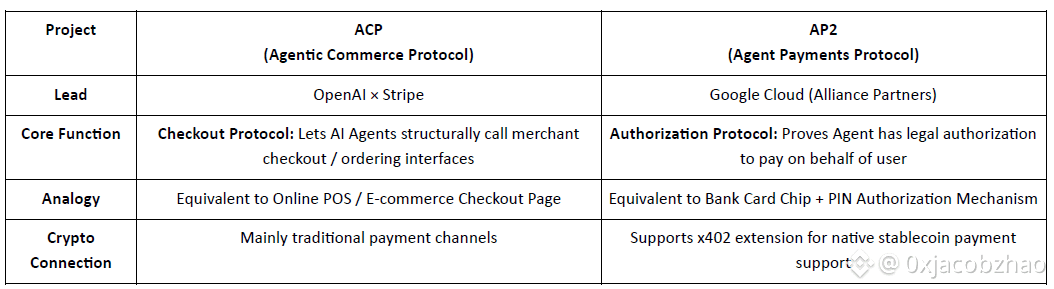

Agentic Commerce Protocol (ACP) – Ordering and Checkout Protocol (OpenAI × Stripe)

ACP (Agentic Commerce Protocol) is an open ordering standard (Apache 2.0) proposed by OpenAI and Stripe. It establishes a structured ordering process that can be directly understood by machines for Buyer—AI Agent—Merchant. The protocol covers product information, price and term verification, settlement logic, and payment credential transmission, enabling AI to safely initiate purchases on behalf of users without becoming a merchant itself.

Its core design is: AI calls the merchant's checkout interface in a standardized way, while the merchant retains full commercial and legal control. ACP enables merchants to enter the AI shopping ecosystem without transforming their systems by using structured orders (JSON Schema / OpenAPI), secure payment tokens (Stripe Shared Payment Token), compatibility with existing e-commerce backends, and supporting REST and MCP publishing capabilities. Currently, ACP has been used for ChatGPT Instant Checkout, becoming an early deployable payment infrastructure.

Agent Payments Protocol (AP2) – Digital Authorization and Payment Instruction Protocol (Google)

AP2 is an open standard jointly launched by Google and multiple payment networks and technology companies. It aims to establish a unified, compliant, and auditable process for AI Agent-led payments. It binds the user's payment intent, authorization scope, and compliance identity through cryptographically signed digital authorization credentials, providing merchants, payment institutions, and regulators with verifiable evidence of "who is spending money for whom".

AP2 takes "Payment-Agnostic" as its design principle, supporting credit cards, bank transfers, real-time payments, and accessing stablecoin and other crypto payment rails through extensions like x402. In the entire Agentic Commerce protocol stack, AP2 is not responsible for specific goods and ordering details, but provides a universal Agent payment authorization framework for various payment channels.

ERC-8004 – On-chain Agent Identity / Reputation / Verification Standard (Ethereum)

ERC-8004 is an Ethereum standard jointly proposed by MetaMask, Ethereum Foundation, Google, and Coinbase. It aims to build a cross-platform, verifiable, trustless identity and reputation system for AI Agents. The protocol consists of three on-chain parts:

Identity Registry: Mints a chain identity similar to NFT for each Agent, which can link cross-platform information such as MCP / A2A endpoints, ENS/DID, wallets, etc.

Reputation Registry: Standardizes recording of scores, feedback, and behavioral signals, making the Agent's historical performance auditable, aggregatable, and composable.

Validation Registry: Supports verification mechanisms such as stake re-execution, zkML, TEE, providing verifiable execution records for high-value tasks.

Through ERC-8004, the Agent's identity, reputation, and behavior are preserved on-chain, forming a cross-platform discoverable, tamper-proof, and verifiable trust base, which is an important infrastructure for Web3 to build an open and trusted AI economy. ERC-8004 is in the Review stage, meaning the standard is basically stable and feasible, but is still soliciting broad community opinion and has not been finalized.

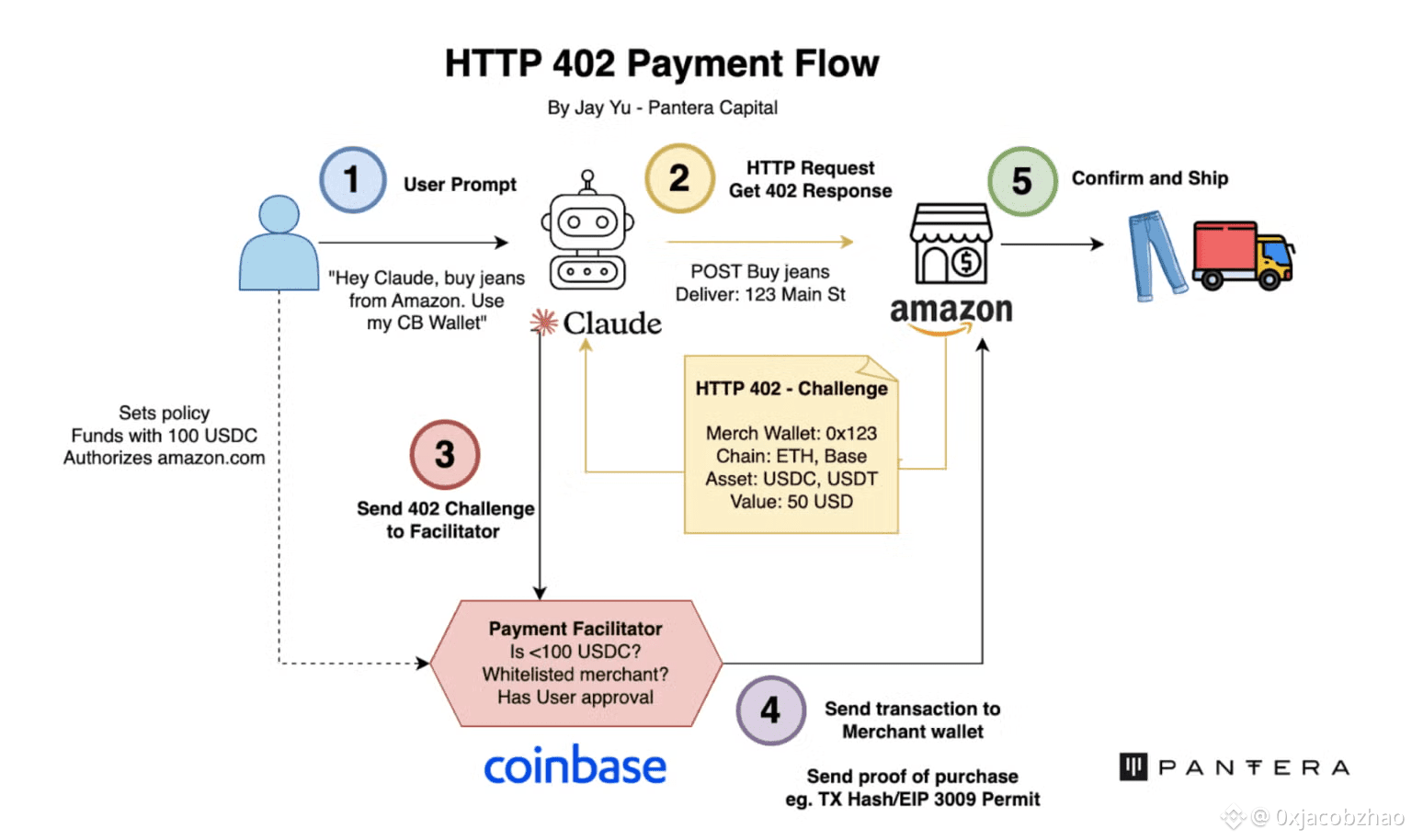

x402 – Stablecoin Native API Payment Rail (Coinbase)

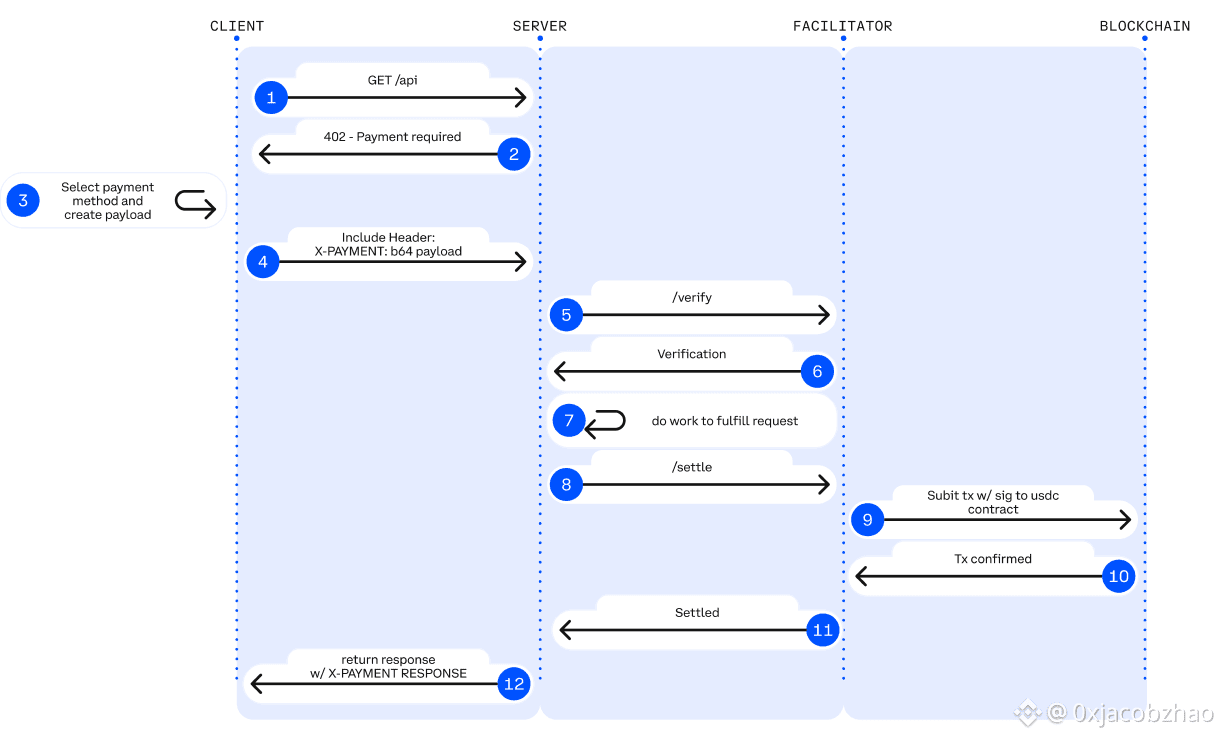

x402 is an open payment standard (Apache-2.0) proposed by Coinbase. It turns the long-idle HTTP 402 Payment Required into a programmable on-chain payment handshake mechanism, allowing APIs and AI Agents to achieve accountless, frictionless, pay-per-use on-chain settlement without accounts, credit cards, or API Keys.

HTTP 402 Payment Flow. Source: Jay Yu@Pantera Capital

Core Mechanism: The x402 protocol revives the HTTP 402 status code left over from the early internet. Its workflow is:

Request & Negotiation: Client (Agent) initiates request -> Server returns 402 status code and payment parameters (e.g., amount, receiving address).

Autonomous Payment: Agent locally signs the transaction and broadcasts it (usually using stablecoins like USDC), without human intervention.

Verification & Delivery: After the server or third-party "Facilitator" verifies the on-chain transaction, resources are released instantly.

x402 introduces the Facilitator role as middleware connecting Web2 APIs and the Web3 settlement layer. The Facilitator is responsible for handling complex on-chain verification and settlement logic, allowing traditional developers to monetize APIs with minimal code. The server side does not need to run nodes, manage signatures, or broadcast transactions; it only needs to rely on the interface provided by the Facilitator to complete on-chain payment processing. Currently, the most mature Facilitator implementation is provided by the Coinbase Developer Platform.

The technical advantages of x402 are: supporting on-chain micropayments as low as 1 cent, breaking the limitation of traditional payment gateways unable to handle high-frequency small-amount calls in AI scenarios; completely removing accounts, KYC, and API Keys, enabling AI to autonomously complete M2M payment closed loops; and achieving gasless USDC authorized payments through EIP-3009, natively compatible with Base and Solana, possessing multi-chain scalability.

Based on the introduction of the core protocol stack of Agentic Commerce, the following table summarizes the positioning, core capabilities, main limitations, and maturity assessment of the protocols at each level, providing a clear structural perspective for building a cross-platform, executable, and payable agent economy.

IV. Web3 Agentic Commerce Ecosystem Representative Projects

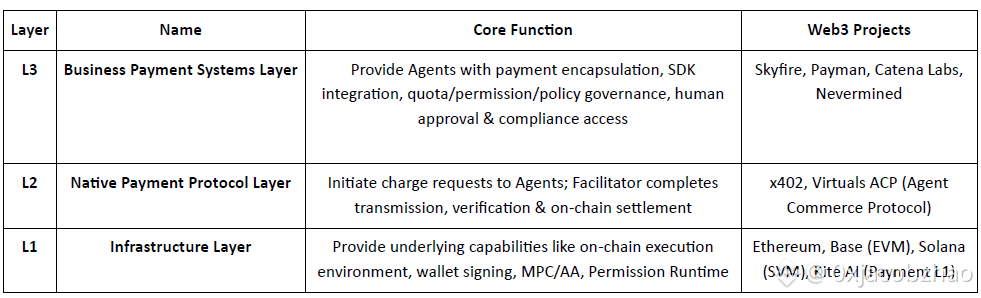

Currently, the Web3 ecosystem of Agentic Commerce can be divided into three layers:

Business Payment Systems Layer (L3): Includes projects like Skyfire, Payman, Catena Labs, Nevermined, providing payment encapsulation, SDK integration, quota and permission governance, human approval, and compliance access. They connect to traditional financial rails (banks, card organizations, PSP, KYC/KYB) to varying degrees, building a bridge between payment business and the machine economy.

Native Payment Protocol Layer (L2): Consists of protocols like x402, Virtual ACP and their ecosystem projects. Responsible for charge requests, payment verification, and on-chain settlement. This is the core that truly achieves automated, end-to-end clearing in the Agent economy. x402 relies completely on no banks, card organizations, or payment service providers, providing on-chain native M2M/A2A payment capabilities.

Infrastructure Layer (L1): Includes Ethereum, Base, Solana, and Kite AI, providing the trusted technical stack base for payment and identity systems, such as on-chain execution environments, key systems, MPC/AA, and permission Runtimes.

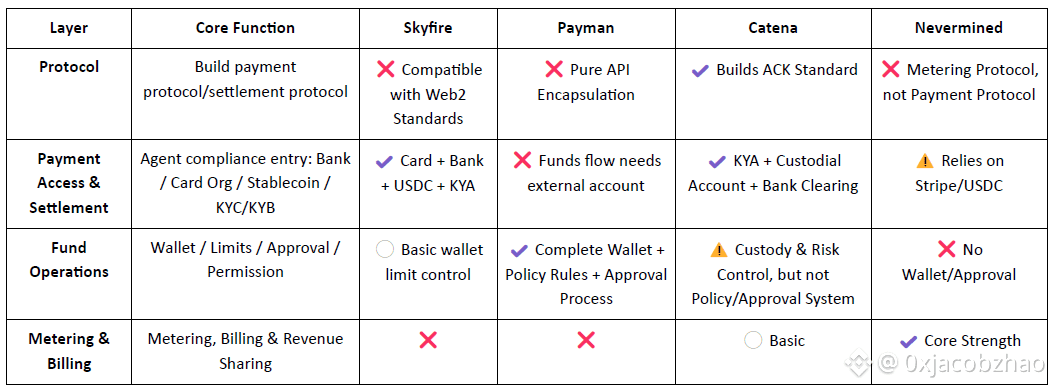

L3 - Skyfire: Identity and Payment Credentials for AI Agents

Skyfire takes KYA + Pay as its core, abstracting "Identity Verification + Payment Authorization" into JWT credentials usable by AI, providing verifiable automated access and deduction capabilities for websites, APIs, and MCP services. The system automatically generates Buyer/Seller Agents and custodial wallets for users, supporting top-ups via cards, banks, and USDC.

At the system level, Skyfire generates Buyer/Seller Agents and custodial wallets for each user. Its biggest advantage is full compatibility with Web2 (JWT/JWKS, WAF, API Gateway can be used directly), providing "identity-bearing automated paid access" for content sites, data APIs, and tool SaaS.

Skyfire is a realistically usable Agent Payment middle layer, but identity and asset custody are centralized solutions.

L3 - Payman: AI Native Fund Authority Risk Control

Payman provides four capabilities: Wallet, Payee, Policy, Approval, building a governable and auditable "Fund Authority Layer" for AI. AI can execute real payments, but all fund actions must meet quotas, policies, and approval rules set by users. Core interaction is done through the payman.ask() natural language interface, where the system is responsible for intent parsing, policy verification, and payment execution.

Payman's key value lies in: "AI can move money, but never oversteps authority." It migrates enterprise-level fund governance to the AI environment: automated payroll, reimbursement, vendor payments, bulk transfers, etc., can all be completed within clearly defined permission boundaries. Payman is suitable for internal financial automation of enterprises and teams (salary, reimbursement, vendor payment, etc.), positioned as a Controlled Fund Governance Layer, and does not attempt to build an open Agent-to-Agent payment protocol.

L3 - Catena Labs: Agent Identity/Payment Standard

Catena uses AI-Native financial institutions (custody, clearing, risk control, KYA) as the commercial layer and ACK (Agent Commerce Kit) as the standard layer to build the Agent's unified identity protocol (ACK-ID) and Agent-native payment protocol (ACK-Pay). The goal is to fill the missing verifiable identity, authorization chain, and automated payment standards in the machine economy.

ACK-ID establishes the Agent's ownership chain and authorization chain based on DID/VC; ACK-Pay defines payment request and verifiable receipt formats decoupled from underlying settlement networks (USDC, Bank, Arc). Catena emphasizes long-term cross-ecosystem interoperability, and its role is closer to the "TLS/EMV layer of the Agent economy", with strong standardization and a clear vision.

L3 - Nevermined: Metering, Billing and Micropayment Settlement

Nevermined focuses on the AI usage-based economic model, providing Access Control, Metering, Credits System, and Usage Logs for automated metering, pay-per-use, revenue sharing, and auditing. Users can top up credits via Stripe or USDC, and the system automatically verifies usage, deducts fees, and generates auditable logs for each API call.

Its core value lies in supporting sub-cent real-time micropayments and Agent-to-Agent automated settlement, allowing data purchase, API calls, workflow scheduling, etc., to run in a "pay-per-call" manner. Nevermined does not build a new payment rail, but builds a metering/billing layer on top of payment: promoting AI SaaS commercialization in the short term, supporting A2A marketplace in the medium term, and potentially becoming the micropayment fabric of the machine economy in the long term.

Skyfire, Payman, Catena Labs, and Nevermined belong to the business payment layer and all need to connect to banks, card organizations, PSPs, and KYC/KYB to varying degrees. But their real value is not in "accessing fiat", but in solving machine-native needs that traditional finance cannot cover—identity mapping, permission governance, programmatic risk control, and pay-per-use.

Skyfire (Payment Gateway): Provides "Identity + Auto-deduction" for Websites/APIs (On-chain identity mapping to Web2 identity).

Payman (Financial Governance): Policy, quota, permission, and approval for internal enterprise use (AI can spend money but not overstep).

Catena Labs (Financial Infrastructure): Combines with banking system, building (AI Compliance Bank) through KYA, custody, and clearing services.

Nevermined (Cashier): Does metering and billing on top of payment; payment relies on Stripe/USDC.

In contrast, x402 is at a lower level and is the only native on-chain payment protocol that does not rely on banks, card organizations, or PSPs. It can directly complete on-chain deduction and settlement via the 402 workflow. Upper-layer systems like Skyfire, Payman, and Nevermined can call x402 as a settlement rail, thereby providing Agents with a truly M2M / A2A automated native payment closed loop.

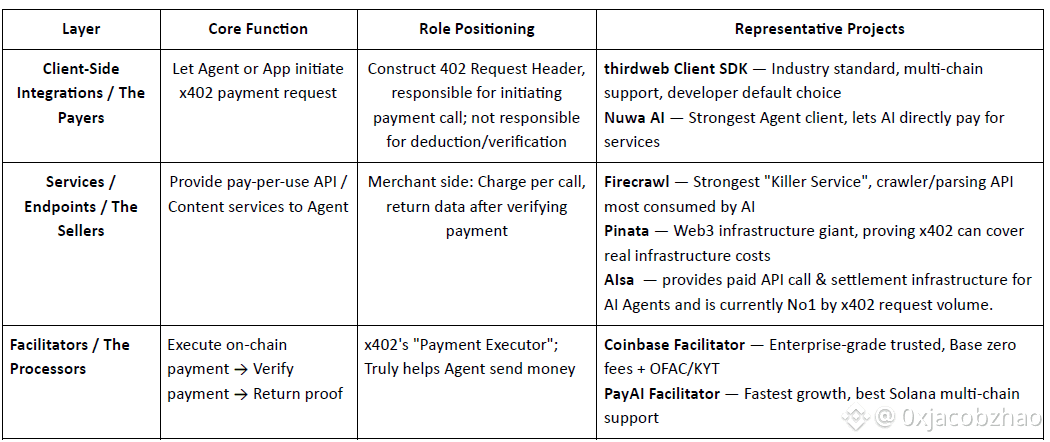

L2 - x402 Ecosystem: From Client to On-chain Settlement

The x402 native payment ecosystem can be divided into four levels: Client, Server, Payment Execution Layer (Facilitators), and Blockchain Settlement Layer. The Client is responsible for allowing Agents or Apps to initiate payment requests; the Server provides data, reasoning, or storage API services to Agents on a per-use basis; the Payment Execution Layer completes on-chain deduction, verification, and settlement, serving as the core execution engine of the entire process; the Blockchain Settlement Layer undertakes the final token deduction and on-chain confirmation, realizing tamper-proof payment finality.

x402 Payment Flow Source: x402 Whitepaper

Client-Side Integrations / The Payers: Enable Agents or Apps to initiate x402 payment requests, the "starting point" of the entire payment process. Representative projects:

thirdweb Client SDK: The most commonly used x402 client standard in the ecosystem, actively maintained, multi-chain support, default tool for developers to integrate x402.

Nuwa AI: Enables AI to directly pay for x402 services without coding, representative project of "Agent Payment Entrance".

Others like Axios/Fetch, Mogami Java SDK, Tweazy are early clients.

Current status: Existing clients are still in the "SDK Era", essentially developer tools. More advanced forms like Browser/OS clients, Robot/IoT clients, or Enterprise systems managing multi-wallet/multi-Facilitator have not yet appeared.

Services / Endpoints / The Sellers: Sell data, storage, or reasoning services to Agents on a per-use basis. Representative projects:

AIsa: provides payment and settlement infrastructure for real AI Agents to access data, content, compute, and third-party services on a per-call, per-token, or usage basis, and is currently the top project by x402 request volume.

Firecrawl: Web parsing and structured crawler entrance most frequently consumed by AI Agents.

Pinata: Mainstream Web3 storage infrastructure, x402 covers real underlying storage costs, not lightweight API.

Gloria AI: Provides high-frequency real-time news and structured market signals, intelligence source for Trading and Analytical Agents.

AEON: Extends x402 + USDC to online & offline merchant acquiring in Southeast Asia / LatAm / Africa. Reaching up to 50 million merchants.

Neynar: Farcaster social graph infrastructure, opening social data to Agents via x402.

Current status: Server side is concentrated in crawler/storage/news APIs. Critical layers like financial transaction execution APIs, ad delivery APIs, Web2 SaaS gateways, or APIs executing real-world tasks are almost undeveloped.

Facilitators / The Processors: Complete on-chain deduction, verification, and settlement. The core execution engine of x402. Representative projects:

Coinbase Facilitator (CDP): Enterprise-grade trusted executor, Base mainnet zero fees + built-in OFAC/KYT, strongest choice for production environment.

PayAI Facilitator: Execution layer project with widest multi-chain coverage and fastest growth (Solana, Polygon, Base, Avalanche, etc.), highest usage multi-chain Facilitator in the ecosystem.

Daydreams: Project combining payment execution with LLM reasoning routing, currently the fastest-growing "AI Reasoning Payment Executor", becoming the third pole in the x402 ecosystem.

Others: According to x402scan data, there are long-tail Facilitators/Routers like Dexter, Virtuals Protocol, OpenX402, CodeNut, Heurist, Thirdweb, etc., but volume is significantly lower than the top three.

Blockchain Settlement Layer: The final destination of the x402 payment workflow. Responsible for actual token deduction and on-chain confirmation.

Base: Promoted by CDP official Facilitator, USDC native, stable fees, currently the settlement network with the largest transaction volume and number of sellers.

Solana: Key support from multi-chain Facilitators like PayAI, fastest growing in high-frequency reasoning and real-time API scenarios due to high throughput and low latency.

Trend: The chain itself doesn't participate in payment logic. With more Facilitators expanding, x402's settlement layer will show a stronger multi-chain trend.

In the x402 payment system, the Facilitator is the only role that truly executes on-chain payments and is closest to "protocol-level revenue": responsible for verifying payment authorization, submitting and tracking on-chain transactions, generating auditable settlement proofs, and handling replay, timeout, multi-chain compatibility, and basic compliance checks. Unlike Client SDKs (Payers) and API Servers (Sellers) which only handle HTTP requests, it is the final clearing outlet for all M2M/A2A transactions, controlling traffic entrance and settlement charging rights, thus being at the core of value capture in the Agent economy.

However, reality is that most projects are still in testnet or small-scale Demo stages, essentially lightweight "Payment Executors", lacking moats in key capabilities like identity, billing, risk control, and multi-chain steady-state handling, showing obvious low-threshold and high-homogeneity characteristics. As the ecosystem matures, facilitators backed by Coinbase, with strong advantages in stability and compliance, do enjoy a clear early lead. However, as CDP facilitators begin charging fees while others may remain free or experiment with alternative monetization models, the overall market structure and share distribution still have significant room to evolve. In the long run, x402 is still an interface layer and cannot carry core value. What truly possesses sustainable competitiveness are comprehensive platforms capable of building identity, billing, risk control, and compliance systems on top of settlement capabilities.

L2 - Virtual Agent Commerce Protocol

Virtual's Agent Commerce Protocol (ACP) provides a common commercial interaction standard for autonomous AI. Through a four-stage process of Request → Negotiation → Transaction → Evaluation, it enables independent agents to request services, negotiate terms, complete transactions, and accept quality assessments in a secure and verifiable manner. ACP uses blockchain as a trusted execution layer to ensure the interaction process is auditable and tamper-proof, and establishes an incentive-driven reputation system by introducing Evaluator Agents, allowing heterogeneous and independent professional Agents to form an "autonomous commercial body" and conduct sustainable economic activities without central coordination. Currently, ACP has moved beyond the purely experimental stage. Adoption through the Virtuals ecosystem suggests early network effects, looking more than "multi-agent commercial interaction standards".

L1 Infrastructure Layer - Emerging Agent Native Payment Chain

Mainstream general public chains like Ethereum, Base (EVM), and Solana provide the most core execution environment, account system, state machine, security, and settlement foundation for Agents, possessing mature account models, stablecoin ecosystems, and broad developer bases.

Kite AI is a representative "Agent Native L1" infrastructure, specifically designing the underlying execution environment for Agent payment, identity, and permission. Its core is based on the SPACE framework (Stablecoin native, Programmable constraints, Agent-first certification, Compliance audit, Economically viable micropayments), and implements fine-grained risk isolation through a three-layer key system of Root→Agent→Session. Combined with optimized state channels to build an "Agent Native Payment Railway", it suppresses costs to $0.000001 and latency to the hundred-millisecond level, making API-level high-frequency micropayments feasible. As a general execution layer, Kite is upward compatible with x402, Google A2A, Anthropic MCP, and downward compatible with OAuth 2.1, aiming to become a unified Agent payment and identity base connecting Web2 and Web3.

AIsaNet integrates x402 and L402 (the Lightning Network–based 402 payment protocol standard developed by Lightning Labs) as a micro-payment and settlement layer for AI Agents, supporting high-frequency transactions, cross-protocol call coordination, settlement path selection, and transaction routing, enabling Agents to perform cross-service, cross-chain automated payments without understanding the underlying complexity.

V. Summary and Outlook: From Payment Protocols to Reconstruction of Machine Economic Order

Agentic Commerce is the establishment of a completely new economic order dominated by machines. It is not as simple as "AI placing orders automatically", but a reconstruction of the entire cross-subject link: how services are discovered, how credibility is established, how orders are expressed, how permissions are authorized, how value is cleared, and who bears disputes. The emergence of A2A, MCP, ACP, AP2, ERC-8004, and x402 standardizes the "commercial closed loop between machines".

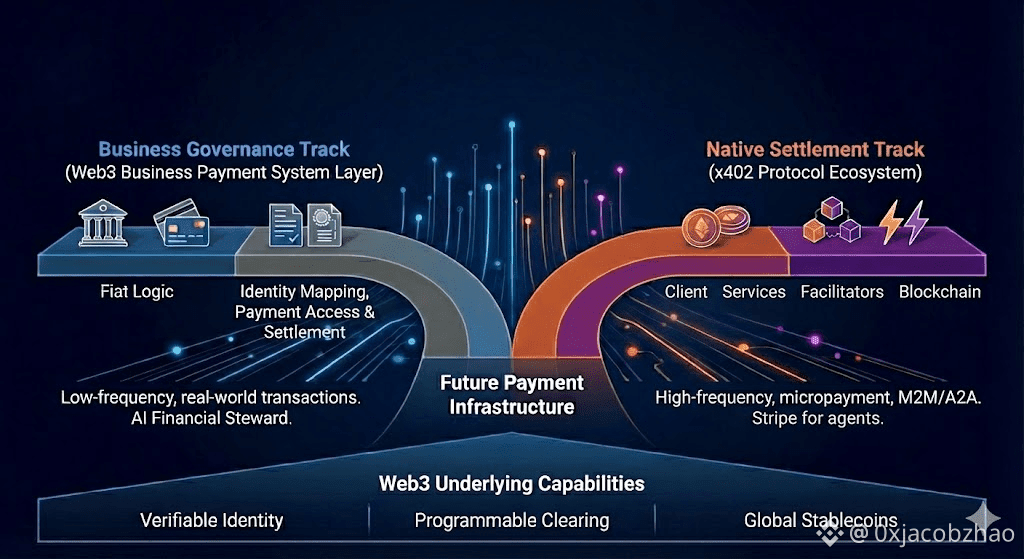

Along this evolutionary path, future payment infrastructure will diverge into two parallel tracks: one is the Business Governance Track based on traditional fiat logic, and the other is the Native Settlement Track based on the x402 protocol. The value capture logic between the two is different.

1. Business Governance Track: Web3 Business Payment System Layer

Applicable Scenarios: Low-frequency, non-micropayment real-world transactions (e.g., procurement, SaaS subscription, physical e-commerce).

Core Logic: Traditional fiat will dominate for a long time. Agents are just smarter front-ends and process coordinators, not replacements for Stripe / Card Organizations / Bank Transfers. The hard obstacles for stablecoins to enter the real commercial world on a large scale are regulation and taxation.

The value of projects like Skyfire, Payman, Catena Labs lies not in underlying payment routing (usually done by Stripe/Circle), but in "Machine Governance-as-a-Service". That is, solving machine-native needs that traditional finance cannot cover—identity mapping, permission governance, programmatic risk control, liability attribution, and M2M / A2A micropayment (settlement per token / second). The key is who can become the "AI Financial Steward" trusted by enterprises.

2. Native Settlement Track: x402 Protocol Ecosystem and the Endgame of Facilitators

Applicable Scenarios: High-frequency, micropayment, M2M/A2A digital native transactions (API billing, resource stream payments).

Core Logic: x402 as an open standard achieves atomic binding of payment and resources through the HTTP 402 status code. In programmable micropayment and M2M / A2A scenarios, x402 is currently the protocol with the most complete ecosystem and most advanced implementation (HTTP native + on-chain settlement). Its status in the Agent economy is expected to be analogous to 'Stripe for agents'.

Simply accessing x402 on the Client or Service side does not bring sector premium; what truly has growth potential are upper-layer assets that can precipitate long-term repurchases and high-frequency calls, such as OS-level Agent clients, Robot/IoT wallets, and high-value API services (market data, GPU reasoning, real-world task execution, etc.).

Facilitator, as the protocol gateway assisting Client and Server to complete payment handshake, invoice generation, and fund clearing, controls both traffic and settlement fees, and is the link closest to "revenue" in the current x402 Stack. Most Facilitators are essentially just "Payment Executors" with obvious low-threshold and homogeneity characteristics. Giants with availability and compliance advantages (like Coinbase) will form a dominant pattern. The core value to avoid marginalization will move up to the "Facilitator + X" service layer: providing high-margin capabilities such as arbitration, risk control, and treasury management by building verifiable service catalogs and reputation systems.

We believe that a "Dual-Track Parallel of Fiat System and Stablecoin System" will form in the future: the former supports mainstream human commerce, while the latter carries machine-native and on-chain native high-frequency, cross-border, and micropayment scenarios. The role of Web3 is not to replace traditional payments, but to provide underlying capabilities of Verifiable Identity, Programmable Clearing, and Global Stablecoins for the Agent era. Ultimately, Agentic Commerce is not limited to payment optimization, but is a reconstruction of the machine economic order. When billions of micro-transactions are automatically completed by Agents in the background, those protocols and companies that first provide trust, coordination, and optimization capabilities will become the core forces of the next generation of global commercial infrastructure.

Disclaimer: This article was completed with the assistance of AI tools ChatGPT-5 and Gemini 3 during the creation process. The author has made every effort to proofread and ensure the information is true and accurate, but omissions may still exist, and understanding is appreciated. It is important to note that the crypto asset market generally has a divergence between project fundamentals and secondary market price performance. The content of this article is for information integration and academic/research exchange only, does not constitute any investment advice, and should not be considered as a recommendation for buying or selling any tokens.