The price of Ethereum $ETH has strongly recovered above the $3,000 threshold, driving notable trading activity from whales. A series of large-scale long positions were opened, totaling nearly $426 million, indicating that confidence is returning as the market prepares for major volatility factors.

Data from TradingView shows ETH trading around $3,140, up 20% from the low of $2,621 recorded on November 21. Maintaining stability above the psychological threshold of $3,000 is boosting optimism, especially as the market prepares to react to the Fed's interest rate adjustment decision, expected to be a 25 basis point cut.

Whales opened more than 136,000 ETH long positions valued at $426 million

According to Lookonchain, three “smart trader” whales with a history of effective trading have opened a total of 136,433 ETH long positions, equivalent to $425.98 million:

BitcoinOG (1011short): long $169 million ETH

Anti-CZ: long $194 million ETH

pension-usdt.eth: long 20,000 ETH, approximately $62.5 million

Additionally, Arkham Intelligence confirms that whale 0xBADBB is also using two wallets to open a total of $189.5 million ETH long position.

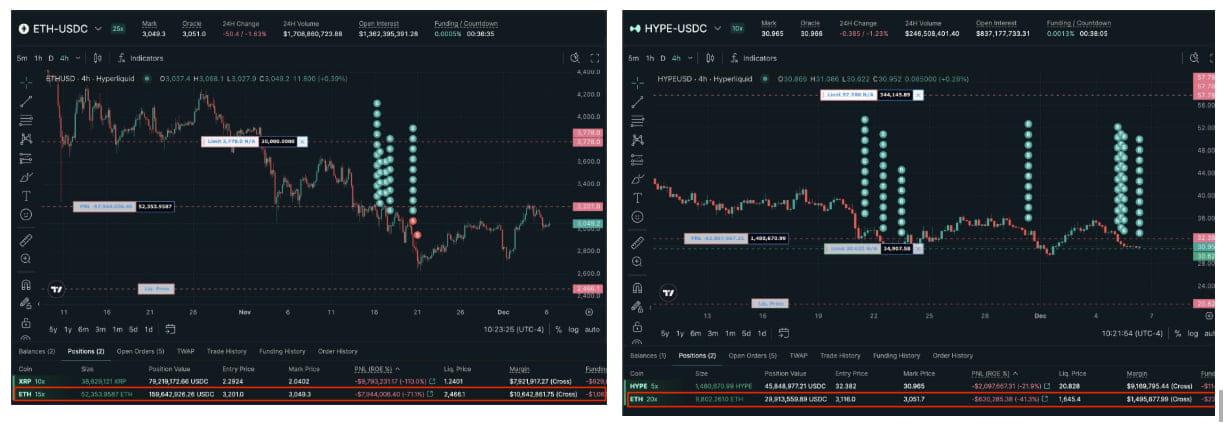

Whales' buying position in Ethereum.

This is the largest long opening since August, showing confidence that the previous downtrend has ended.

Whale activity coincided with BitMine - the largest ETH holding company in the world, continuing to increase its asset holdings. Last week, BitMine purchased an additional $199 million ETH, raising total holdings to 3.73 million ETH valued at $13.3 billion.

The combination of whale and institutional cash flow increases the view that the current price range is an opportunity to enter before the new volatility.

Technical analysis

On the daily chart, ETH is forming an ascending triangle pattern – a popular bullish continuation pattern.

The multi-month downtrend line was broken at the beginning of the week

Important resistance to overcome: $3,250

If the breakout is successful, the price target calculated based on the model is around $4,020, an increase of more than 28% from the current level

The RSI indicator has also recovered from the oversold level of 28 (on November 28) to around 50, indicating a gradual increase in momentum

Daily chart ETH/USD.

Besides the positive outlook, ETH still faces strong resistance zones:

$3,350–$3,550: the confluence zone of the 50-day MA and 100-day MA

$3,800: the 200-day MA – an important barrier before heading up to $4,000

If these levels are not successfully broken, ETH may accumulate further before generating new upward momentum.