Brothers, Hongcai is here! The weekend market is fluctuating narrowly. But the more it is like this, the more you need to be fully alert; the dog fund loves to launch surprise attacks when everyone relaxes! Today, I will clarify the future script of SOL and the escape route for you.

News

Yesterday, the US Solana spot ETF had a net inflow of $15.7 million! This is real institutional money entering the market, which is a significant positive for the medium to long term. Large capital accumulation is a process, not an instant surge. They often buy more as prices drop, quietly collecting chips.

The global main forces are resting on weekends, and market trading is light. It is difficult to drive a big market trend relying solely on news, and it is more easily manipulated by short-term funds to 'trap people'.

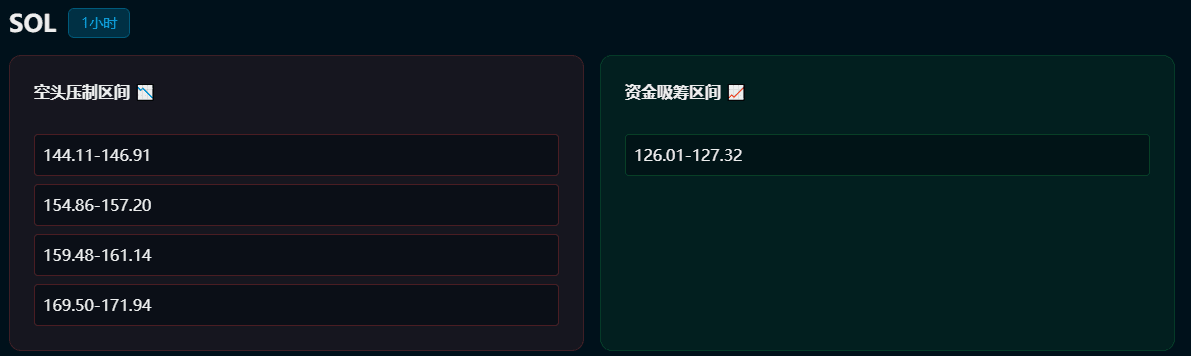

Technical analysis

On the 1-hour chart, MACD has formed a golden cross, with the white line above the 0 axis, signaling that the bulls may be gaining momentum. But if you look closely: the volume is shrinking! This is called a volume-less rebound, like a sports car stepping on the gas pedal but running out of fuel, purely for show.

After the failure to rise to 140 yesterday, the bulls' confidence has been shaken, and 135 has become a new psychological barrier. Today's attempts to test have not succeeded, indicating heavy selling pressure here.

If 130 breaks, 128 is the last strong support. If it can't hold here, the trend may turn bearish.

In simple terms, SOL is stuck between the pressure at 135 and the support at 130, forming a 'consolidation triangle', and will soon choose a direction.

My opinion

I believe SOL will find it difficult to effectively break through 135 in the short term. This position has accumulated too many trapped positions, breaking through once is very difficult.

Today continues to narrow between 130-135, and may even pretend to surge up to 135, creating a false impression of a breakout to lure in those chasing highs. Once you find that the volume near 135 still can't keep up, be wary of a rapid drop at any time, with a pullback or even breaking below 130! The market maker's trick is 'consolidation—false breakout—dumping', washing out the weak bulls.

What should retail investors do?

Take the opportunity to reduce positions around 134-135! Reduce positions! Reduce positions! Don't wait until the waterfall comes before you regret.

Absolutely don't chase the highs! Keep your hands steady. Going in now means playing games with the market makers.

If you have a long position, decisively place the stop-loss below 130. Once it breaks, it indicates that the pattern may have changed, so it’s better to step back and observe.

Remember Hongcai's words: Before the direction is clear, treat every rise as an opportunity to escape, rather than a call to charge. Protect your capital, and only then can we strike hard when the real trend comes!

If you don't know the specific entry and exit points, and the fans holding positions can follow Hongcai, Hongcai will publish the daily coins and entry and exit points at Caishen's place 24 hours a day!!!#加密市场观察 $SOL