Latest Gold analysis (spot Gold, XAU/USD)—including technicals, drivers and outlook.

✅ Key Drivers

Gold recently pulled back from record highs (~US $4,381/oz) and is hovering just above the US$4,000 level.

A stronger US dollar and rising expectations that the Federal Reserve may not cut interest rates soon are weighing on gold’s upside.

Safe-haven demand remains present (central banks, ETFs) which supports gold’s floor.

Technical factors: gold is finding support near its 50-day moving average and key trend lines, but overhead resistance remains heavy.

#MarketPullback #BTC90kBreakingPoint #AmericaAIActionPlan #StrategyBTCPurchase #TrumpTariffs

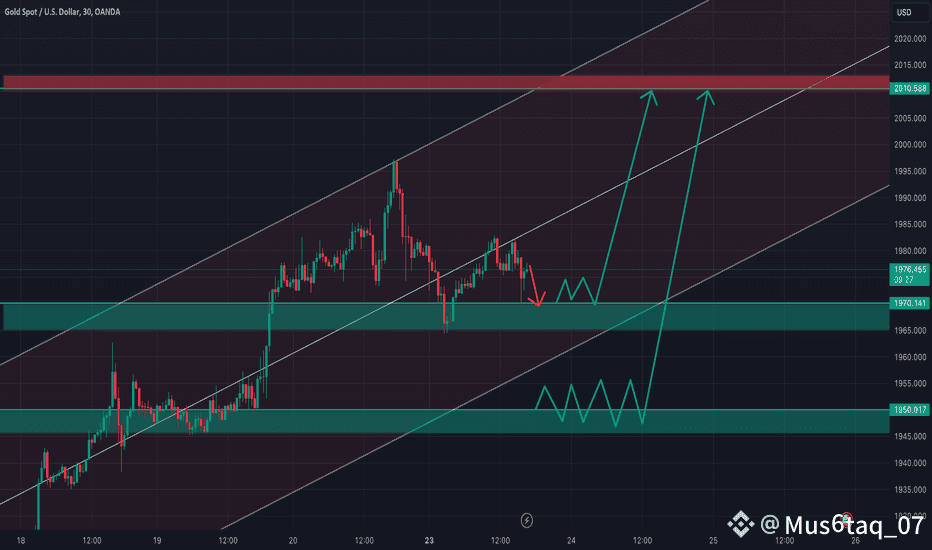

📊 Technical Outlook

Support & Resistance

Support: Roughly US$4,000/oz is a major psychological and technical support zone.

Resistance: Key resistance zones in the US$4,075–4,133/oz range (38.2% and 50% Fibonacci retracements) based on recent highs-to-lows.

If gold breaks above ~$USDT4,133/oz, next target to watch ~US$4,191/oz (61.8% retracement).

Indicators

Technical signal summaries show a “Strong Buy” bias for gold futures on many moving average and momentum metrics.

On the shorter timeframe, there is some bearish pressure: recent correction has seen RSI below 50, MACD showing red histogram.

🔍 Short-Term Outlook

The immediate trend appears bearish to neutral: price has been pushed down from its highs and is consolidating around support.

If support near $USDT4,000/oz holds, gold may attempt a rebound toward $USDT4,075–4,133/oz.

If support fails decisively, downside could extend toward US$3,945–US$3,880/oz as per one technical update.

📅 Mid-to-Long-Term Outlook

Many major banks are bullish: for example, Goldman Sachs projects a rise toward US$4,900/oz by end-2026.

Others (e.g., Morgan Stanley) estimate $USDT 4,500/oz by mid-2026 citing strong physical demand.

The bullish case hinges on: weaker USD, lower real interest rates, geopolitical/regional risk, and ongoing central bank buying.

Upcoming US economic data & Fed commentary: employment numbers, inflation data, Fed minutes — these will impact rate cut expectations and thus gold.

$USDT strength/weakness: A strong dollar tends to pressure gold and vice versa.

Safe-haven flows / central bank purchases: If these pick up, that supports gold’s base.

Technical breakouts: A clean break above resistance ~$US$4,133 could open the way upward; a break below support ~$USDT 4,000 could open deeper pullbacks.