📌 Why the Federal Reserve quietly drained purchasing power — and why Bitcoin is challenging the system

Most people believe inflation is accidental.

It isn’t.

It’s a feature of the modern monetary system.

🎯 Core Idea

The U.S. monetary system, built around the Federal Reserve, runs on elastic money.

While it solved short-term liquidity crises, it systematically eroded purchasing power and concentrated wealth at the top.

Bitcoin proposes a radically different alternative.

🕰️ A century of erosion

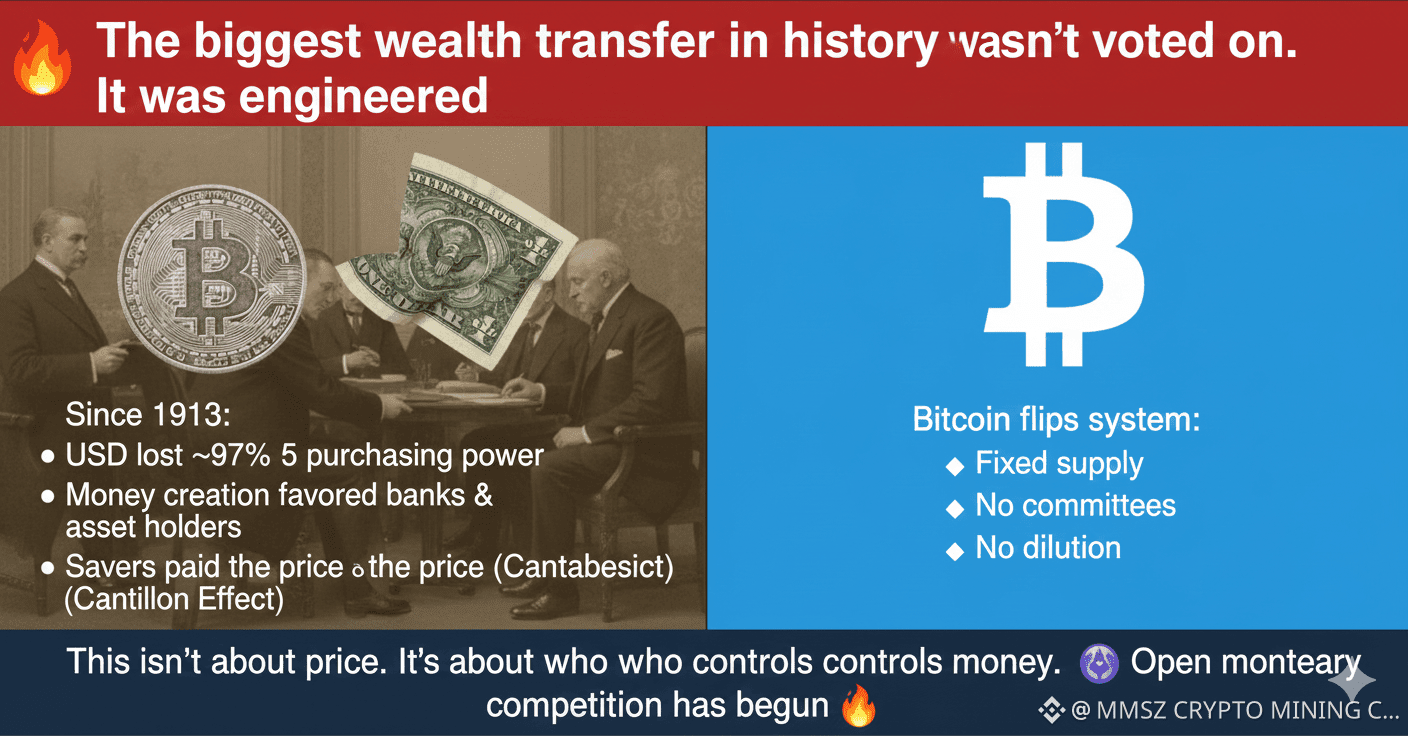

💵 Since 1913, the U.S. dollar has lost ~97% of its purchasing power

📈 Money supply and the Fed’s balance sheet expanded at historic, compounding rates

📉 Savings lost value faster than wages could keep up

🕵️ The hidden origins

🚆 In 1910, elite bankers and policymakers met privately on Jekyll Island

🎭 Central banking was sold as protection from Wall Street

🏦 In practice, it centralized monetary power closer to it

⚙️ The elastic money dilemma

🌾 Flexible money was justified for seasonal economic needs

🖨️ Temporary expansion became permanent money creation

🔗 The gold constraint was eventually abandoned

📉 Scarcity was removed — but discipline wasn’t replaced

🔁 The unequal impact (Cantillon Effect)

🏛️ Banks, governments, and asset holders receive new money first

👨👩👧 Workers and savers receive it last

📉 Prices rise before wages adjust

➡️ This is the silent wealth transfer no one teaches in school.

🟠 Bitcoin’s alternative

🔒 Fixed supply — no committees, no bailouts

✂️ Infinitely divisible (satoshis)

⚡ Fast, global, permissionless settlement

🌍 Accessible without dilution or favoritism

Bitcoin doesn’t promise stability.

It promises rules.

⏳ Perspective check

🏦 Federal Reserve: 112 years old

🟠 Bitcoin: ~17 years old

🚀 Bitcoin reached multi-trillion-dollar relevance in ~15% of the time, despite constant resistance.

🧠 Bottom line

🎁 The Federal Reserve represents discretionary money, framed as stability

⚖️ Bitcoin represents rule-based money, enforced by math

🔹 Gold constraint abandoned → unlimited fiat expansion

🔹 Bitcoin → digital scarcity without centralized control

🔮 The coming decades won’t be about regulation.

They’ll be about which money survives open competition.