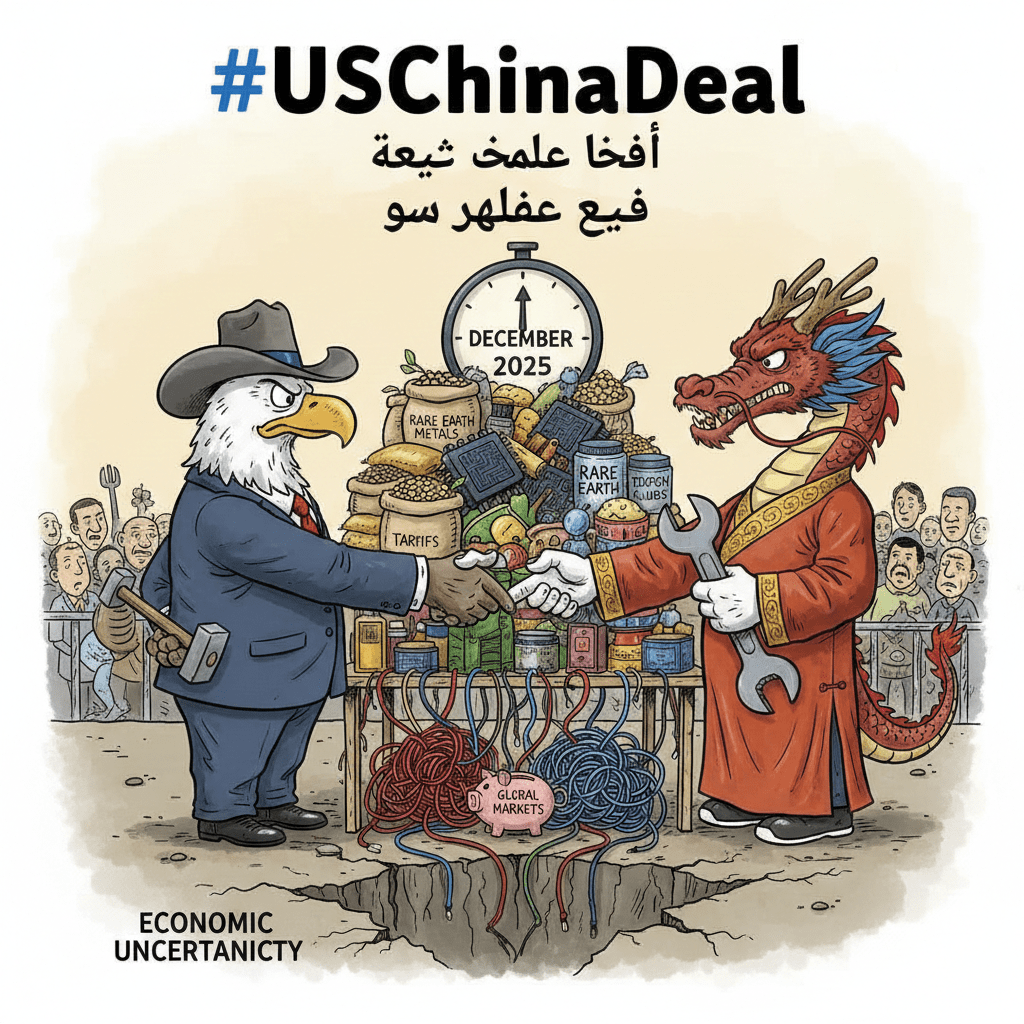

In the final meters of 2025, it seems that the two great powers have decided to choose the path of "temporary de-escalation" instead of a full-scale collision, with the emergence of a new trade agreement aimed at rearranging the cards.

📍 Key features of the current scene:

Framework Agreement (November 2025): The Trump administration and Beijing reached a one-year agreement, which includes an extension of the mutual tariff reductions and exemptions for certain vital goods until late 2026.

Semiconductor file: In a notable move (December 2025), Washington announced it would delay imposing additional tariffs on Chinese chips until June 2027, to give American companies a chance to adjust their supply chains.

Chinese commitments: Beijing has pledged to purchase large quantities of American agricultural products (such as soybeans and corn) in exchange for delaying U.S. restrictions on exporting advanced technology to certain Chinese companies.

🔍 Why now?

Market stability: Both parties are seeking to avoid major economic disruptions ahead of the U.S. midterm elections in 2026.

Rare metals crisis: China has agreed to delay its restrictions on exporting rare metals (such as gallium and graphite) used in chip and battery manufacturing.

⚠️ The next challenge:

Despite the "truce", U.S. tariffs remain at an average of 17% (compared to 3% in 2024), meaning economic pressures are still in place and any "final" and comprehensive agreement is still out of reach.$BNB

Currencies have a future