With Uniswap V4 officially launching at the end of January 2025 (deployed on 12 chains including Ethereum, Polygon, Arbitrum, etc.), it introduces hooks (custom plugins), a singleton contract model, and native ETH support, significantly reducing the cost of pool creation (up to 99.99%) and optimizing the gas efficiency of multi-hop swaps. These upgrades aim to enhance the protocol's scalability and market efficiency, encouraging more projects to migrate from V3 to V4 for more refined liquidity management and innovative applications.

However, the problems exposed during the migration of emerging tokens are quite prominent, especially the pain points of routing compatibility and infrastructure adaptation. Below, I will analyze the migration of projects such as CUBE and SHAKA based on the latest community feedback and market dynamics, and discuss potential impacts and solutions:

1. Overall migration trend: Multi-project follow-up, efficiency first

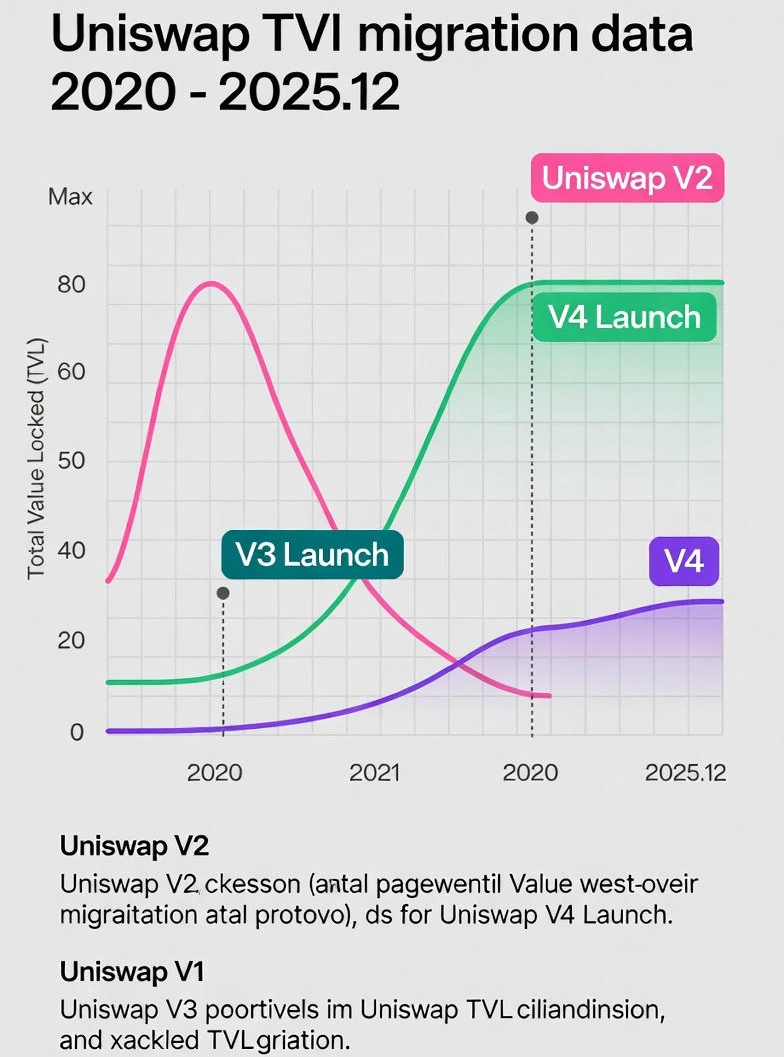

The launch of Uniswap V4 encourages liquidity providers (LP) to migrate existing positions from V3 or directly create new pools. Official guidelines show that the migration process must first remove liquidity and fees from V3, then inject into V4 pools, supporting unlimited fee tiers and custom price ranges. By December 2025, hundreds of community-contributed hooks have been developed to enhance pool functionalities (such as dynamic fee adjustments or limit orders). Emerging projects (like meme coins or AI-related tokens) are actively responding, as V4's gas optimization can lower the entry barrier for small-scale LPs and promote market efficiency.

1. Community feedback: On X (formerly Twitter), developers discuss the security of V4 hooks (such as slippage checks), emphasizing that migration must be cautious of slippage risks after new pool creation. Meanwhile, Uniswap's frontend fees have accumulated to over $133 million, but UNI holders have not directly benefited, exacerbating the misalignment of incentives between equity and token holders.

2. Market impact: V4 is expected to squeeze the existence of low-quality pools, reducing the number of ineffective liquidity pools long-term. However, in the short term, TVL migration is slow, expected to show no significant growth within 24 hours.

2. SHAKA: Liquidity dilemma caused by V4 lock-up

SHAKA (a sharecoin centered on the 'Aloha spirit', launched in April 2024, once reached a market value of $15 million, with over 166,000 holders) is a typical case of V4 migration issues. The project team will migrate LP from V3 to V4 in April 2025 and lock it for one year, aiming to enhance protocol standards, but this has led to serious compatibility issues:

1. Core pain points routing limitations: While the hooks and singleton model of V4 pool are efficient, mainstream routers (such as Uniswap's Universal Router) were not fully adapted in the early stages, leading to blocked trading paths.

2. Poor infrastructure compatibility: Scanners (like Dexscreener, CoinGecko) marked as 'honeypot', MetaMask, Base App, and OpenSea show anomalies, unable to properly index prices and trading data.

3. Liquidity obstruction: Community feedback indicates that LPs are 'stuck in a box', unable to adjust flexibly, with a decline in trading volume. This is similar to the indexing limitations of Uniswap's native USDC pool on Arbitrum (though not exclusive to V4, it amplifies migration risks).

4. Latest progress: On December 4th, the SHAKA team announced the deployment of a new LP to the Aerodrome on Base chain (native DEX), to restore visibility and routing support. This marks a liberation from the 'trap' of V4, shifting towards a more mature ve(3,3) model (Aerodrome's LP return rate exceeds 150%, far higher than Uniswap's 100%). Community Spaces discussion will be held the next day, expected to focus on brand rebuilding and future products.

5. Lessons: V4 is suitable for mature projects, but emerging tokens need to assess lock-up period risks. Recommendations: Test hooks configurations before migration, and prepare backup DEX (like Aerodrome) as a fallback.

3. CUBE: A robust entry into the AI trust layer

Compared to SHAKA, CUBE's V4 migration places more emphasis on security and strategic positioning. As a representative of the AI trust layer (possibly referring to AI-driven validation mechanisms), CUBE launched on the Ethereum mainnet, emphasizing 'secure contract addresses' to guard against common vulnerabilities (such as the aforementioned slippage issue).

1. Security first: The project highlights contract audits and hooks integration to ensure transparency of V4 pools. This aligns with Uniswap V4's security commitments (after 9 independent audits, $15.5 million bug bounty, no hacking incidents).

2. Market significance: Marks the deepening integration of AI-DeFi, V4's custom hooks can be used for AI-optimized liquidity (such as dynamic risk assessment). After going live, the CUBE pool shows normal routing without SHAKA-style display anomalies.

3. Community dynamics: No large-scale CUBE migration feedback has been seen on X, but similar AI projects (like Capx AI) report that Uniswap frontend issues have been alleviated through multi-chain pools (Arbitrum + BSC). CUBE's ETH chain deployment benefits from V4's native ETH support, with significant gas savings.

4. Outlook: CUBE can leverage the V4 ecosystem to expand to multiple chains (such as Blast or World Chain), strengthening market adoption of AI trust mechanisms.

4. Challenges and recommendations, balancing efficiency and compatibility

V4 upgrade improves standards, but emerging tokens face growing pains:

1. Common issues: Abnormal routing display stems from indexing delays and the complexity of hooks; the community calls for Uniswap to accelerate frontend adaptation.

2. Technical level: Use V4 SDK to restructure routing (integrating StateLibrary and Universal Router), and simulate slippage before migration.

3. Strategic level: Hybrid deployment (such as SHAKA's Aerodrome backup), or wait for Uniswap ecosystem maturity (expected Q1 2026 TVL to exceed V3).

4. Community action: Monitor X discussions, participate in hooks development to customize solutions.

Uniswap V4 is the 'new era' of DeFi, but migration must be cautious. The setbacks of emerging projects like SHAKA remind us that technological upgrades must match infrastructure. CUBE's security-oriented approach provides a positive example!!!