$XRP Crypto markets are driven as much by emotion as they are by data, and XRP’s recent sentiment swing is a clear reflection of that reality. Investor psychology has once again taken center stage, with narratives shifting sharply as price action changes.

The result is a familiar cycle of euphoria, disappointment, and renewed doubt—one that says more about market behavior than about XRP itself.

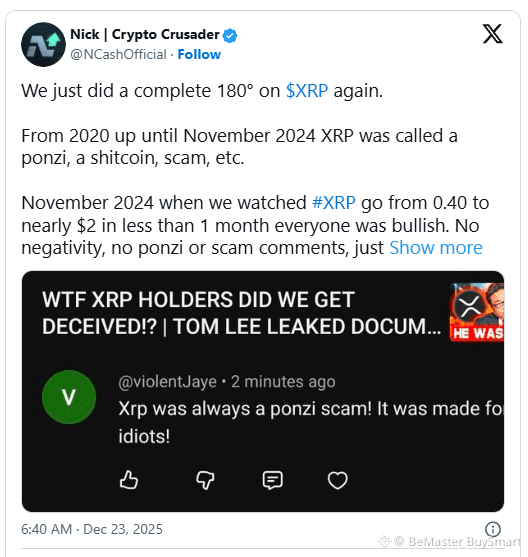

Nick, a well-followed crypto market commentator, recently highlighted this phenomenon in an X post, pointing to how dramatically sentiment around XRP has flipped over the past few years. His commentary comes at a time when negativity has returned in force, despite XRP’s undeniable performance since the bear market.

✨From Years of Skepticism to Sudden Optimism

Between 2020 and late 2024, XRP was routinely dismissed across the crypto space. Labels such as “ponzi,” “scam,” and “dead coin” became common, reinforced by prolonged price stagnation and regulatory uncertainty. That narrative collapsed almost overnight in November 2024 when XRP surged from around $0.40 to nearly $2 within weeks.

As momentum accelerated, criticism faded. Social sentiment turned overwhelmingly bullish, and XRP was once again framed as a major contender in the market. The shift was swift, revealing how quickly conviction can follow price rather than precede it.

✨The Pullback That Changed Everything Again

That optimism proved fragile. After peaking above the $3.60 region, XRP entered a sharp correction, sliding back toward the $1.80 range. With red candles dominating the chart, the earlier enthusiasm evaporated. Accusations that had disappeared during the rally resurfaced, and confidence gave way to frustration and doubt.

Nick emphasized that this pattern reflects emotional investing at scale. Green candles are interpreted as validation, while red candles are treated as proof of failure, regardless of the broader context.

✨Market Psychology and Emotional Warfare

According to Nick, this emotional volatility is not random. Fear, uncertainty, and doubt tend to intensify during drawdowns, pushing retail investors toward reactive decisions. The market, in effect, conditions participants to associate price direction with truth, even when fundamentals remain unchanged.

Notably, XRP still stands more than 10x above its bear market lows in the $0.20–$0.50 range—a fact that is largely ignored amid current negativity.

✨Why Sentiment Extremes Matter

Historically, periods of widespread pessimism often coincide with late-stage corrections rather than market tops. Nick argues that when sentiment is “completely wiped out,” it can signal exhaustion rather than further downside. While he acknowledges that only time can confirm whether XRP has found a durable bottom, the sentiment reset itself is significant.

XRP’s latest 180° is less about the asset and more about the crowd. It serves as a reminder that in crypto, narratives follow price—but disciplined investors must look beyond them.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.