The BTC/USD market experienced a dramatic shift on Monday as Bitcoin price abruptly reversed last week’s strong recovery. After surging toward $93,000, the world’s largest cryptocurrency entered an aggressive sell-off, erasing most of its recent gains. The brokers at Trade Alles provide a comprehensive and well-structured breakdown of this topic in this article.

The pair has now plunged to its lowest level since November 21, marking a drop of nearly 32% from the recent highs and triggering widespread concern across the crypto and forex markets. This sudden reversal underscores how fragile risk sentiment has become across global financial assets.

Bitcoin Price Crashes as Rally Loses Momentum

The BTC/USD pair declined in tandem with major US equity indices, reinforcing the correlation between Bitcoin and risk-sensitive assets. The S&P 500, Dow Jones, and Nasdaq 100 all slipped by more than 0.50%, showing an industry-wide move away from high-beta assets.

This decline was amplified by a sharp jump in crypto liquidations. Leveraged traders who entered long positions during the late-week surge were hit hardest. More than $700 million worth of leveraged longs were liquidated within 24 hours, a staggering figure that dwarfs the $20 billion liquidation event on October 10. The rapid unwinding of leveraged bets accelerated downside momentum and created violent intraday price swings.

Impact of Bitcoin Options Expiry and ETF Outflows

A significant contributor to the recent volatility was Friday’s Bitcoin options expiry, valued at more than $13 billion. Large expiries often generate turbulence as traders hedge, roll over, or close existing positions. The post-expiry repricing triggered additional pressure on spot markets as the BTC/USD pair lost its bullish footing.

Meanwhile, spot Bitcoin ETFs continued bleeding assets. In the past month alone, Bitcoin ETFs recorded over $3.5 billion in outflows, the biggest monthly reduction in recent history. These persistent outflows highlight weakening institutional appetite and are a key bearish factor for BTC/USD.

With ETFs becoming an increasingly important gateway for mainstream investors, sustained redemptions reflect broader caution and create additional downward pressure on the underlying asset.

Growing USDT Concerns Intensify Market Stress

Sentiment worsened after S&P Global issued a downgrade of USDT, the largest stablecoin in the crypto ecosystem. The downgrade cited several issues, including exposure to risky assets such as Bitcoin, gold, and corporate bonds, transparency concerns related to reserve reporting, and structural risks tied to the composition of its backing assets.

This assessment is notable because USDT plays a critical role in global crypto liquidity. Unlike USDC, which is fully backed by fiat instruments, Tether’s reserves include risk-weighted assets that may fluctuate in value during market stress. As confidence in USDT wavers, traders often unwind Bitcoin positions as a precaution, adding further downside pressure.

Additionally, market analysts are increasingly concerned that Bitcoin treasury companies, firms that hold significant BTC reserves, may start disposing of assets as their mNAV multiples deteriorate. With profit margins shrinking and financing conditions tightening, any systematic selling from these firms could amplify volatility and deepen the sell-off.

BTC/USD Technical Analysis: Bears Tighten Their Grip

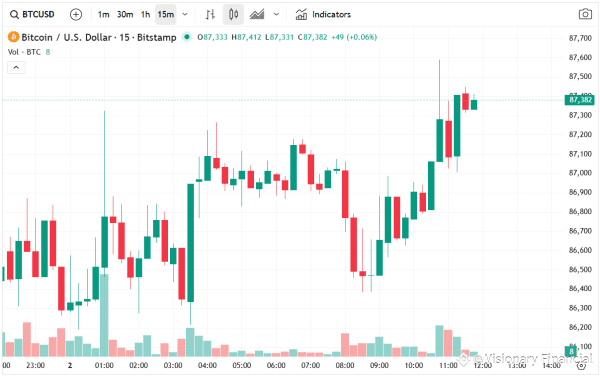

From a technical perspective, the BTC/USD daily chart shows a clear bearish structure that has intensified in recent weeks. Bitcoin’s failed rebound attempt at $93,000 formed a lower high, reinforcing the broader downtrend.

Key technical factors include the price trading firmly below all major moving averages, with BTC/USD sitting under the 50-day, 100-day, and 200-day averages that now act as dynamic resistance and reinforce strong bearish momentum. The breakdown below both the Ichimoku Cloud and the Supertrend indicator signals a full shift into a bearish market phase, leaving bulls struggling to regain control.

Additionally, the RSI continues to weaken, showing deteriorating momentum and reduced buying pressure, which raises the risk of further downside as traders grow more cautious about initiating new long positions.

BTC/USD Outlook: More Downside Ahead?

Given the current market conditions, the BTC/USD pair may remain under pressure in the near term. A continuation of ETF outflows, ongoing worries about USDT reserves, and intensified selling from institutional holders could all contribute to further declines.

The next major support level sits near $80,000, which corresponds with a previous demand zone and psychological threshold. A decisive break below that level would invalidate recent bullish attempts, reinforce the broader downtrend, and open the door to deeper retracements.

However, if the pair stabilizes above the $80,000 zone, traders may begin watching for a potential consolidation phase.

Conclusion

The recent BTC/USD crash reflects a complex mix of macroeconomic pressure, liquidity stress, leveraged unwinds, and renewed concerns around key crypto infrastructure such as stablecoins and ETFs. Technical indicators confirm that bears are in firm control, and unless market sentiment improves, Bitcoin may continue sliding toward critical support levels.

The post BTC/USD Trading Alert: Bitcoin Plunges as Risk Sentiment Deteriorates appeared first on Visionary Financial.