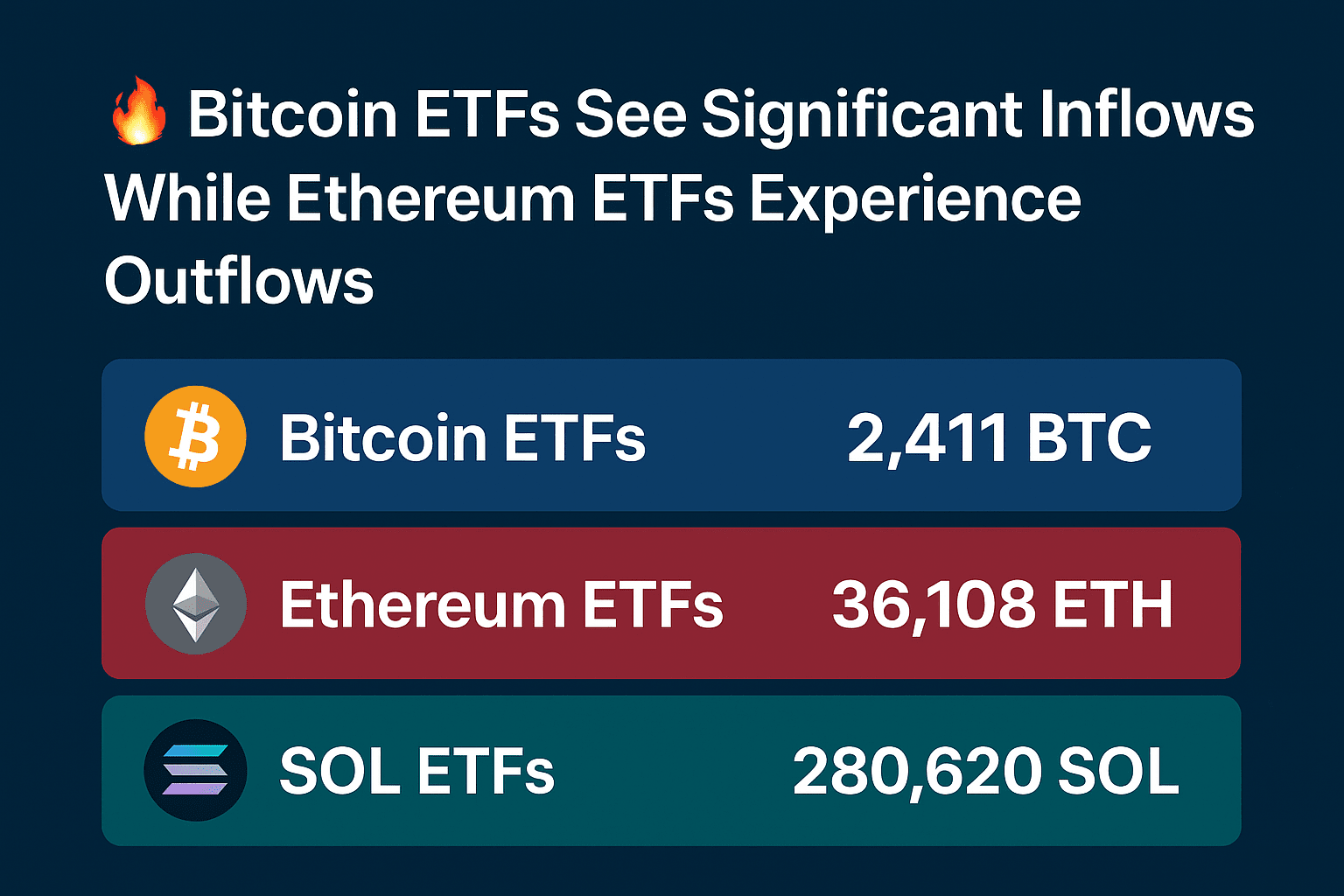

Data from **Lookonchain** indicates notable movements in the cryptocurrency exchange-traded funds (ETFs) market, as investors continue to redistribute their portfolios among the largest digital assets.

### **📈 Bitcoin ETFs: Strong Positive Inflows**

The **10 Bitcoin ETF** boxes witnessed a net inflow of **2,411 BTC**, reflecting increasing confidence in Bitcoin as new liquidity enters the market. This trend reinforces the hypothesis of a return to bullish momentum for Bitcoin with the start of a new cycle of institutional interest.

### **📉 Ethereum ETFs: Clear outflow of liquidity**

In stark contrast, **9 Ethereum ETF funds** recorded a net **outflow of 36,108 ETH**. This decline may indicate:

- Repositioning of investors towards Bitcoin

- Or short-term concerns about Ethereum's performance in the market

### **⚡ SOL ETFs: Positive surprise**

Funds **SOL** also recorded strong inflows of **280,620 SOL**, reflecting increasing interest from investors in this cryptocurrency, which continues to strengthen its position among the fastest-growing projects.

## **🔍 What do these movements mean for investors?**

- Institutional investors seem to be currently leaning towards **Bitcoin and Solana**

- Ethereum's performance needs close monitoring in the coming days

- The change in flows may indicate the beginning of a shift in asset dominance within the market

## **📌 What do you think?**

Do you think this shift is temporary? Or are we really facing a new wave of confidence in BTC and SOL at the expense of ETH? Share your thoughts in the comments 👇