I have been trading cryptocurrencies for ten years and made 80 million, but the biggest secret is: I spend most of my time 'not trading'. In this market that advocates 'hard work leads to wealth', 90% of people are becoming poor due to overexertion.

Today, I want to tell you how to defeat the market with 'laziness' in the crazy cryptocurrency world.

If you expect to get rich instantly after reading this article, then you can turn it off now. I don't have a 'wealth code' here, only a set of 'survival rules' that helped me survive three bull and bear markets and accumulate 30 million in assets.

This is not a feel-good article, but a 'health report' that will diagnose the most fatal issues in your investment system.

In addition to solid skills, I also strictly adhere to the following 10 iron rules of trading:

1. Invest in hard assets as soon as possible.

When I first bought gold, the price was about 1600 dollars. Now that price has more than doubled. When I first bought Bitcoin, the price was about 700 dollars. And now the price has broken through 100,000 dollars. These are all hard assets: they cannot be diluted and cannot be issued out of thin air. They possess scarcity, high market demand, and are hard to replicate.

Working or earning a salary will never create wealth like investing in hard assets. Both gold and Bitcoin fall into the category of hard assets. Regardless, please start investing your spare money into hard assets.

This also includes purchasing index funds like the S&P 500 or real estate in areas with consistently high demand for gold. Then let time work its magic; after 5, 10, or 20 years, you will be pleasantly surprised!

If you never invest in hard assets, it is almost impossible to become wealthy and accumulate wealth. When viewed from the long-term perspective of decades, even investing 1000 dollars today will bring a huge change. Do not procrastinate, make a plan and take action as soon as possible.#加密市场回调

2. Do some growth-oriented things.

This principle applies to any field; I have previously discussed similar points. Assess your current skills and passions; imagine that 100,000 people can see the content you produce. Even if only 1% of them recognize your value, that means you have 1,000 potential customers, fans, subscribers, or supporters.

Be bold in trying. If you don't take the first step proactively, you'll never know the outcome, and it often brings surprises. Few dare to do this, but those who dare to try always get some returns. Although it takes time to settle, one day you will break through.

When I started, I had zero fans and no community base. So I began to work hard. I persisted in outputting daily, giving it my all; people would naturally see your brilliance. Once you earn your first dollar online or receive any income from entrepreneurship, the door to success will be fully opened.#ETH走势分析

Starting is the hardest point, yet very few put it into practice.

3. You can never be richer than your true self.

Your wealth level today reflects the level of personal development you have reached.

Therefore, if an ordinary person suddenly wins a lottery of 1 million dollars, he will almost certainly squander the money within a year. The reason is that his personal qualities are far from the capabilities required to manage this sum.

Stop expecting others to act for you. If you do not invest in yourself, no one will help you invest. Knowledge is very open now; as long as you can access the internet, you can explore any field. With artificial intelligence, you can even have a personal mentor to guide you anytime, provided you are willing to spend the time.

No excuses needed.

Hone your skills through practice (see point two). Even if your abilities are limited now, continuous practice will eventually lead to improvement. Take action now, and time will witness your transformation; this idea sounds like investing in Bitcoin.

4. Properly overestimate yourself.

Maintaining a positive feedback loop is crucial. When you assess your own value as slightly higher than your current skill level, you will continue to pursue improvement.

Even if you have achieved nothing today, you must believe that you deserve more and will ultimately succeed. Changing this mindset may have a significant impact on your future self.

What you do today shapes who you will be tomorrow.

5. Money is not omnipotent.

Gold or Bitcoin can be purchased. However, you cannot go to Amazon to buy a family or find a place to call 'home.' These forms of wealth cannot be measured in money and cannot be sold anywhere.

In the pursuit of material wealth, do not forget the truly important things.

Not establishing a family or cultivating meaningful relationships may result in high costs in the future; depression, mid-life crises, or identity crises may follow, which is as important as holding Bitcoin.

Material wealth is usually meaningless if no one shares it. After all, what humans cherish are various experiences, and more wealth allows more experiences. However, some of the deepest experiences are actually almost free.

6. Embrace challenges.

If you are afraid to buy Bitcoin, that may be a good sign that you should buy. Fear often hinders you from trying new things. But if you want to enhance personal development (see point 3), it is crucial to engage with new things.

These experiences can be painful, pleasant, or flavorless. If you no longer label them and simply view them as new experiences of personal growth, you can quickly enter the next stage.

When you experience this feedback loop repeatedly, success and failure will meet again and again. The difference is: if surplus energy is invested in hard assets, every fall is from a higher point, and the climb is faster. Success will also come faster, and the harvest will be more abundant.

7. Learn to reset yourself.

People are born here and have never left for decades, and the environment has never changed. This situation is okay, but you need to be careful not to let your environment limit your personal growth.

If you have the mindset described in point 4 (i.e., valuing self-worth more), you will be keenly aware of this. As you continue to grow personally (see point 3), the things that bind you will naturally reveal themselves. At this point, you must make a choice, and this decision may trigger the psychological response described in point 6 (fear).

Break through the limits or give up and turn back? This might be your breakthrough to wealth.

8. Never fall into traps that diminish wealth.

A typical representative of cryptocurrencies is altcoins. The entire crypto space has only one hard asset, yet is filled with thousands of traps. Every time you spend money buying altcoins, the opportunity cost is the inability to purchase Bitcoin.

This simple decision will cost you dearly in terms of wealth over the next 5 to 10 years. The same logic applies to your choice to buy a car instead of investing that money; every expenditure comes at the cost of sacrificing investment opportunities.

Please view consumption and investment rationally, and be wary of lifestyle inflation. If you have not invested your income, please correct this issue immediately.

Once you have a certain amount of wealth, reveal less, do not show off, and do not post on social media. Because that will attract ill-intentioned people. These may include relatives and friends who are ready to pitch 'investment' projects to you.

9. Never sell your hard assets.

One major taboo in cryptocurrency investment is exchanging Bitcoin for altcoins. Anyone who does this will eventually pay a bloody price if they wait long enough. Although altcoins may occasionally outperform Bitcoin within a six-month to one-year cycle, this situation has never occurred when viewed over a longer timeframe of several years.

The second issue with selling hard assets is that there are no better purchase options. If you sell Bitcoin to buy gold, you still hold hard assets, just with different risk-reward characteristics.

No matter what you do, ensure that you are not exchanging hard assets for inferior assets. If you do decide to do so, be sure to calculate the risks and keep them to a minimum, ideally not exceeding 5% of your total wealth. The return for taking such risks must be asymmetric and should allow you to buy more Bitcoin later.

If you want to accumulate wealth and keep it, you must hold onto hard assets tightly and never sell.

10. If you achieve success, be prepared to be targeted.

All success attracts wrongdoers, in crypto and any other field. Last year, I suffered a hacker attack after downloading malicious software, losing 50,000 dollars, and my assets in the hot wallet were instantly cleared. I fell victim to such a simple scam.

I should have thought of this earlier, but before the RAT Escape incident, I had never stored large assets in a hot wallet. Once the price of coins soared, hackers came rushing in. This is why, as long as you have any public exposure, you are bound to become a target.

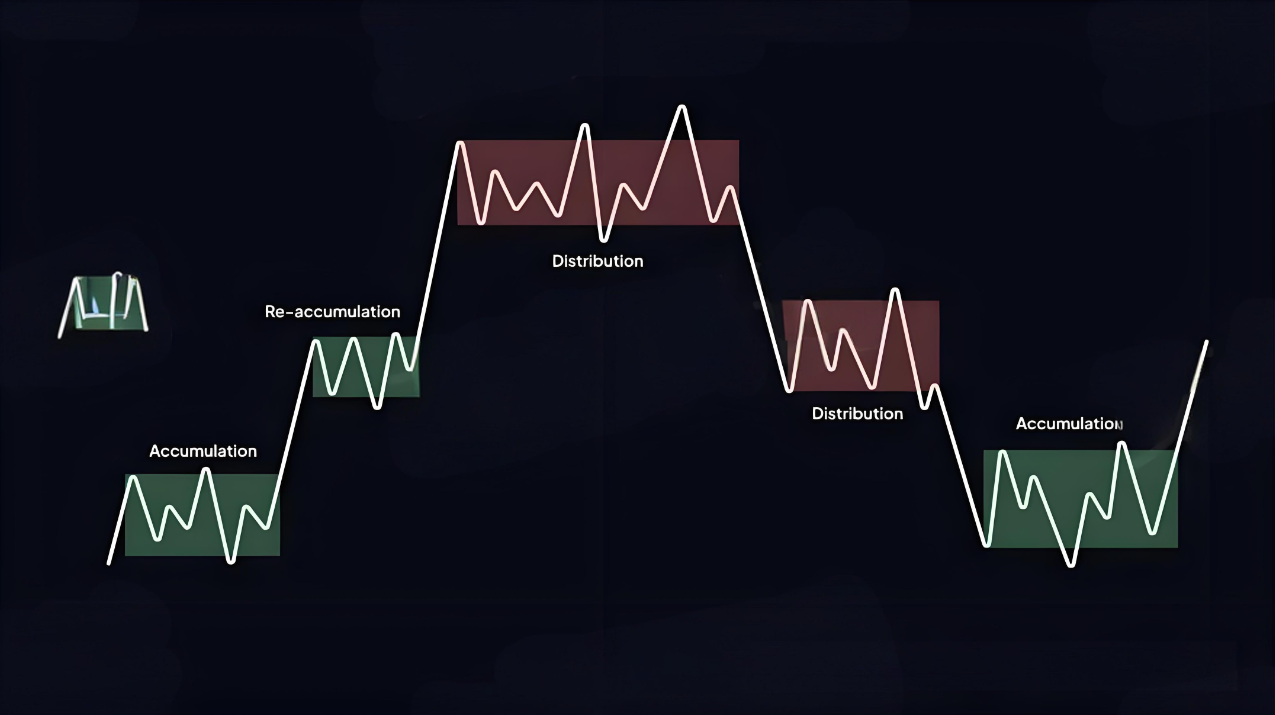

Market structure is the foundation of trading; understanding its key phases can significantly enhance trading execution and risk management. Large institutions (commonly referred to as 'smart money') strategically accumulate and distribute in order to dominate price movements within oscillating ranges.

When the market is not trending, traders need to adjust their trading ideas by identifying range consolidation, liquidity shifts, and optimal entry points. Mastering this knowledge can help traders avoid false breakout traps and align their position direction with institutional funds rather than against them.

The following content will break down the key concepts of market phases, liquidity traps, and trading strategies specifically designed for oscillating markets.

Terminology and core concepts of oscillating markets.

Accumulation.

This is the phase where institutional investors continuously build long positions within a narrow range. As buying power accumulates, this phase typically triggers a subsequent upward trend.

Key features:

❍ Price enters a clear range oscillation after a downtrend ends.

❍ Trading volume often increases, indicating that smart money is accumulating positions.

❍ False downward breakouts (shifts, washouts) often occur to shake off retail positions.

❍ An upward breakout often follows.

Distribution.

The opposite of accumulation; institutions gradually sell (distribute) their positions during this phase. Due to supply exceeding demand, this usually triggers a subsequent downtrend.

Key features:

❍ Price enters a narrow range of stagnation after an uptrend.

❍ Increased volatility often accompanies sudden false breakouts.

❍ Smart money sells positions to retail investors at high points.

❍ A downward pullback often follows.

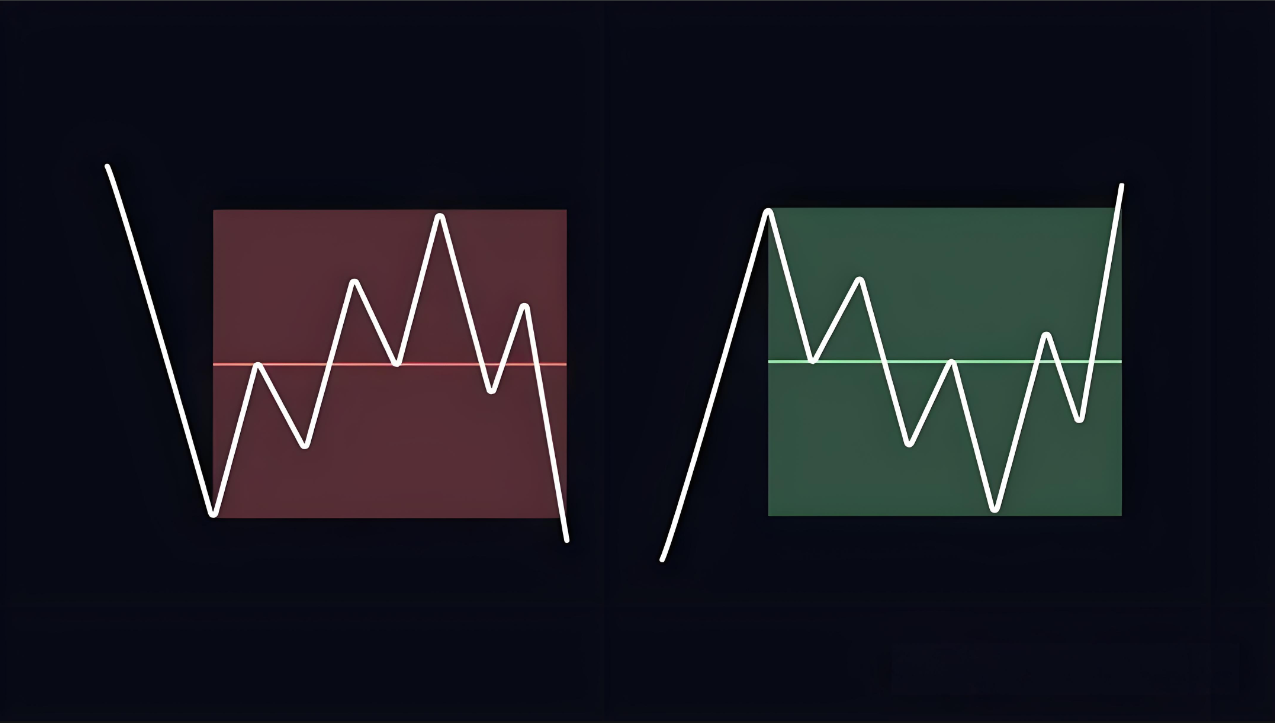

Sideways market (range oscillation/consolidation/flat).

This is a phase where the price operates within a horizontal structure, neither rising nor falling. Such ranges typically serve as accumulation or distribution areas before a breakout.

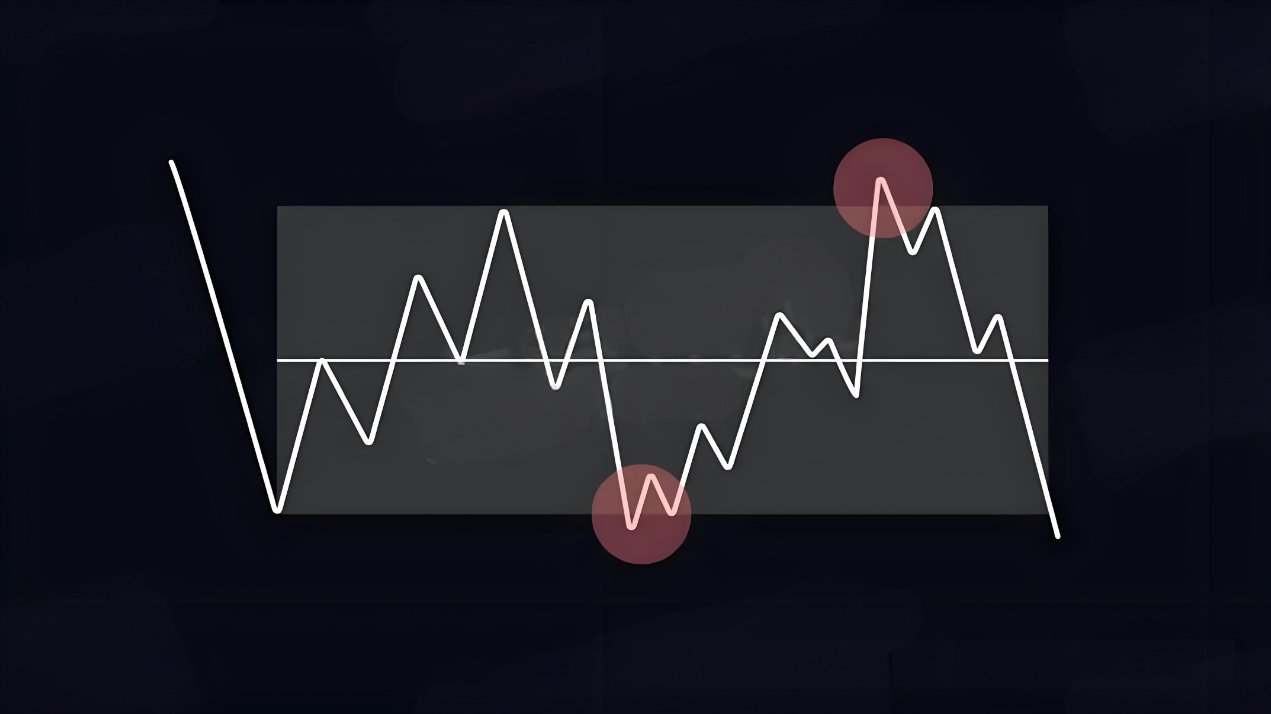

Price deviation.

Price deviation refers to a brief breakout of price beyond the boundary of a range, used to trigger stop-loss orders and then quickly reverse. Smart money uses price deviation to seize liquidity from trapped traders.

Market phases: Accumulation and distribution.

The market typically goes through four main phases:

1. Accumulation phase → Uptrend begins.

2. Uptrend → Prices rise due to demand exceeding supply.

3. Distribution phase → Institutions sell off positions.

4. Downtrend → Prices fall due to supply exceeding demand.

Because large funds cannot complete positions through a single order, they will gradually build or exit positions during these phases. Identifying these structures can help traders anticipate trend reversals or continuations in advance.

Re-accumulation and re-distribution occur within a trend; they are continuation patterns. They are smaller levels of accumulation or distribution that allow smart money to supplement or increase positions as the trend continues.

Sideways consolidation (range oscillation).

After a strong impact market, a range will form, providing clear trading boundaries for traders.

Identify ranges:

❍ First boundary of the range: formed at the end of the initial impulsive market.

❍ Second boundary of the range: formed during the pullback phase after an impulsive market.

❍ Fibonacci retracement tool: Use levels 0, 0.5, and 1 to identify ranges.

❍ Midpoint (0.5 level): If the price reacts significantly here, it confirms the range is valid.

Professional tip: If the price fluctuates chaotically near the 0.5 level without clear reactions, then this range may be unreliable—skip this setup.

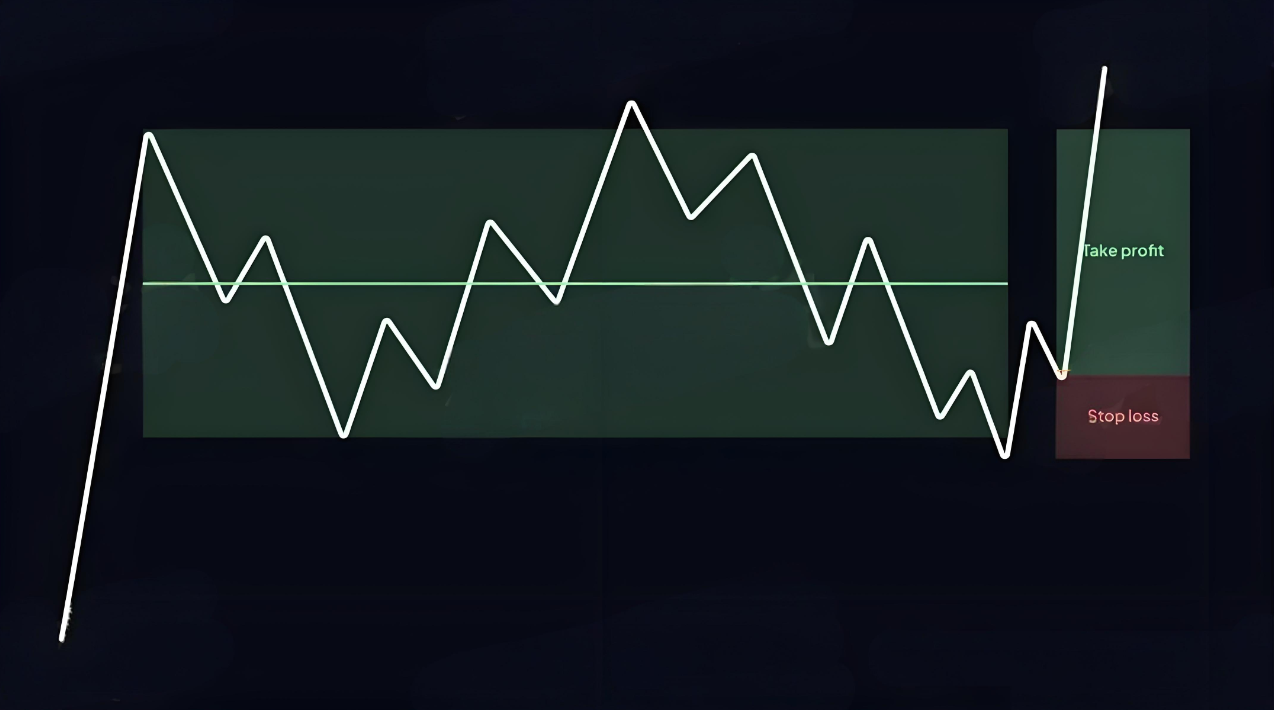

Price deviation: Capturing liquidity outside the range.

Smart money will push the price beyond the range boundary to trigger liquidity and then reverse. Such deviations often create high-probability trading opportunities.

Key rules:

1. Price deviation above the range usually leads to a price pullback to the opposite boundary (and vice versa).

2. Only enter after confirming a breakout is weak.

3. Observe structural breakouts on lower time frames.

4. No confirmation = No trading.

5. Multiple unilateral deviations usually indicate that prices will break out in the opposite direction.

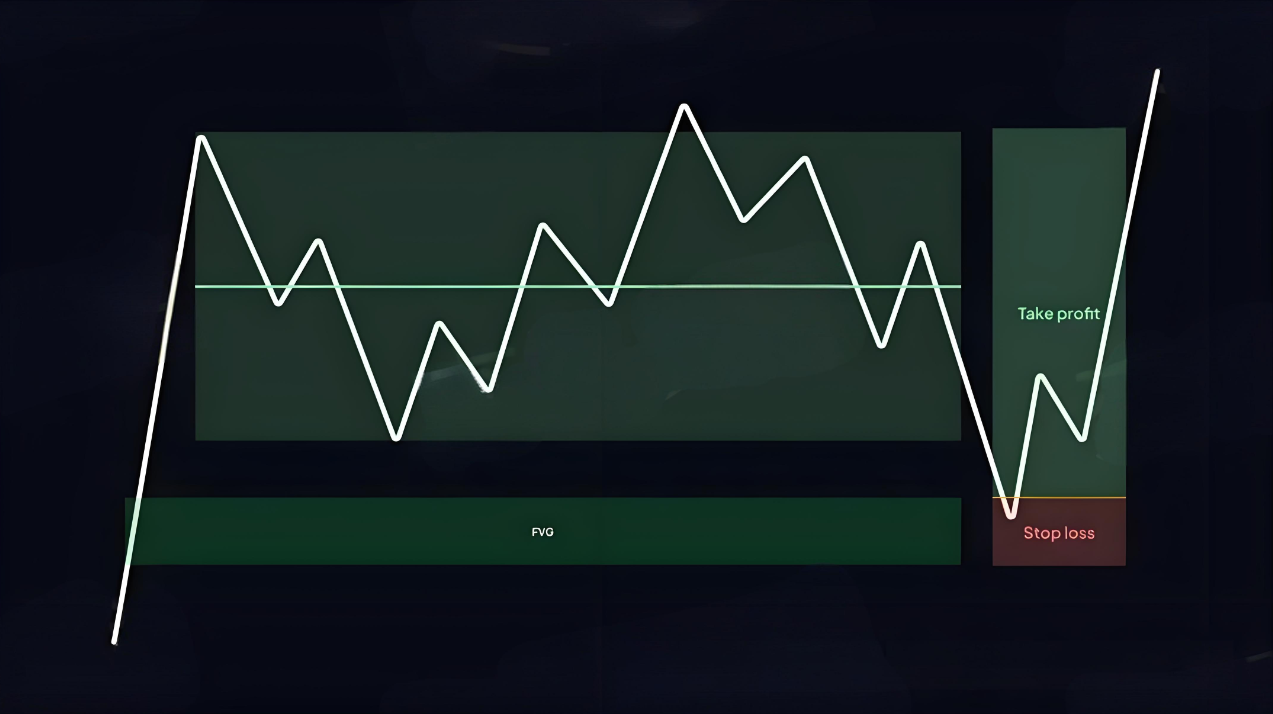

Trading strategies within ranges.

A. Encourage entry.

If there are points of interest (POI) nearby, you can enter directly when the price deviates.

Entry conditions:

❍ Low time frame structure breakout.

❍ Candlestick confirmation (e.g., strong rejection wicks, engulfing patterns, etc.).

Profit-taking strategies should follow the pattern below:

❍ 80% of positions are closed near the opposite boundary.

❍ 20% of positions are reserved for potential breakout opportunities.

This strategy is most suitable for intraday trading and short-term trading.

B. Conservative entry.

Wait for the price to react at the POI (e.g., fair value gaps, order blocks, liquidity pools) outside the range.

Only enter the market after the price returns to the range and confirms re-entry (e.g., testing the range boundary).

This method is usually suitable for swing traders or any trader trading pullbacks within a trend.

Conclusion.

A sideways market is not random fluctuations—it represents the accumulation and distribution areas of smart money operations.

Summary of key points:

1. Price deviation helps you avoid liquidity traps and identify real breakouts.

2. Use market structure, Fibonacci, and lower time frames (LTF) to confirm advantages in range markets.

3. Clear range, confirmed price deviation, and points of interest (POI) = high-probability trading opportunities.

By applying these principles, you will avoid the traps that retail traders commonly fall into and will be able to operate in sync with smart money instead of against it.

This is the trading experience I want to share with you today. Many times, you lose many money-making opportunities because of your doubts; if you do not dare to try boldly, engage, and understand, how will you know the pros and cons? You only know how to take the next step after you have taken the first step. A warm cup of tea and a word of advice, I am both a teacher and a good friend.

Fate brings people together, but knowing each other is a parting. I firmly believe that those destined to meet will ultimately know each other, and those who brush past each other are fated to do so. The journey of investment is long; momentary gains and losses are just the tip of the iceberg along the way. Remember, the wisest person will make mistakes, and the most foolish person will have some gains, no matter how emotions fluctuate, time will not stand still for you. Pick up the frustrations in your heart and get back up to move forward.

The skills have been provided to you; whether you can make a name in the world depends on yourself.

These methods should definitely be saved; share them with friends who find them useful, and follow me to learn more about crypto content. After being through the rain, I’m willing to hold an umbrella for the investors! Follow me, and let’s walk the crypto road together!