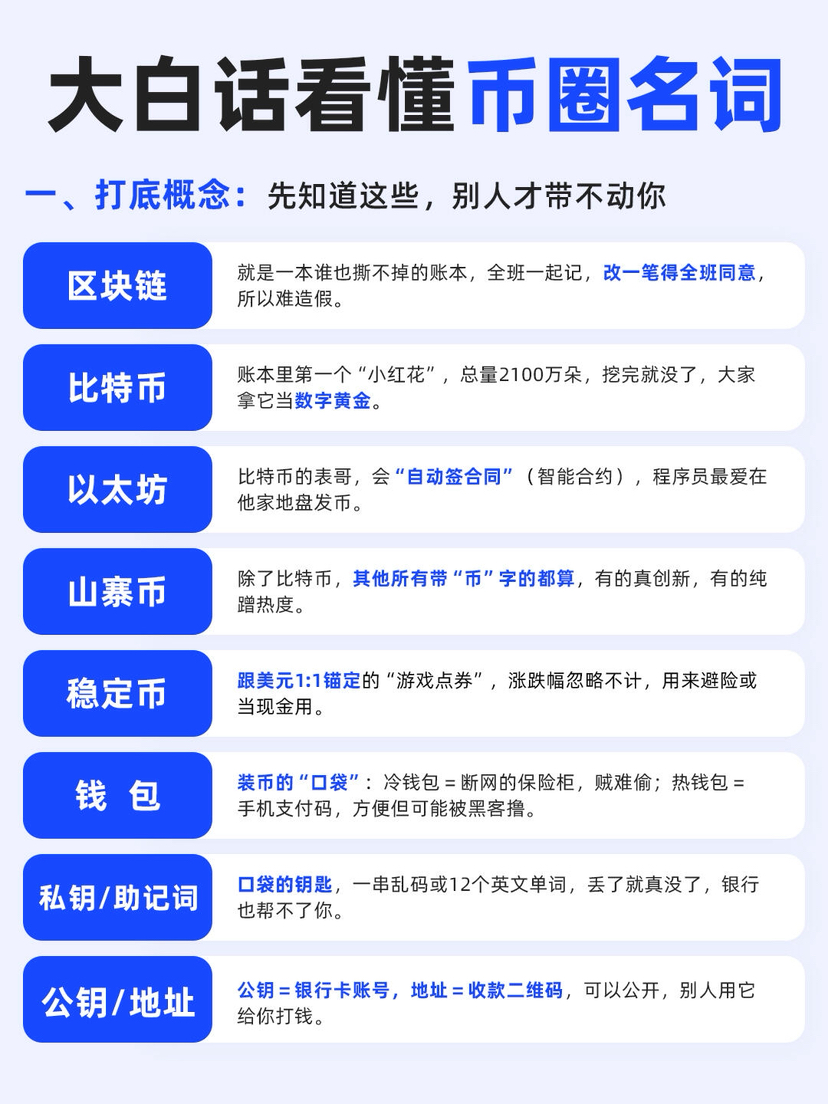

1. Basic Concepts: First understand these, so you won't be treated as a novice.

• Blockchain: A public, immutable, distributed ledger where everyone keeps the accounts, and no one can tear out a page.

• Bitcoin (BTC): The first application on the blockchain, with a fixed total supply of 21 million coins, possessing the strongest digital gold attributes.

• Ethereum (ETH): A programmable blockchain, the pioneer of smart contracts, nearly all DeFi and NFTs run on it.

• Altcoin: All coins other than Bitcoin, most are just riding the hype, but a small portion truly has innovation.

• Stablecoins (USDT/USDC, etc.): 'On-chain cash' pegged to the US dollar at a 1:1 ratio, used for hedging, transferring, and earning profits.

• Wallet = your bank account, cold wallet (hardware/offline) is the safest, hot wallet (App) is the most convenient.

• Private Key/Mnemonic Phrase = bank password, losing it equals going to zero, never screenshot and send to others.

• Public key/address = bank account number, can be freely shared with others to receive money.

Two, Mining and Consensus Mechanisms: Where do new coins actually come from?

• Mining: Using computing power to grab block rewards, those who succeed get new coins + transaction fee rewards.

• PoW (Proof of Work): Bitcoin model, whoever has more electricity gets to decide.

• PoS (Proof of Stake): Ethereum 2.0 model, those who stake more coins have the say, more energy-efficient.

• Gas Fee: The 'toll fee' for Ethereum, can be ridiculously high during network congestion.

Three, Market Sentiment and K-Line Jargon: Understand what the veterans are shouting.

• Bull Market: Overall rise, everyone is excited, FOMO sentiment dominates.

• Bear Market: Overall decline, everyone is fearful, the most spectators are outside the market.

• Waterfall: A short-term drop of more than 10%, specifically for heart diseases.

• Whale: A trader or institution with a huge position, a single order can crash the floor or skyrocket the ceiling.

• Pump/Dump/Wash Trading: Common tactics used by traders, pump to sell, dump to accumulate, fluctuate to wash away weak hands.

• Rebound vs Correction: A rebound is a small breather during a decline, while a correction is a normal adjustment during an uptrend.

• Fluctuation/Consolidation: Prices fluctuate back and forth, no direction, waiting for a breakthrough.

Four, Exchanges and Order Types: How to actually operate buying and selling.

• CEX (Centralized): Binance, OKX, Coinbase, etc., funds stored on the platform, fast but has custody risks.

• DEX (Decentralized): Uniswap, Raydium, etc., funds do not leave the wallet, slow but truly 'your coins, your control.'

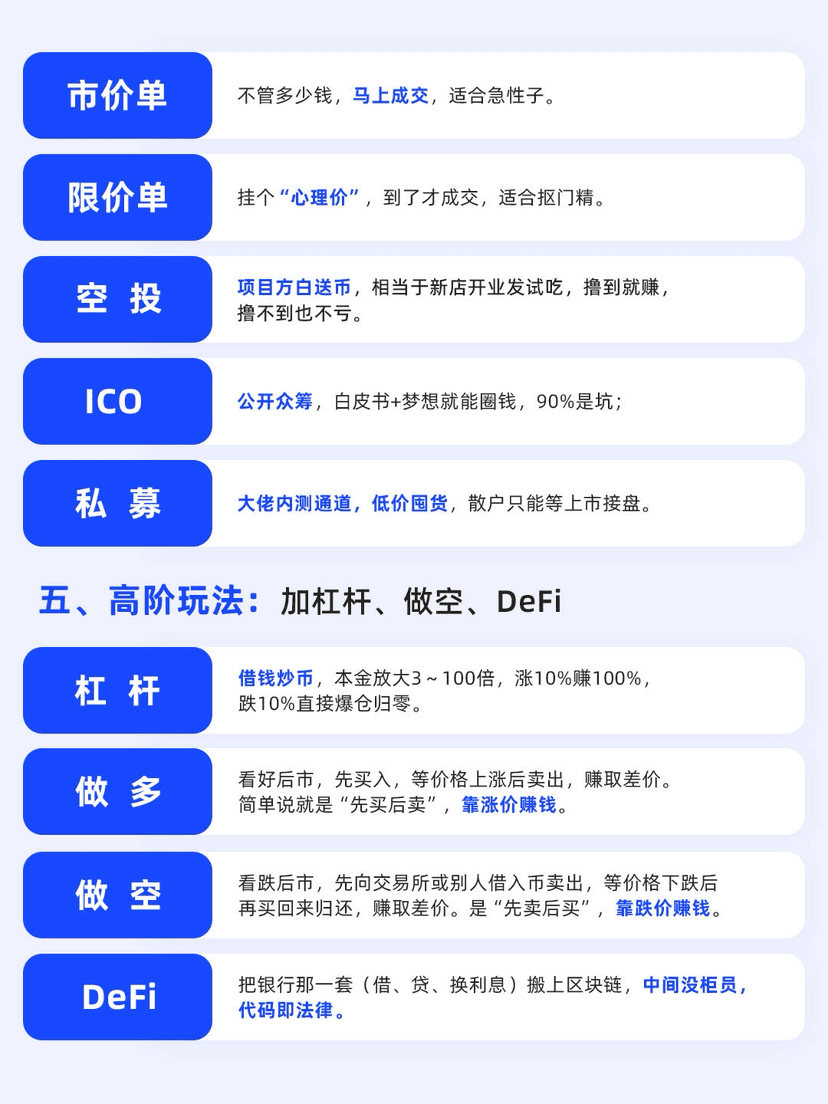

• Market Order: Execute immediately, no price selection, use when in a hurry.

• Limit Order: An order that waits for the price to reach your desired point before executing, the most commonly used.

• Airdrop/Private Placement/ICO: Airdrops are free, private placements are for big players, ICOs have a high failure rate.

Five, Advanced Strategies: Leverage, Short Selling, and DeFi.

• Leverage: Borrowing money to trade coins, amplifying profits but also increasing the risk of liquidation, beginners should avoid.

• Going Long: Buy first, sell later, profit from the rise.

• Going Short: Sell first, buy later, profit from the decline.

• DeFi: Moving traditional finance onto the blockchain, no intermediaries, lending, trading, and wealth management all rely on code.

• Smart Contract: An automatically executed contract, transfers funds when conditions are met, no need to trust anyone.

• DApp, NFT, Metaverse: Applications on the blockchain, digital collectibles, virtual worlds, once the three major narratives.

Six, Survival Rules for Retail Investors (the most expensive lesson).

• There is no bottom to catch, and no top to escape.

• Taking profits is harder than cutting losses, but it must be done.

• FOMO is the biggest killer; rushing in after seeing others make crazy profits, likely to be the one picking up the pieces.

• Never go All in, never use leverage, always keep cash flow.

• The most important point: Living longer is more important than earning more.

By 2025, these terms will still be the most commonly used 90% in the crypto world.

Newbies should memorize this first, veterans can occasionally glance at it to save their lives.

Does not constitute any investment advice, purely personal organization, welcome to save and share.