XRP has emerged as one of the strongest-performing major cryptocurrencies at the start of 2026, significantly outpacing both Bitcoin and Ether as a mix of ETF inflows, bullish sentiment, tightening supply, and renewed institutional activity drives momentum.

The rally has been strong enough to attract mainstream attention. CNBC this week described XRP as the “new cryptocurrency darling,” highlighting its outsized gains relative to the rest of the market.

“The hottest crypto trade of the year is not Bitcoin, it is not Ether, it is XRP,” CNBC Power Lunch host Brian Sullivan said on Tuesday.

XRP price surges while majors lag

Since Jan. 1, XRP has gained roughly 25%, climbing to around $2.24. By comparison:

Bitcoin is up about 6% to roughly $91,900

Ether has risen about 10% to near $3,210

The performance gap suggests XRP’s move is being driven by token-specific catalysts, rather than a broad market rally.

ETF inflows set XRP apart

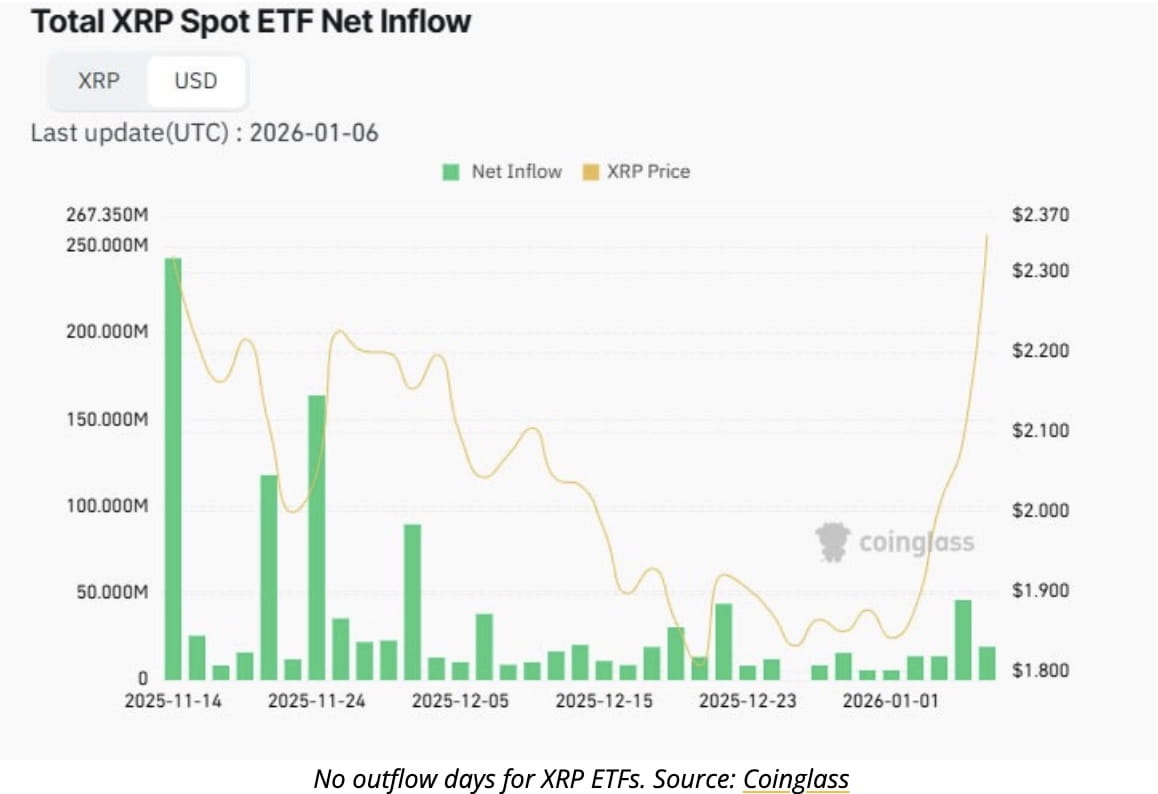

One of the most visible tailwinds has been strong and persistent inflows into spot XRP ETFs, particularly during the weak market conditions of late 2025.

CNBC reporter Mackenzie Sigalos noted that XRP ETF flows have behaved differently from Bitcoin and Ether ETFs.

“During the doldrums of Q4, a lot of people were piling into XRP ETFs — the exact opposite of what happens with spot Bitcoin and Ether ETFs, where people move in tandem with the price of the coin,” she said.

The dynamic effectively made XRP a less crowded trade, allowing investors to position for a higher-percentage rebound.

According to Coinglass:

Spot XRP ETFs have seen nearly $100 million in inflows since the start of the year

Aggregate inflows now stand at about $1.15 billion

The products have not recorded a single outflow day

Monday marked the largest daily inflow in more than five weeks, reinforcing the sense of sustained institutional demand.

Social sentiment and on-chain signals align

Beyond ETFs, sentiment and on-chain metrics are also reinforcing the bullish narrative.

AI-based analytics firm Market Prophit reports that:

Crowd sentiment toward XRP is bullish

“Smart money sentiment” is also bullish

On-chain data shows tightening supply:

XRP exchange reserves on Binance have fallen to their lowest level in two years, according to CryptoQuant

Lower exchange balances are often interpreted as reduced immediate sell pressure

Network activity has also accelerated. Data from XRPscan shows transaction counts are up more than 50% over the past two weeks, suggesting renewed engagement beyond pure price speculation.

Ripple expands footprint in Japan

Corporate developments at Ripple Labs are adding another layer of support.

Ripple has reportedly announced partnerships with major Japanese financial institutions, including:

Mizuho Bank

SMBC Nikko

Securitize Japan

The partnerships aim to expand adoption of the XRP Ledger in Japan.

In December, Ripple also received conditional approval from the Office of the Comptroller of the Currency to charter Ripple National Trust Bank, a move that could strengthen its regulatory positioning in the U.S.

Ripple President Monica Long told Bloomberg that the company’s November fundraising round and $40 billion valuation were “very positive and favorable,” though she said there are no immediate plans for an IPO.

Caution flags remain despite strong start

Despite the strong performance, analysts caution that several of XRP’s current tailwinds can be volatile.

ETF inflows driven by narrative momentum have historically cooled when sentiment shifts

Social-media-driven enthusiasm can reverse quickly

Declining exchange balances can rise again during periods of sharp volatility

Regulatory developments, macroeconomic shocks, and broader crypto market conditions remain key external risks that could still weigh on XRP’s price action.

Why XRP is leading — for now

Taken together, XRP’s early-2026 outperformance reflects a confluence of factors:

Sustained ETF inflows when other majors saw outflows

Bullish sentiment from both retail and institutional cohorts

Tightening exchange supply

Rising network activity

Renewed corporate and regional expansion by Ripple

Whether that leadership persists will depend on how durable those flows prove to be — and whether broader market risk appetite catches up to XRP’s strong start.