$XRP A seemingly unrelated debate over billionaire taxation has reignited a long-standing and emotionally charged discussion within the XRP community: have Ripple’s escrow-based XRP sales held back the token’s true market value?

What began as criticism of Elon Musk’s tax claims quickly spiraled into a broader argument about wealth, fairness, and ultimately, the mechanics behind XRP’s price behavior.

The conversation took a decisive turn when Ripple Chief Technology Officer David Schwartz weighed in, initially challenging the logic of comparing net worth to taxable earnings. While his early remarks focused on economic reasoning, the exchange soon shifted toward Ripple’s XRP sales model, reopening years of debate around the escrow system introduced in 2017.

✨How the Debate Shifted to Ripple Escrow

Following Schwartz’s response, critics redirected their attention to Ripple itself, arguing that the company’s ability to sell up to one billion XRP monthly through escrow has suppressed XRP’s price.

Schwartz responded by clarifying an often-misunderstood historical fact: before the escrow was implemented, Ripple had no formal limits on how much XRP it could sell in any given month.

According to Schwartz, the escrow was not designed to enable sales but to introduce predictability and reduce market uncertainty. Notably, he revealed that he opposed the escrow’s implementation at the time, believing it gave up strategic flexibility without providing enough tangible benefit in return.

✨Examining Claims of Price Suppression

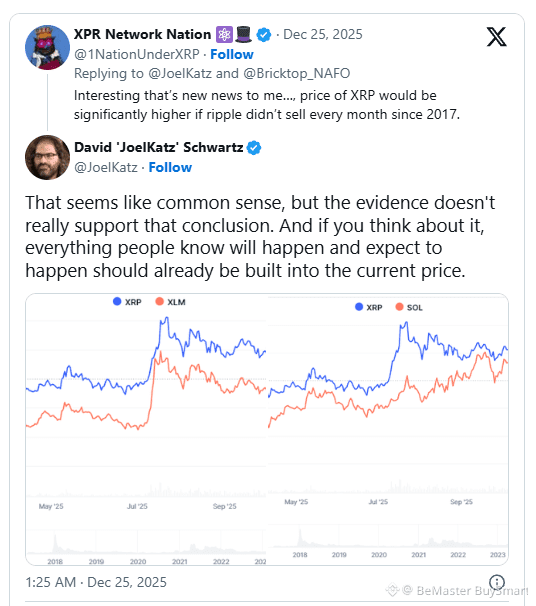

Critics countered by asserting that XRP’s price would be significantly higher today if Ripple had not sold XRP consistently since 2017. Schwartz pushed back on this assumption, arguing that while the claim may seem like common sense, available evidence does not support a direct causal relationship between escrow sales and long-term price suppression.

He stressed that XRP’s price history cannot be explained solely by supply releases, particularly when those releases are transparent, capped, and widely anticipated by the market.

✨Market Expectations and Price Discovery

At the core of Schwartz’s argument is a fundamental market principle: known and expected events are typically priced in. Ripple’s escrow structure, monthly release schedule, and the routine re-locking of unused XRP have been public knowledge for years. As a result, traders and institutional participants have long incorporated these dynamics into their valuation models.

This perspective challenges the idea that escrow sales represent an ongoing surprise or hidden pressure on XRP’s price. Instead, Schwartz suggests that price movements are more likely driven by broader factors such as utility growth, liquidity conditions, regulatory clarity, and macroeconomic trends.

✨Reframing the XRP Escrow Narrative

By grounding the discussion in market mechanics rather than speculation, Schwartz’s clarification reframes a debate that has persisted for nearly a decade. His position does not deny that supply matters, but it rejects the notion that a transparent, predictable escrow system alone explains XRP’s historical price performance.

Ultimately, the exchange highlights a critical distinction often lost in online discourse: markets respond less to emotion and more to expectations—and in the case of XRP, those expectations have long been out in the open.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.